News

Big boost for millions of Premium Bond holders

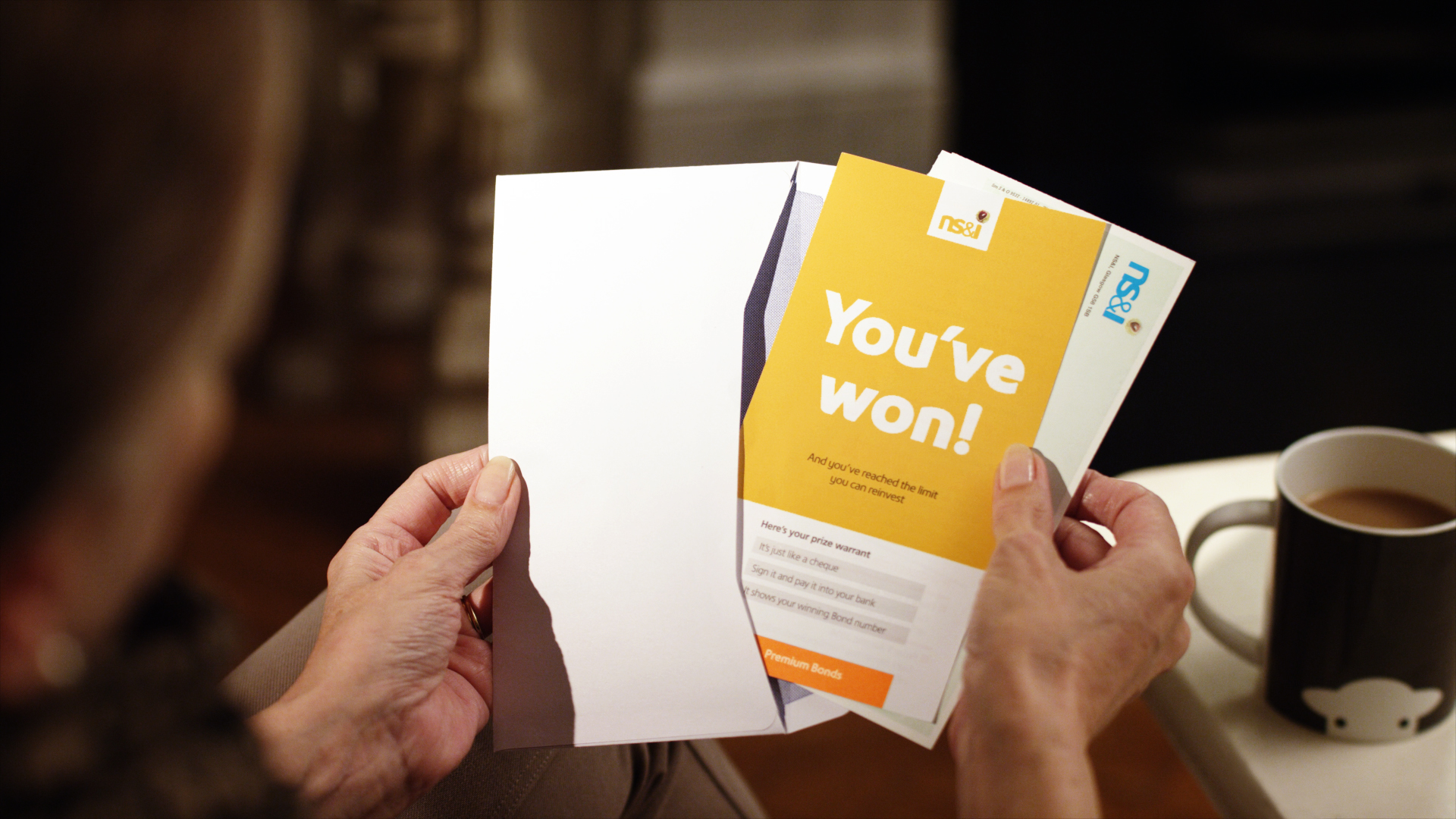

Premium Bond holders will have more chance of winning a prize in next month’s draw and the fund rate will also increase as NS&I confirms it’s passing on the full 0.25% interest rate rise for savers.

NS&I – the government’s savings arm – has today confirmed it will increase interest rates across its variable rate products by 0.25%, including Premium Bonds, ISAs and income bonds from 1 December.

The massively popular Premium bonds aren’t like normal savings accounts as they don’t pay interest. Instead the interest that should be paid (currently 1.15%) is used to fund a monthly prize draw. See YourMoney.com’s Premium Bonds guide for more information.

From next month’s drawn, the prize fund rate on Premium Bonds will increase from 1.15% to 1.40% and the odds of winning will also shorten from 30,000 to one, to 24,500 to one.

The number of prizes paid out each month will also increase from 2.3 million to around 2.9 million. NS&I confirmed this is the highest number of prizes in any monthly Premium Bonds prize draw to date.

This is welcome news for the 21 million Premium Bond holders who have seen two prize fund rate cuts in a year – from 1.35% to 1.25% in June 2016 and then to 1.15% in May 2017 – as well as a decrease in the value and number of prizes available.

However, from 1 December the value of prizes will rise from £68.3m to £83m. The prizes are tax-free and another bonus of saving with NS&I is that all products offer 100% capital security as it’s backed by the Treasury.

Other variable rate savings products

NS&I will pass on the full 0.25% interest rate rise announced by the Bank of England last week to customers with variable rate savings products.

The rates are as follows:

Sarah Coles, personal finance analyst at Hargreaves Lansdown, said: “The really exciting news for many people is that Premium Bonds are going to get more generous. The prize fund rate will hit 1.4% – so if you are averagely lucky you will beat the best easy access savings accounts on the market. Of course, people don’t hold Premium Bonds on the off-chance that they’ll be averagely lucky, so the good news is that there will be more of the bigger prizes too.”

However Coles added that even after all of these announcements, savers should still check the rate they’re receiving against the most competitive in the market.

“Even if your rate has risen, you may be able to beat it by shopping around. Over the past few days we have seen the release of some highly competitive fixed rate deals – and the rates available on the most competitive one-year bonds are edging ever-closer to 2%.”