News

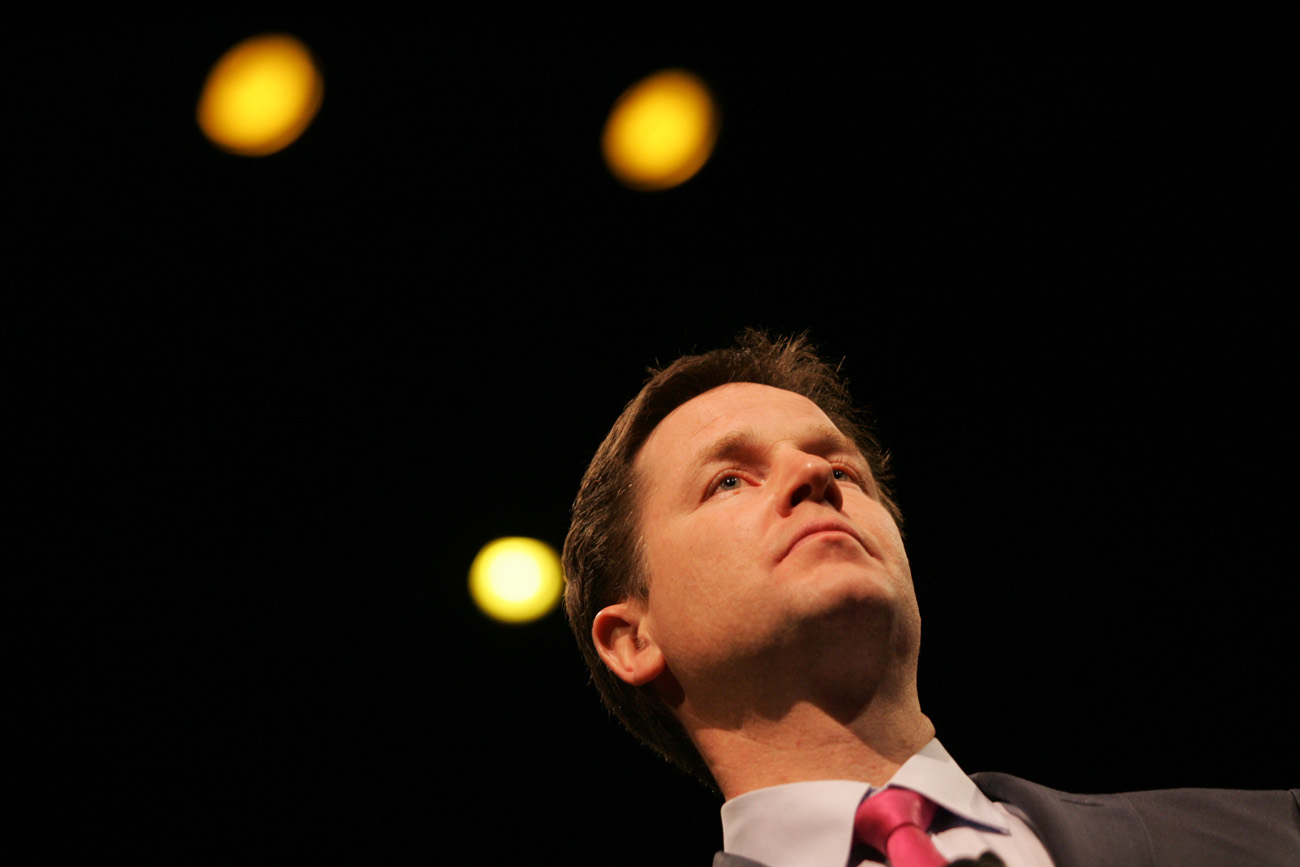

Clegg pledges no further cuts to top tax rate

Nick Clegg has said there can be “no question of reducing further” the top rate of income tax under the coalition government’s watch.

Addressing attendees at the Liberal Democrat party conference this afternoon, Clegg said he would not permit a reduction in the top rate of income tax below the existing 45p.

At the last Budget, the Conservative/Lib Dem coalition government announced the income tax rate for those earning above £150,000 would be reduced from 50p to 45p from next April.

It also said it would raise the threshold at which people start paying tax to £9,205.

Of these measures, Clegg said he “insisted” on the second, “conceded” on the first, but that he stood by the package as a whole.

“There can be no question of reducing [the 45p rate] further within this parliament,” Clegg said.

He also said the existing 45p tax rate was still higher than at any time throughout Labour’s years in power.

Clegg again said the party would not sanction further spending cuts without a wealth tax on rich people.

“All parties will need to acknowledge that belt-tightening is needed… but we’ll start with the richest and work our way down,” he said.

The theme of this year’s Liberal Democrat conference is ‘fairer tax in tough times’.

Clegg said: “Our tax cuts are not standalone consumer offers, they are part of a broader agenda …to secure Britain’s position in a changing world.”