Household Bills

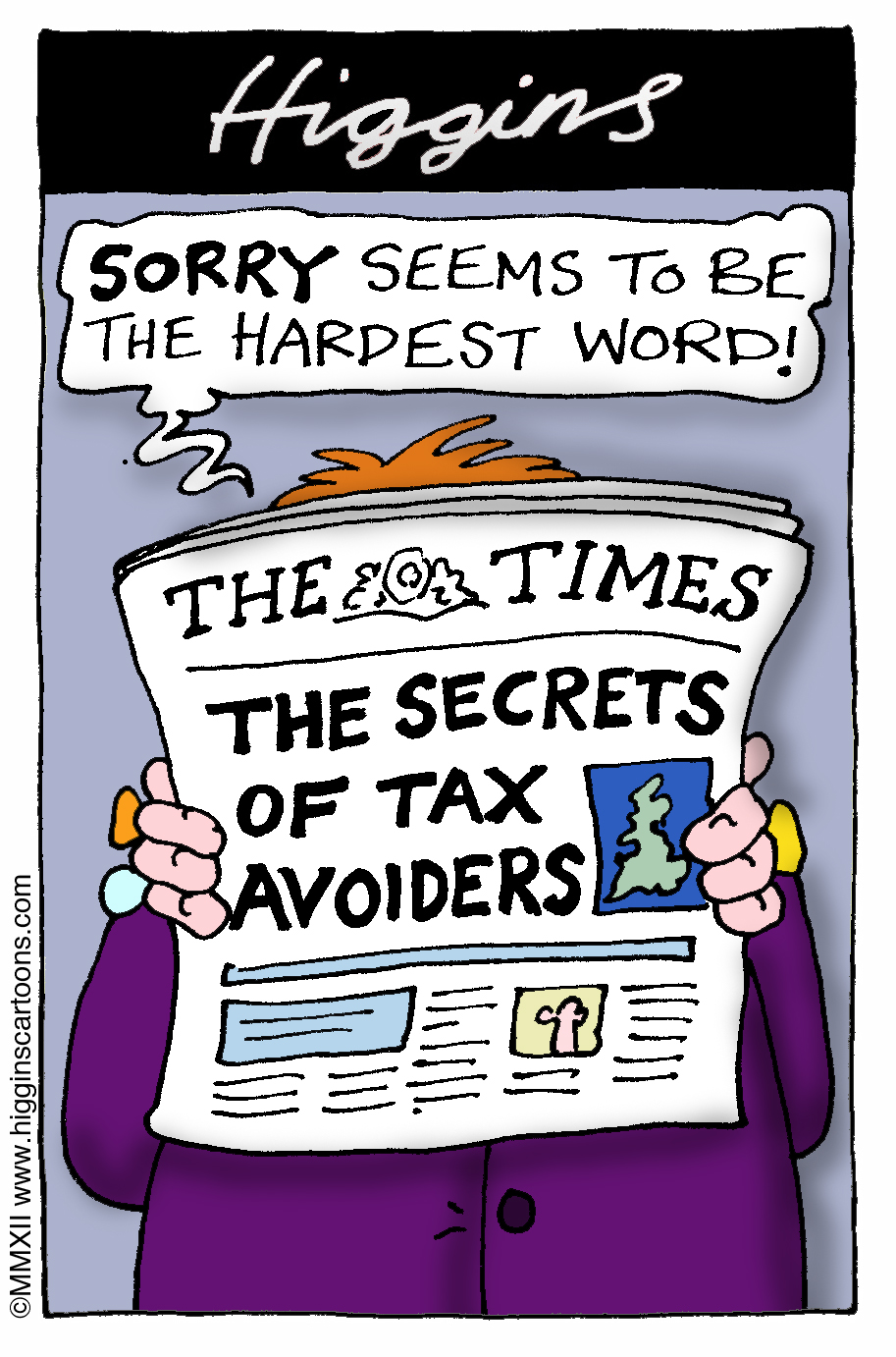

‘Big four’ accountancy firms too cosy with Government – MPs

MPs have called for a ban on external accountants working in government to prevent them passing on knowledge of tax loopholes to benefit clients.

The Commons Public Accounts Committee are concerned employees of the UK’s ‘big four’ accountancy firms, seconded to government, are taking insider knowledge back to their firms.

The big four – KPMG, Ernst & Young, Deloitte and PwC – have also been accused of being too ‘cosy’ with government, creating a ‘conflict of interest’ which should be banned.

Margaret Hodge MP, chair of the Committee of Public Accounts, said: “The large accountancy firms are in a powerful position in the tax world and have an unhealthily cosy relationship with government. They second staff to the Treasury to advise on formulating tax legislation.

“When those staff return to their firms, they have the very inside knowledge and insight to be able to identify loopholes in the new legislation and advise their clients on how to take advantage of them. The poacher, turned gamekeeper for a time, returns to poaching.

“This is a ridiculous conflict of interest which should be banned in a code of conduct for tax advisers.”

The committee has also called for a ban on firms being used by the public sector if they have been selling tax avoidance schemes.

However, the four firms insisted they no longer sell the type of very aggressive avoidance schemes that they sold ten years ago.

But the committee said: “While this may be the case, we believe they have simply moved to advising on other forms of tax avoidance which are profitable for their clients; such as the complex operating models they offer to major corporate clients to minimise tax by exploiting the lowest international tax rates.

“The four firms have developed internal guidelines on where the line between tax planning and aggressive avoidance lies, but these principles do not stop them selling schemes with as little as a 50% chance of succeeding if challenged in court. Clearly HMRC has to consider the risk to the taxpayer of a protracted legal battle.

“It would appear that firms and tax avoiders are taking advantage of the constraints under which HMRC is obliged to operate. Furthermore, HMRC is always constrained by resources.”

This comes less than six months after Amazon, Google and Starbucks faced the same committee to defend the levels of corporation tax they paid in the UK.