Investing

Monday newspaper round-up: UK economy, BAE, eurozone banking

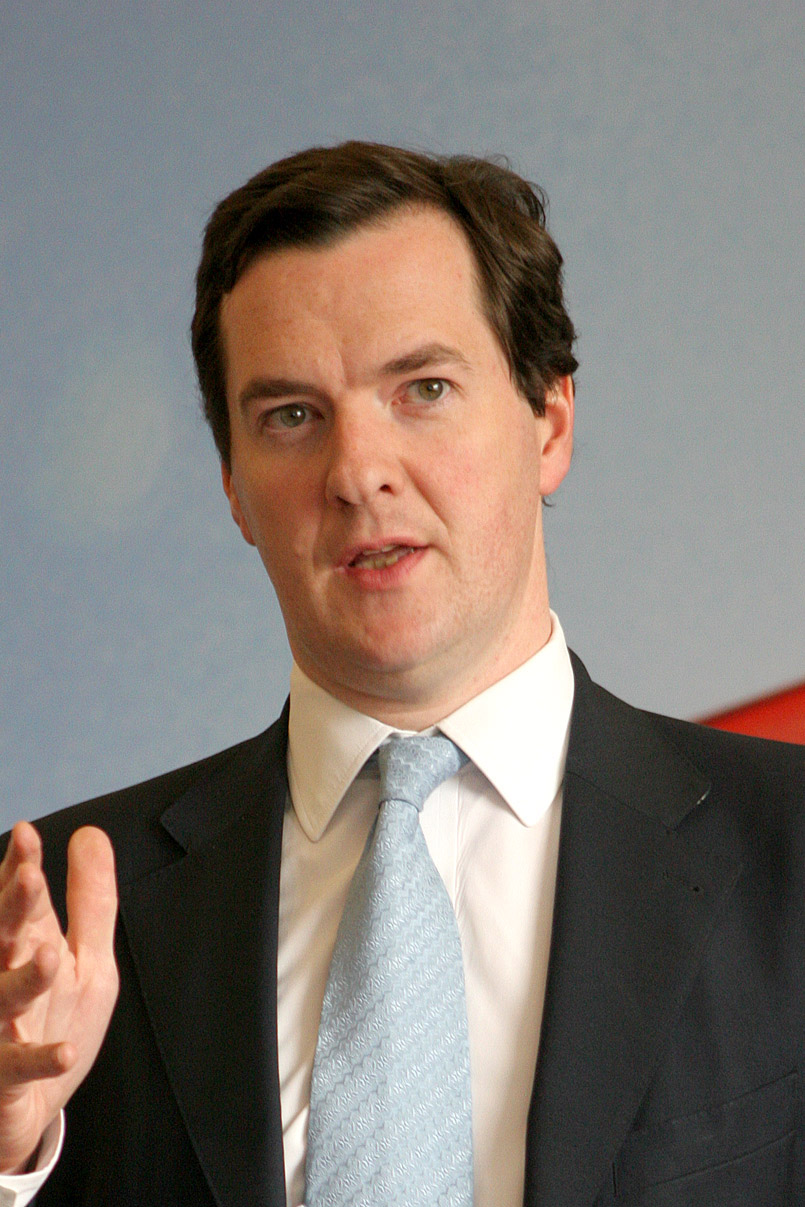

IMF berates Osborne, BAE shifts focus, Cameron to defend the City

George Osborne has been warned by the International Monetary Fund that he risks further damaging the economy unless the pace of austerity slows and he faces up to the country’s “growth challenge”.

David Lipton, the IMF’s deputy managing director, suggested the Chancellor may have to take bolder measures to ease the pain of cuts to spending and instead give higher priority to rescuing the flagging economy. “Our view has been that doing nothing is not a good answer given the problems that could arise when very, very low growth becomes entrenched,” Mr Lipton told The Daily Telegraph as the IMF and World Bank annual meetings in Tokyo wound down.

He also said the Bank of England should look at being more inventive in the way it used quantitative easing to aid recovery by buying assets other than gilt-edged securities.

BAE Systems is to focus on a collection of vital export deals worth more than £30bn to shore up its future after the collapse of mega-merger talks with EADS. The potential contracts are now central to the defence manufacturer’s growth aspirations amid budget cuts in its key UK and US markets.

They include deals to sell the Typhoon aircraft in Asia, and the Hawk training jet to the US. BAE will work alongside EADS to try to win contracts for the Eurofighter Typhoon, which is built through a joint venture between the two companies and Italian defence manufacturer Finmeccanica. The contracts include a £7bn contract with Saudi Arabia to provide another 48 Typhoon jets as well as training and weapons procurement, The Telegraph says.

Britain will demand changes to the structure of the Eurozone banking union this week as Cabinet ministers tell The Times that David Cameron will veto the plans if he feels they threaten the City of London. The Prime Minister and 26 other European leaders will gather in Brussels on Thursday to discuss a blueprint to harmonise banking supervision across the single currency area. It will be the first of several leaders’ summits on the issue before the changes are due to come into force on January 1st.

Britain supports moves towards a banking union, providing it leaves UK institutions unaffected and is overseen by the European Central Bank, The Times reports.

Sir Richard Branson and US private equity entrepreneur Christopher Flowers are set to go head to head for hundreds of branches being offloaded by Royal Bank of Scotland after the collapse of an agreement to sell the assets to Santander. News of their interest emerged as Stephen Hester, RBS chief executive, expressed confidence he would be able to extend a Brussels state aid deadline to sell the 316 branches by the end of 2013.

This was imposed as a penalty for the bank’s £45bn bail-out by the UK government. Mr Hester has told colleagues it should be “straightforward” to secure more time beyond the original deadline to sell the branches. The sale process with Santander, already underway for two years, was at least a year away from completion, The Financial Times writes. They are stocks that, theoretically, should be a screaming buy.

A study published today names 13 companies in the FTSE 100 whose share price trades below the value of the assets in a liquidation. The state-backed lender Royal Bank of Scotland and Barclays lead a list of companies whose shares are priced at a discount to their net asset value, published by the trader Banc de Binary. As well as banks, insurers, miners and an airline — International Airlines Group — the list also includes a quartet of property companies.

Banc de Binary says that, although the number of such lowly rated companies is below its level when Britain was even further mired in recession, there are still an unusually high number of deeply discounted businesses, The Times writes.

Banks are taking advantage of strong investor demand for high-yielding assets to issue large quantities of a form of riskier debt as lenders race to meet new regulatory requirements on capital. The boom is particularly noticeable in Europe, where last month $7.9bn of so-called tier two debt was issued by banks including Erste Bank, Danske and Rabobank, making it the busiest month for the region since May 2008, according to data from Dealogic. European banks have issued more than $25bn of tier two debt so far this year, surpassing the amount raised for the whole of last year and taking it close to 2010 levels, The Financial Times says.