Retirement

One in four will save more following Chancellor’s pension shakeup

One in four adults say they will save more in their pension following the reforms announced in this year’s Budget, with younger savers most interested in putting more money away.

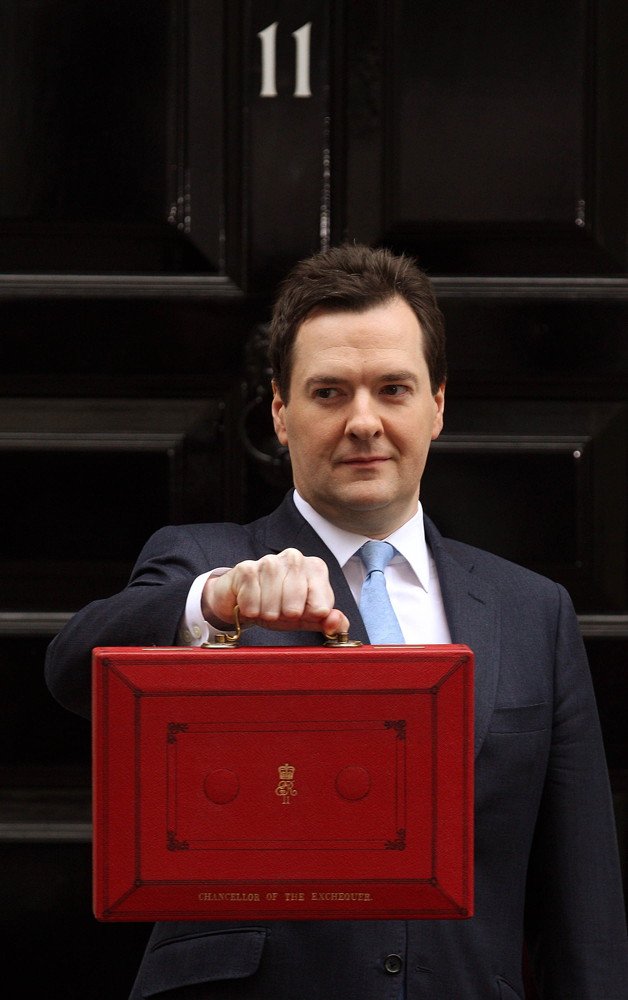

Chancellor George Osborne’s sweeping changes to the pension sector – which gave savers increased flexibility with regards to how they take out their cash – were announced in March.

Legal & General’s MoneyMood survey found that four out of ten people in younger groups – 18 to 24 year olds and 25 to 34 year olds – said they would pay more into their pension pots as a result of Osborne’s pension shake-up.

Across all age groups, 24 per cent of savers said the Budget changes would encourage them to contribute more. This equates to about 10 million people.

Helen Buchanan of Legal & General said: “The positive response among young pension savers to the pension flexibility introduced in the budget is a fantastic result. The Chancellor seems to have achieved the impossible and created a pension system that appeals to those under 35 who, until now, were the age group who tended to put off saving for their retirement.”

According to Legal & General auto-enrolment has also played a role.

The latest MoneyMood indicates that 30 per cent of people are now thinking of saving for a pension, up slightly from 29 per cent pre-auto enrolment.

Among women the interest is significantly higher. Some 28 per cent of women are now considering saving compared to 20 per cent in April 2012, while the number of men doing the same has dropped from 37 per cent to 32 per cent.

While the number of 18 to 24 year olds considering a pension dropped sharply from 20 per cent in April 2012 to eight per cent in May of this year, 25 to 34 year olds, 35 to 44 year olds and 55 to 64 year olds were all more likely to consider saving.

Buchanan concluded: “The prime target for the campaign, the under 45s, appear to be ‘nudging’ towards saving in a pension. And it’s encouraging to see indications that pension saving is now higher on the agenda for those aged 55 to 64, too.”