Investing

King calls end of UK recession in Q4

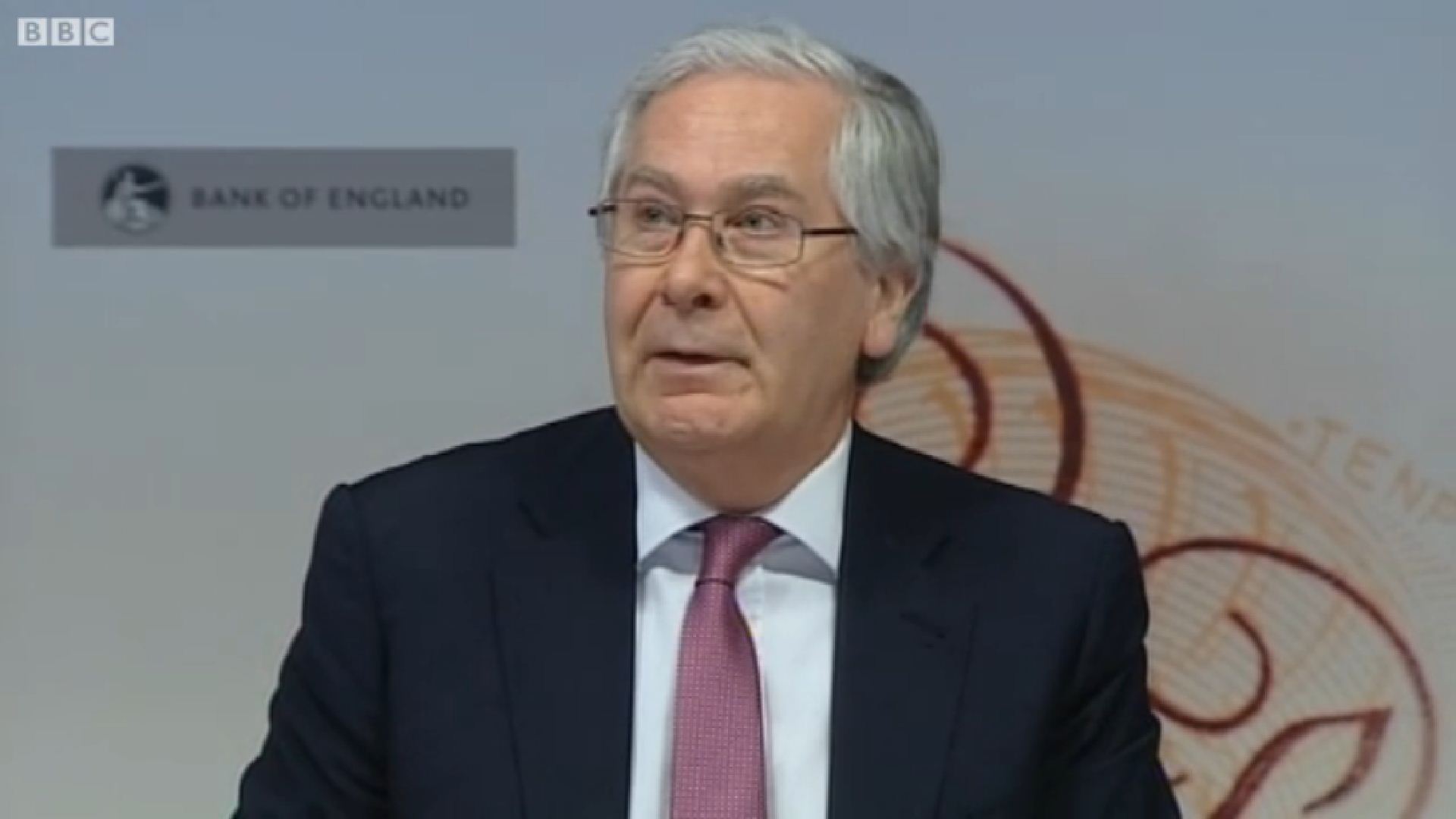

Bank of England governor Mervyn King has called the end of the recession in the UK and pointed to signs of growth returning to the economy.

In a live interview with Channel 4 News, King (pictured) predicted a pick-up in growth in the fourth quarter of the year.

“I think the next quarter will probably be up. I think we are beginning to see a few signs now of a slow recovery, but it will be a slow recovery,” he said.

“After a banking crisis one cannot expect to get back to normal and I fear it will take a long time.”

However, King stopped short of referring to ‘green shoots’, and said any recovery will be linked to what happens in the eurozone and the rest of the world, notably a “struggling” China and Brazil.

Interviewer Jon Snow also asked King whether the taxpayer could end up having to bail out another UK bank in the future. King said the taxpayer may have to provide temporary finance in the short term, but would not lose money rescuing a bust bank.

“We now have a legal regime which would enable us to get control of the bank and deal with it very quickly, which we did not have when Northern Rock got into trouble in 2007,” the governor said.

He added it is essential that the UK overhauls its banking system, changing the way the banks finance themselves to make them less reliant on leverage.

The governor said the undiluted Vickers Report “in its original form” was sensible and had his support because it imposed more onerous borrowing limits on the banks.

Describing the various scandals such as LIBOR that have hit the sector as “deeply unsatisfactory” and said bank management is changing, with many senior executives “shocked” at the practices which have been uncovered.

Asked if he had told the board of Barclays to fire former CEO Bob Diamond, King said he had simply tried to “impress upon the non-executive board at Barclays that the regulator had real concerns” about Diamond’s leadership.

Finally, the governor was asked about the government’s deficit-cutting plans, which are designed to curb the gap between spending and income by 2015.

He said it would be acceptable if that target was missed, as long as it was a result of slower global economic growth.