Investing

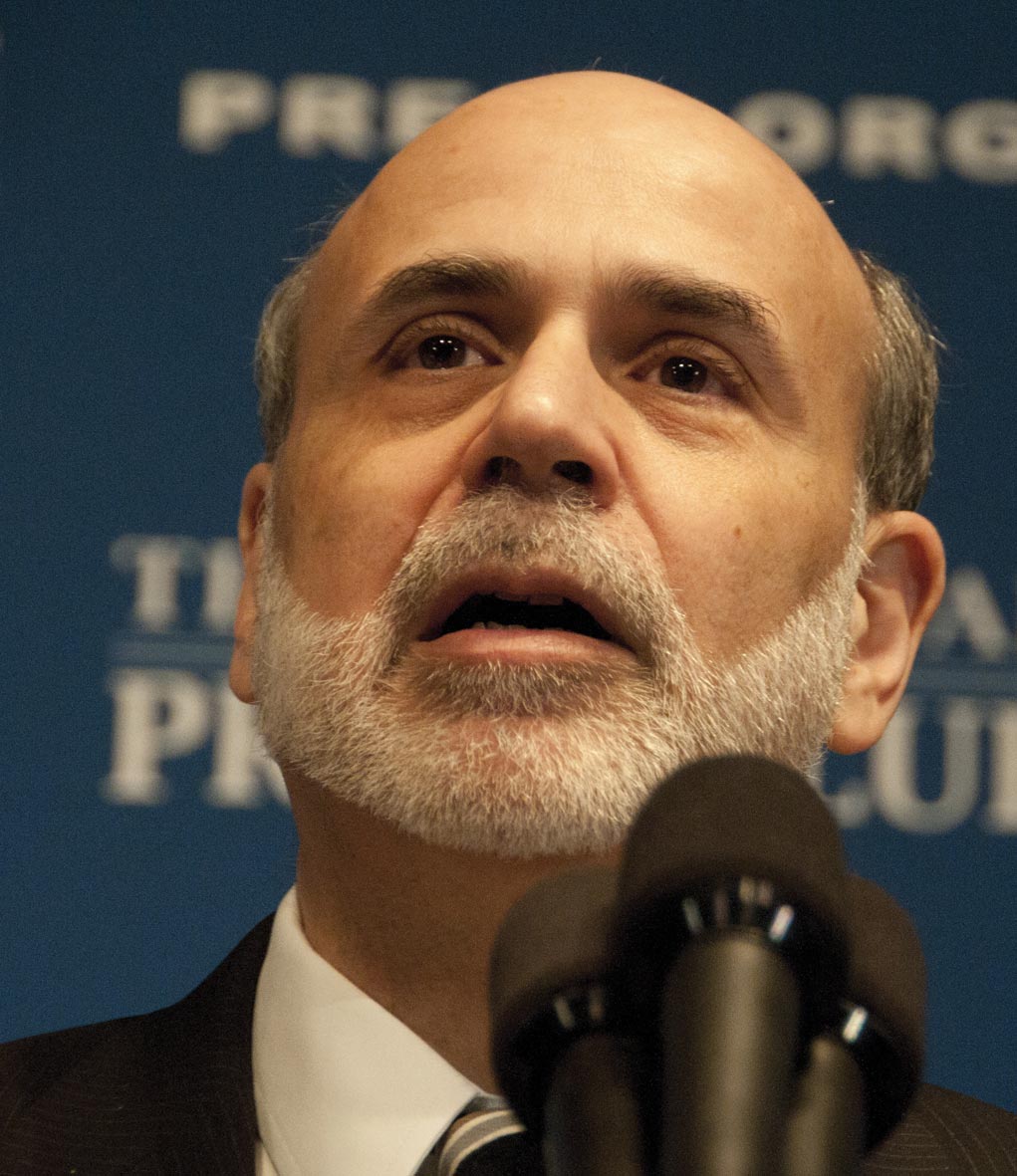

Fed chief: US economy still needs QE

Federal Reserve chairman Ben Bernanke last night moved to quell fears there will be a quick exit from QE in the coming months, arguing the US economy is not yet in a strong enough position to halt stimulus measures.

Minutes released last night from the Federal Reserve’s June meeting indicated that around half of the 19 participants in the Federal Open Market Committee are in favour of drawing QE to a close.

However, dovish QE members argued the employment market is not yet strong enough to bring the $85bn in monthly bond purchases to an end.

In a speech after the minutes were released Bernanke conceded that non-farm payrolls data needs to improve before the Fed begins to taper its monetary easing policy.

For this reason Bernanke opted to vote in favour of continuing to pump QE into the US economy.

“Highly accommodative monetary policy for the foreseeable future is what’s needed in the US economy,” he said.

Bernanke’s comments were welcomed by markets which have suffered a torrid two months amid fears the Fed could begin withdrawing QE as early as September. Asian indices all climbed on the news.

The comments also sent the US dollar down sharply, while treasuries strengthened on Bernanke’s comments.

Over the past two months losses have racked up across bond sectors after comments from the Federal Reserve signalling the end of quantitative easing spooked global markets.

Global bonds suffered their fourth-worst month in 20 years in May after Bernanke said the central bank may slow the rate of its bond purchases if the unemployment rate continues to fall amid a strengthening of the economy.