Household Bills

Avon ladies offered chance to settle tax bills

Direct sellers are being urged to take up the opportunity to come forward and pay up under a new HMRC campaign.

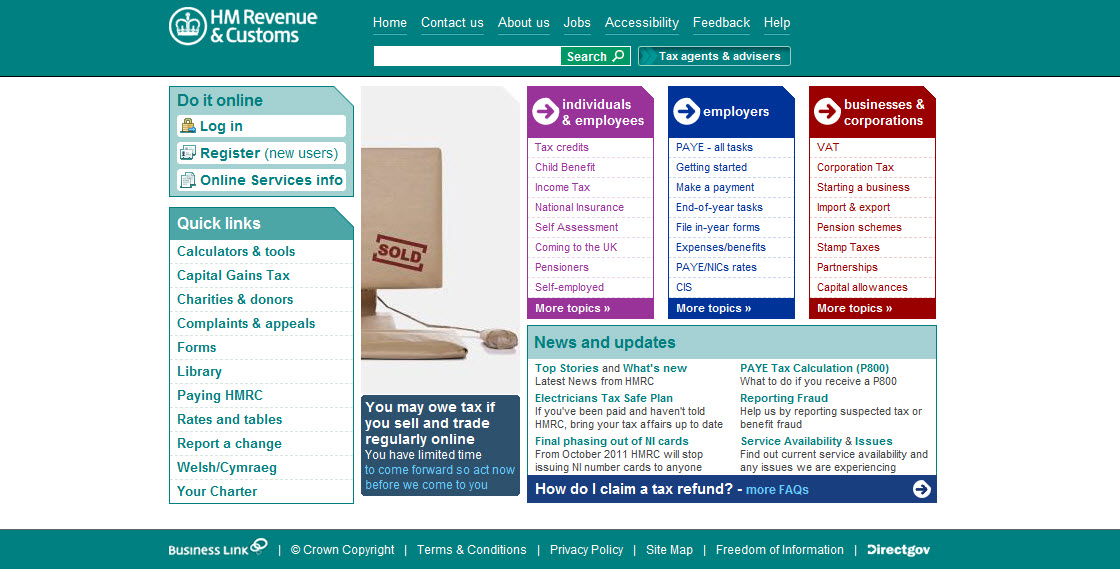

Under the HMRC’s limited-time opportunity, direct sellers, often called “agents”, “consultants”, “representatives” or “distributors”, can pay the tax they owe and benefit from lower penalties available to those who come forward, rather than wait for HMRC chase up the unpaid taxes.

Marian Wilson, head of HMRC Campaigns, said: “If you are involved in direct selling and have not told HMRC about all of your income, you may not be paying the right amount of tax.

“The Direct Selling campaign is an opportunity for you to bring your tax affairs up to date, on the best possible terms.”

Direct sellers are anyone who contacts a potential customer directly, without the need for a shop.

HMRC says that direct selling can involve demonstrating a product in a customer’s home, sometimes at a party, while some agents sell door to door, often using catalogues.

Direct sellers take commission on the sales they make as part of their income.