Household Bills

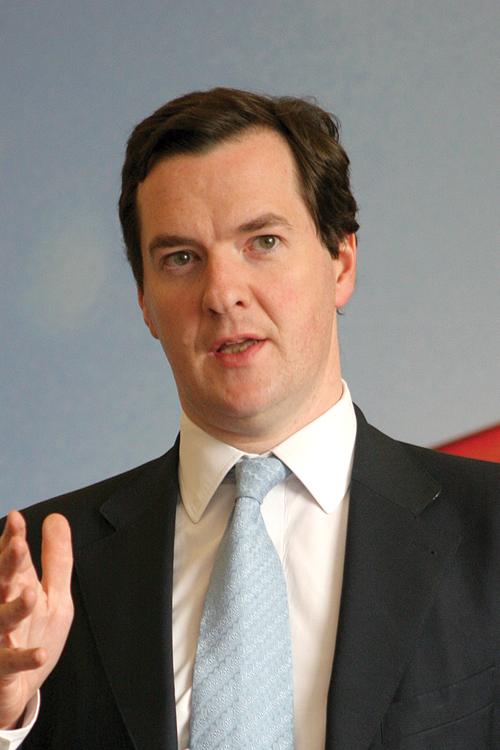

Tory Lords urge Osborne to act on 40p tax rate

George Osborne should use next week’s Budget to increase the 40p tax threshold, according to two former Tory Chancellors.

Lord Lamont said the Conservative Party would not be the “tax-cutting party” unless changes were made, the BBC reports.

Lord Lamont, the ex-Chancellor who introduced the 40p tax, said “far too many” people were paying 40% tax.

The report said while the coalition government had raised the threshold at which people start paying tax to £10,000 the threshold for higher rate taxpayers had not moved with inflation – meaning more people have to fork out 40%.

Lamont, speaking on Newsnight, said it was a “dead end” for more and more people to fall into that band.

“I think there ought to be a rise in the threshold of the 40%, maybe to £44,000 or something like that as a first step,” he said.

“Long-run, you can’t go on and on not increasing this commensurate with earnings because you will end up with a situation where the 40% becomes the basic rate. That is complete nonsense.”

He added: “If we go on and on with this policy we will lose the ability to call ourselves the tax-cutting party because more and more people will be paying a rate of tax, which, when it was introduced by Nigel Lawson, was intended to be the tax rate for the very, very rich.”

Elsewhere, Lawson told the Telegraph the Budget should see 1p knocked off the basic rate of tax. He said “far too many people are paying the 40% rate”. He added the policy was originally intended for the rich but it had sucked in “middling professionals” who should not be in the higher rate.

Prime minister David Cameron told the BBC he was committed to delivering tax cuts for low and middle-income earners.

There will be full coverage of the Budget 2014 on IFAonline.co.uk on 19 March.