Experienced Investor

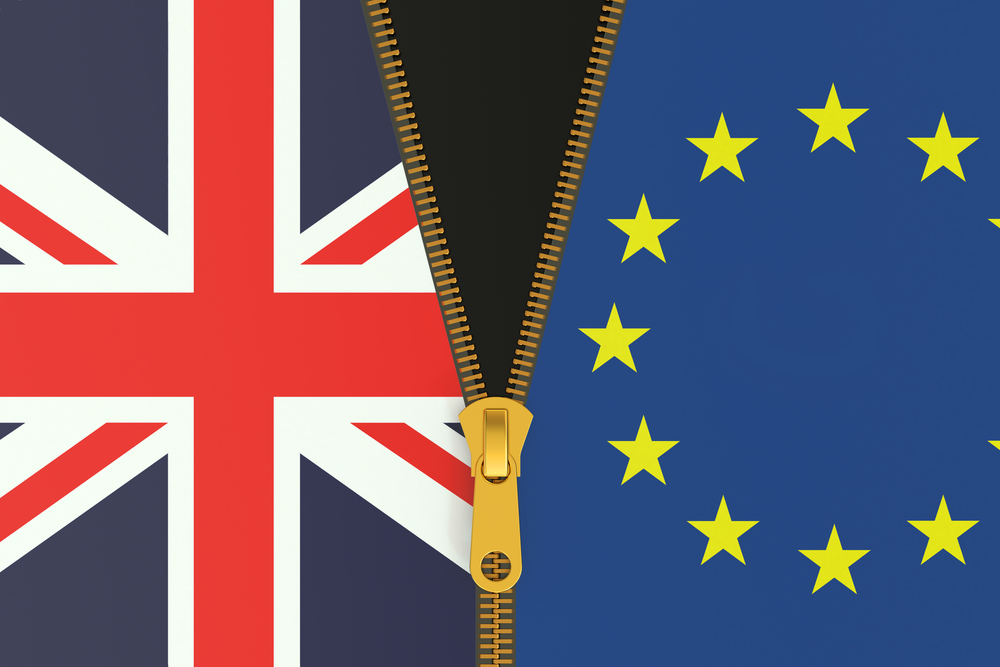

Investor sentiment reflects Brexit voting patterns, says Lloyds

Investor sentiment towards UK and Eurozone equities mirrors the voting patterns in the 2016 referendum, according to the latest investor sentiment index (ISI) from Lloyds Bank Private Banking.

Investors in London, which had the highest remain vote (62%) during the referendum, are looking across the Channel, and have the most positive sentiment on Eurozone equities (15%). In contrast, the North, which includes Yorkshire and the Humber, had the third highest Leave vote in the UK and today has the highest positive sentiment towards UK equities (15.9%) and the most negative sentiment towards Eurozone shares (-9.5%).

The East, which also voted leave, (56.5%) reflects this trend with a positive sentiment score of 7.4% for UK shares but -4.7% for Eurozone stocks. Scotland, although scoring both asset classes negatively, favoured Eurozone (-3.6%) over UK stocks (-5.7%), in line with the remain vote (62%) cast during the referendum.

Overall confidence is lower, falling for the first time in six months to 9.6%, from 8.4%. This may reflect increased volatility in recent weeks, but remains higher than any score achieved throughout 2017.

In the past two years, UK stock markets have taken a hit relative to other geographic regions. The average fund in the UK All Companies sector is up 26.9% and in the UK Equity Income sector, just 20.7%. This compares to 38.9% for the Europe ex UK sector and 47.2% for the US.

Sentiment fell across all equity indices during the month, with the U.S. (-9.3%) and U.K. (-9.2%) seeing the largest decline in investor confidence. In a sign of investors’ increasing risk aversion, sentiment improved for gold and cash. However, sentiment across all equity markets is significantly higher relative to last year, with the exception of UK shares.

Markus Stadlmann, chief investment officer at Lloyds Bank Private Banking, said: “As we approach the anniversary of the government triggering Article 50, it’s interesting to see investor sentiment broadly mirroring the referendum results. It could reflect political leanings but it’s more likely that investors are simply keeping a close eye on how the negotiations unfold and what impact these will have regionally.

“The recent market correction was sparked by US wage growth being higher than expected, which will put further pressure on US policymakers to more aggressively increase interest rates. This news has particularly taken its toll on global equities and fixed income assets, with cautious investors viewing the safety appeal of gold and cash more favourably.”

He added that it was not all ‘doom and gloom’ pointing out that confidence is still higher than at any point in 2017, and there are still some strong performers out there in the shape of emerging market and Japanese shares.