News

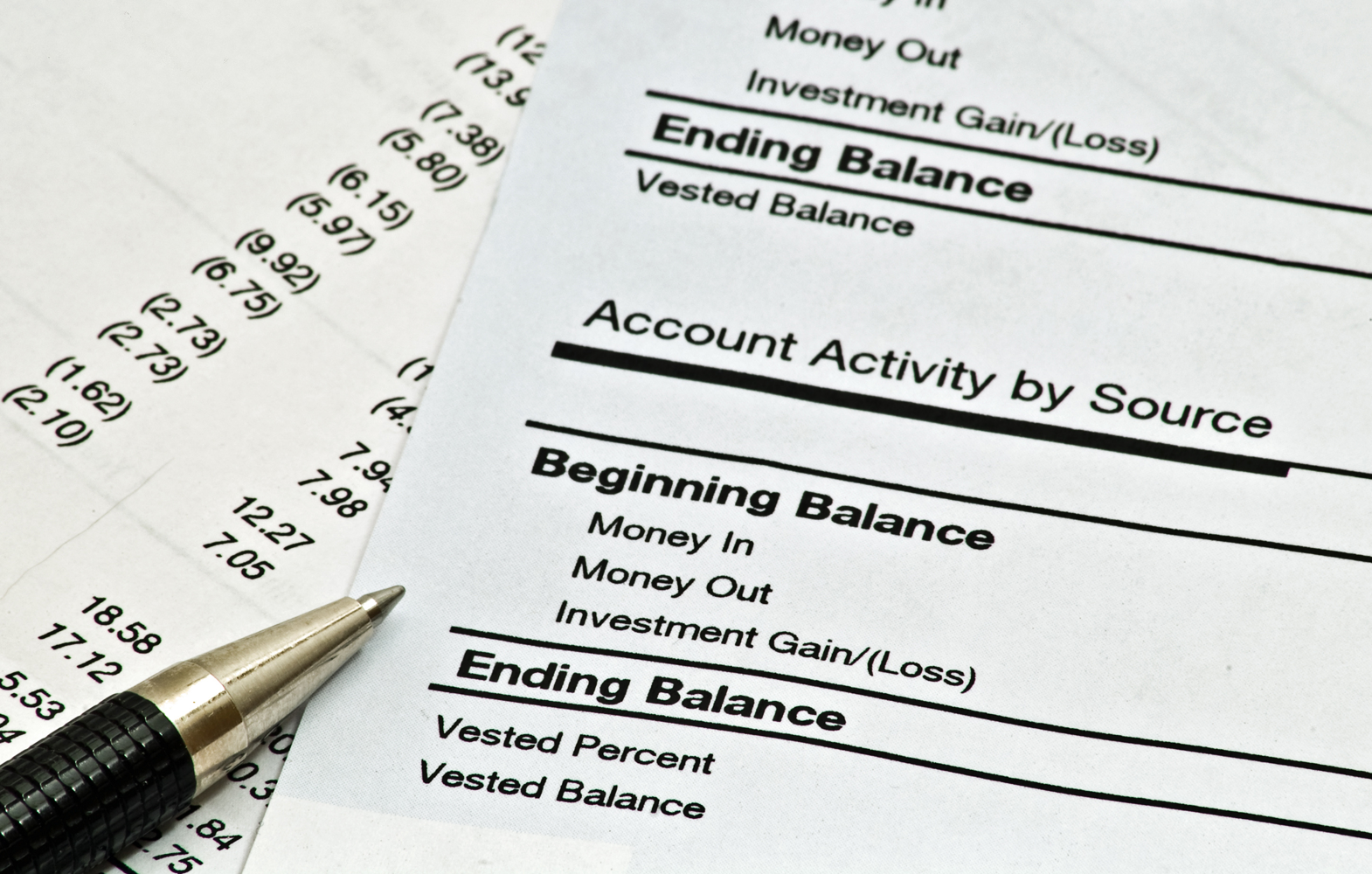

A fifth of Britons ‘cannot read a bank statement’

One in five British adults cannot read a bank statement according to a new report highlighting “stubbornly” low levels of financial capability in the UK.

The report by the Money Advice Service also found that just half of families have any life cover and four in ten adults have less than £500 in savings.

The Service, in conjunction with the UK Financial Capability Board, has launched a 10 year strategy aiming to improve people’s ability to manage money day-to-day, prepare for and manage life events, and deal with financial difficulties.

Its focus is on developing people’s financial skills and knowledge as well as their attitudes and motivation.

“Four out of ten adults are not in control of their finances, so for a great many people money is a constant source of worry and stress. This is a problem first and foremost for the individuals concerned and for their families, but it also has wider implications for society and the economy,” said Andy Briscoe, chairman of the Financial Capability Board

“The stubbornly low levels of financial capability in the UK can no longer be tolerated. Today we are calling for a fully collaborative approach to ensure we achieve the goals set out in the Strategy over the next decade.”

The survey of 5,000 people also found that 36% of the UK population cannot calculate the impact of a 2% interest rate on £100 in savings and 14% don’t agree that it’s important to track income and expenditure.

[article_related_posts]