News

July Budget: what can we expect?

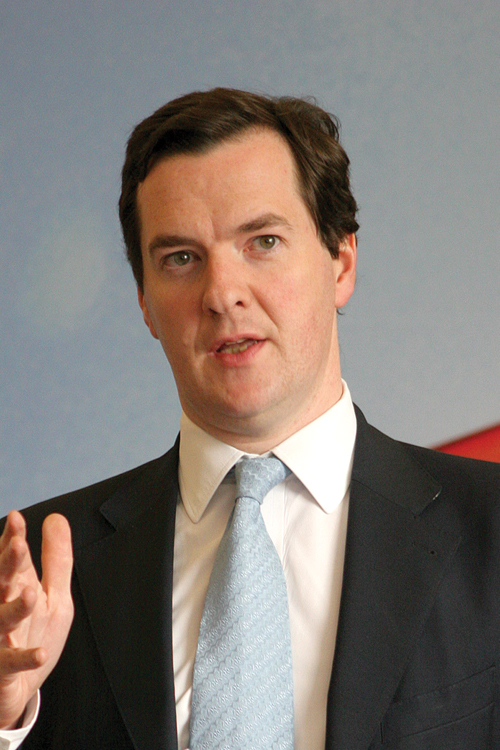

Today will be George Osborne’s first truly Conservative Budget. This time around there will be no need to mesh together Tory and Liberal Democratic policies as was the case during his chancellorship under the coalition government.

So what will he do with this new found freedom? With the next general election five years away, the Chancellor’s strategy will no doubt be to get the political pain out of the way sooner rather than later.

Don’t expect the razzle-dazzle of the preceding two Budget speeches when the Chancellor pulled several white rabbits out of the hat – from the new pension freedoms to incentives playing to the nation’s love of property.

This will be a much more austere Budget marked by spending cuts as Mr Osborne tries to balance the books. As he pointed out in his Mansion House speech, we should “not be surprised” by further savings in public spending announced in next week’s Budget.

The gap between what we spend and earn (the Budget deficit) remains one of the highest in the developed world while the UK’s national debt stands at over 80% of the country’s GDP. As the Chancellor put it, “the country needs to commit to live within its means.”

He now has the unenviable task of reducing national debt while making good on Tory pre-election promises such as reducing inheritance tax, cutting income tax and increasing health spending while protecting pensions, schools and overseas aid. This seemingly impossible balancing act means the cuts to the rest of the government’s spending will have to be brutal.

Here are some key announcements that could feature in next week’s Budget:

- Pensions: he giveth and he taketh away

The pension’s landscape enjoyed a radical overhaul following a spate of pension changes announced by the Chancellor back in his Budget 2014 speech.

These changes have for the most part been welcomed with open arms thanks to the fact that it simplifies the landscape, not least when it comes to taxes. Unfortunately, things could just get complicated again with pension contributions a possible victim of next week’s Budget.

As we have pointed out before: cutting the tax relief on pension contributions could mean huge savings for the government.

Currently, anyone earning more than £150,000 can pay up to £40,000 into a pension and benefit from full tax relief. However, the Conservative election manifesto promised to progressively reduce the £40,000 annual contribution limit to £10,000 for anyone earning between £150,000 and £210,000.

There has also been speculation that the Government could claw back pounds lost each year due to salary sacrifice, a key employee benefit that involves giving up some of your salary in exchange for payments into your pension. The problem for the Government is that this enables companies to save on National Insurance contributions.

Either way, it will be prudent to top up your pension before next week’s budget.

- Inheritance tax – threshold to increase

For years now the Conservatives have promised to raise the threshold at which inheritance tax is paid. In the run up to the election they pledged to raise the inheritance tax free threshold from its current level of £235,000 to allow family homes worth up to £1 million to be passed on free of tax.

More details could be revealed in the Budget but the initial plans were that this will involve an additional transferable allowance of £175,000 per person for main residences, taking the total inheritance tax free threshold per individual to £500,000 and up to £1 million for couples. This would be tapered for estates worth more than £2 million, with no relief for those valued at more than £2.35 million.

- Income tax –some good news

In his last budget speech Chancellor George Osborne pledged to increase the threshold to £10,800 in 2015/2016 and to £11,000 for the 2016/2017 tax year. Increasing the personal tax-free allowance will put more money in taxpayer’s pockets. But it is an expensive tax cut for the government as it drags more individuals out of tax in a country where income tax already tends to be top heavy.

Ahead of the Budget there are also calls from a number of Tory MPs – including two former chancellors – for the 45% additional income tax rate to be reduced to 40%. Labour increased the rate from 40p to 50p in 2009 after the financial crash and Mr Osborne cut it to 45p in his 2012 Budget.

Of course our income tax bands are only a small part of the story. Most of us also pay National Insurance contributions which is another tax on income – this means that our marginal tax rates are much higher once National Insurance contributions kick-in.