Credit Cards & Loans

Real income to grow next year

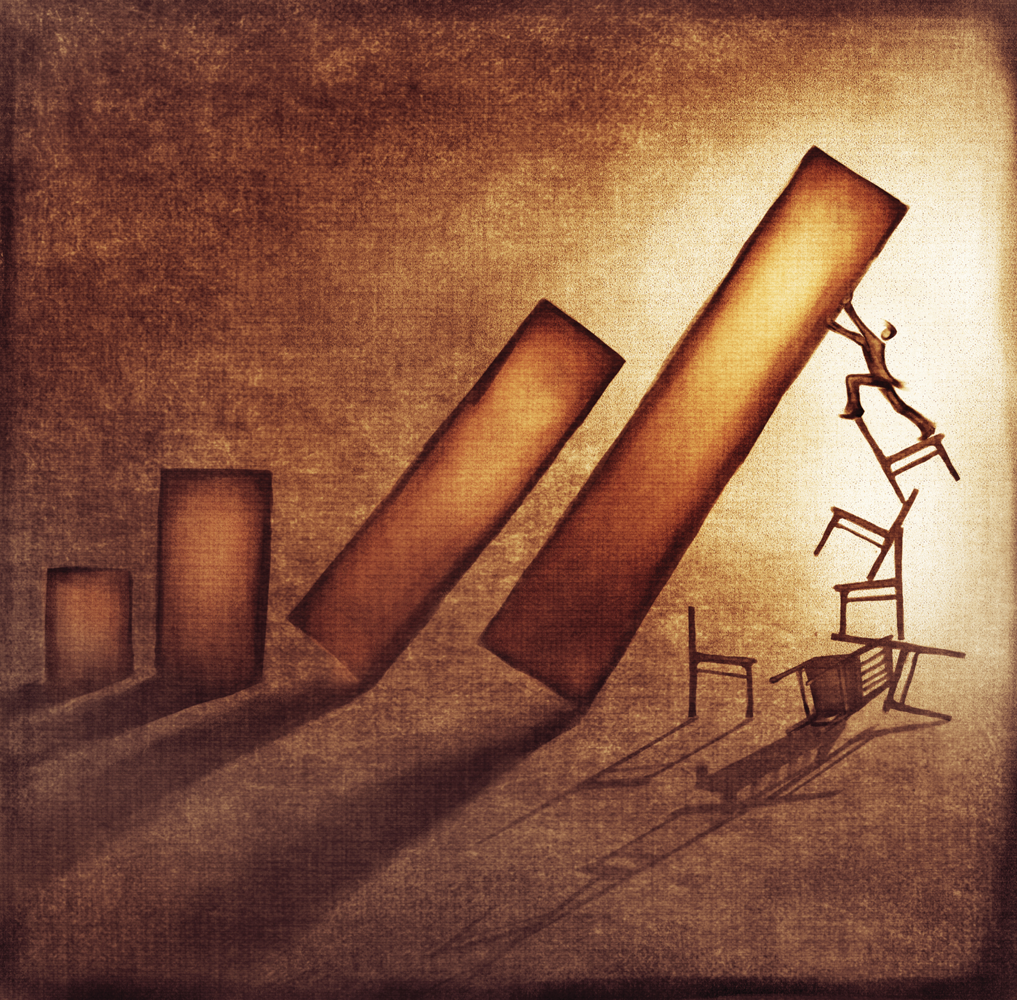

Households should see a rise in real incomes from next year on the back of slowing inflation and rising pay growth.

According to a report by the Centre for Economic and Business Research (CEBR), the rise in 2013 will be the first real increase since the onset of the financial crisis, though inflation will once again outstrip earnings as early as 2016.

Consumer Prices Index (CPI) inflation rose sharply between September 2009 and September 2011 to stand at 5.2%.

Despite a small rise between June and July this year, it has fallen steadily since then and now stands at 2.6%.

The CEBR said real levels of income would start to pick up as inflation fell further. The Bank of England expects CPI inflation to fall below its 2% target by the middle of next year.

The CEBR said middle and low-income families would benefit the most from the rise in real income.

Middle-income households would see incomes rise by 1% next year, with lower-income families seeing a rise of 1.5%, it said.

The richest households would see incomes rise by 0.7%.This is because of a drop in top executives’ pay and bonuses and the scaling back of some tax allowances.