News

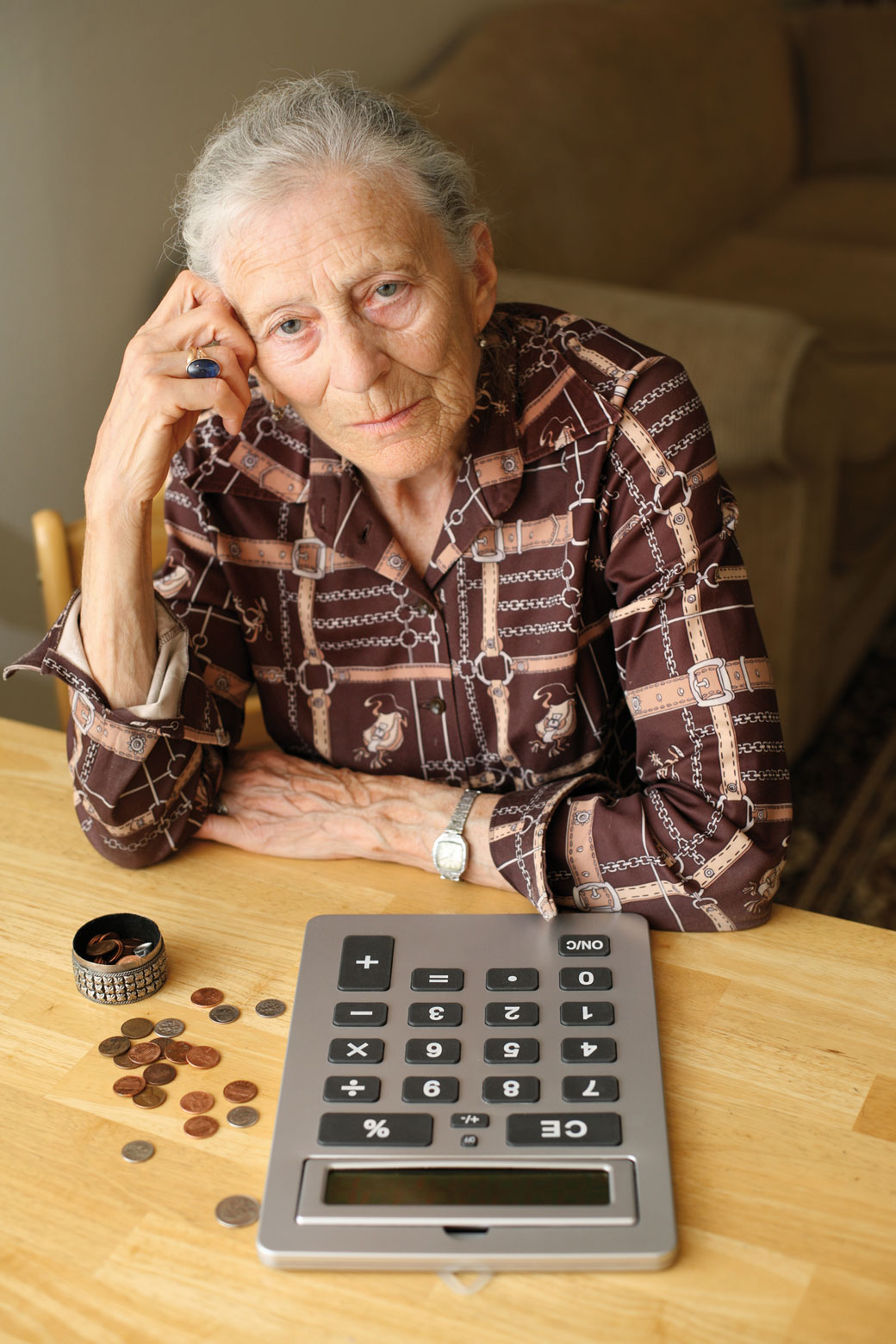

Retirees will need to ‘halve living costs’ under new State Pension

Retirees will need to cut their essential living costs in half under the new State Pension, new research suggests.

The average person nearing pension age currently spends £320.70 a week on essential living costs such as utilities, bills, food and clothing. This equates to £1,379 on average per calendar month.

But people receiving the new State Pension, which launches tomorrow, will have to cope on a maximum handout of just £669.30 a month, according to research from Skipton Building Society’s RetireSavvy platform.

As a result, new retirees will be forced to cut their spending on things such as eating out, socialising, house maintenance, DIY and travel.

The research also found that 42% of those polled had no idea that the maximum new State Pension would be £155.65 per week.

Almost one in six said they were shocked at the figure and claim they’ll never be able to cope, while 21% said they were worried and would need to find a new source of income.

Andrew Sheen, editor of retiresavvy.co.uk said: “It’s amazing how many people don’t know how much State Pension they can expect. Although the New State Pension that comes in from 6 April is more generous than the system it replaces, it’s still less than half of what the average 50-65 year-old currently needs to live on.

“If they get to State Pension Age without having their own plans in place, a lot of people will have a big surprise and face a huge change in the kind of lifestyle they can afford.”