Insurance

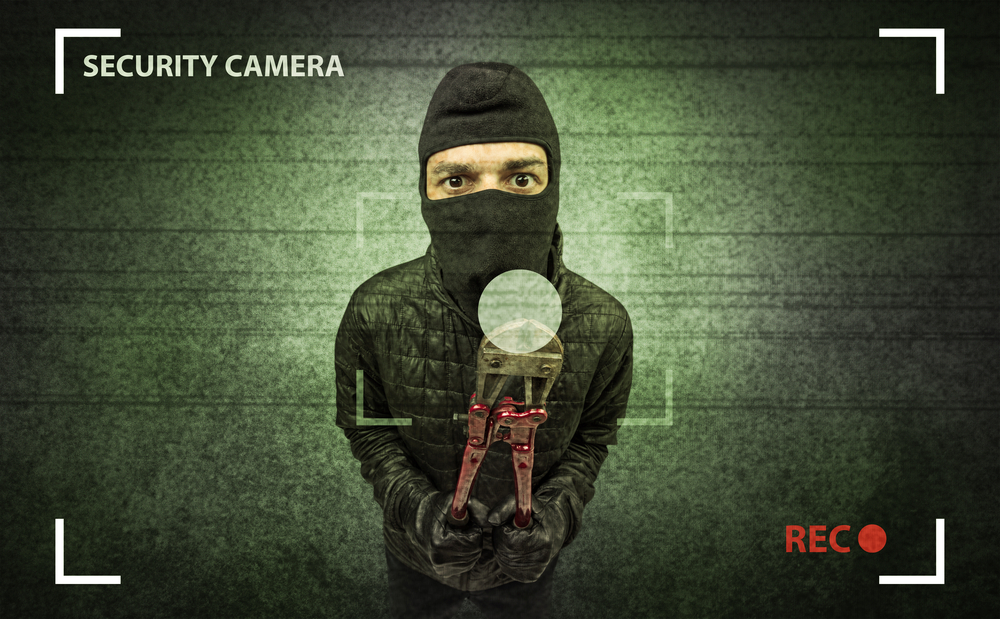

Break-ins rise by a third as clocks go back

Homeowners should be on guard as claims for theft and burglaries increase by a third once the clocks go back.

The clocks go back one hour this Sunday 29 October. The evenings will become darker earlier, and this means burglaries and thefts are on the rise.

Co-op Insurance analysed thousands of claims and found home thefts increased by 36% in the five months after the clocks go back.

Worryingly, 69% of the break-ins were categorised as being ‘forcible and violent entry’ thefts, a tenth higher than those experienced during the summer months. Compared to winter, summer break-ins tend to opportunistic.

The insurance provider also found that Fridays tend to be the most popular day for break-ins while Sundays are the least popular.

As well as homeowners remaining vigilant, there are other deterrents, according to ex-convicts. These are the top 10 things that would stop burglars in their tracks:

- CCTV cameras

- Sound of a dog barking

- Strong, heavy doors

- TV which is turned on

- Locked Upvc windows

- Cars parked on the driveway

- Overlooked property

- Surrounding fences

- Gated property

- Motion-activated security lights.

Caroline Hunter, head of home insurance at the Co-op, said: “Being burgled can be an extremely upsetting and traumatic experience. Unfortunately, when the clocks go back, darker nights do lead to more burglaries and so we’re urging people to be vigilant and think carefully about the safety of their properties.

“We spoke to a number of ex-convicts to understand first-hand how homeowners can keep their properties safe. Installing CCTV cameras, or at least dummy ones is a key deterrent called out by ex-convicts and something we’d encourage homeowners to consider.”