Blog

BLOG: The best Christmas gift ever for a baby

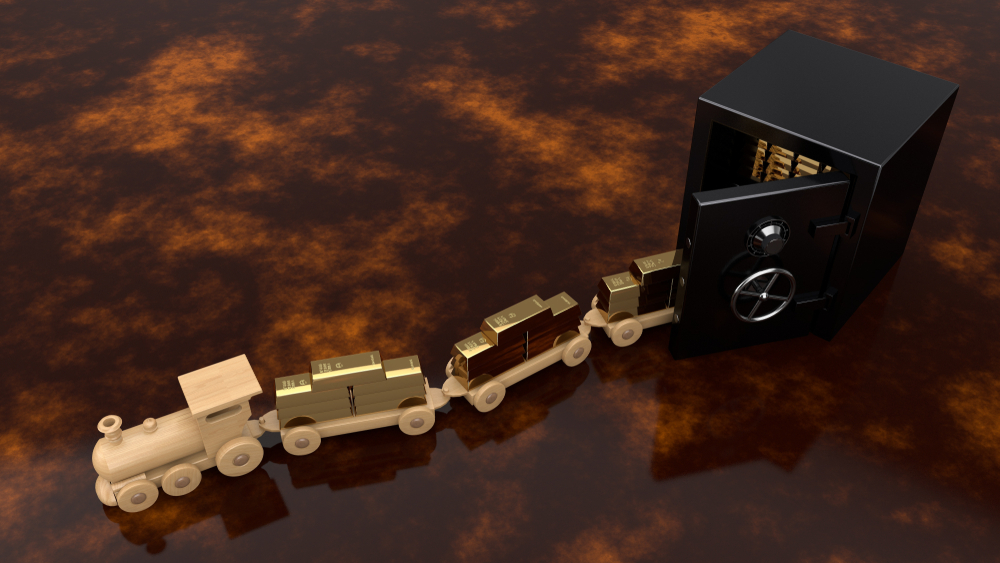

Here’s a mind-blowing statistic…If you had invested 0.01 US dollars on the day of Jesus’s birth – the very first Christmas Day – and it had earned 5% interest every year, today it would be worth the same as almost 60 million balls of gold, each the size of planet earth.

That’s obviously an unfathomable amount, (and where would you keep it?!) but it does highlight the power of compounding.

Compounding, which Albert Einstein described as “the most powerful force in the universe”, is basically the interest earned on interest. £100 earning 5% interest this year would be worth £105 next year. If that £105 earns 5% the year after, it would be worth £110.25, and so on.

Now, achieving 5% interest a year on your cash savings is impossible at the moment as interest rates are close to zero. But by taking some extra risk, you could consider investing the money in shares or bonds instead. The value of your money may go down as well as up but, over the long-term, you could be rewarded.

Investing in baby’s first year

Finding extra money to save on behalf of your child isn’t always easy, especially during the first year of their life. You are likely to be earning less on parental leave, while simultaneously forking out on a cot, riding toys for 1 year olds, a pram, a car seat and the constant supply of nappies.

So, it got me thinking…What if you could invest in all those things? At least then when you’re spending your money, you’d hopefully be contributing to a return on your own investment.

But it’s harder than I thought.

Many companies specialising in baby products – like Mamas & Papas, JoJo Maman Bebe and Britax are all privately owned or owned by private equity firms so they’re basically beyond the reach of the likes of you and me.

And, while you can invest in the parent companies of Boots or Maxi-Cosi or even Teva UK which makes Infacol, none of the professional investors I know own them.

But what are the professionals investing in? Companies that make baby formula for one. Danone (with its Aptamil and Cow & Gate brands) and Nestle (SMA) are relatively popular investments with the professionals.

Guinness Global Equity Income fund owns both. Manager, Matthew Page, said: “Danone enjoys a leading market share in a range of niche product categories which in turn means that brands such as Activia, Actimel, Alpro, Evian and Volvic dominate prime retail shelf space. Recent organic growth has come via strong demand in China and greater direct-to-consumer sales online.”

Ben Moore, co-manager of Threadneedle European Select, which invests in Nestle, said: “Nestle shares to date have offered great security and reliability. The Covid-19 crisis has generally increased consumer trust in big brands owing to their reliability and availability. In infant nutrition, Nestle has strong market share in China which is a key market. The market has been declining, but Nestle’s brand strength and online offering has enabled it to build market share during the virus crisis.”

Johnson & Johnson is another stock that is reasonably well-held, as is Procter and Gamble, which owns the Pampers nappy brand. Jason Borbora-Sheen, co-manager of Ninety One Cautious Managed fund, said: “Both Johnson & Johnson (JNJ) and Procter & Gamble (P&G) offer above average dividends, while also providing a dependable source of income. JNJ for example has consistently increased its dividend throughout the last 58 years to 2020.

“With regards to P&G, we believe the market is being too dismissive of the benefits of the company’s reorganisation – including an enhanced online presence profiting from the ongoing switch to e-commerce and a greater penetration of high-income households – all of which are particularly attractive in the current macro backdrop.”

P&G has also increased its dividend for 64 years, including this year when the company increased its dividend by 6%.

Of course, there are always supermarkets too, like Tesco. A holding in Smith & Williamson Enterprise fund, manager Mark Swain said: “In the short-term, elevated grocery demand is likely to continue – online in particular is booming and in August the firm hired 16,000 new permanent workers, a rare good news story on the employment front in the UK.

“Tesco’s online growth has also been double that of Ocado in lockdown and it has had a good crisis against the discounters who don’t offer online shopping or a complete shop (split shopping is much harder and also less desirable) and the price gap is down from 25% to 5-10%, so there is less of an incentive to switch.”

Morrisons is a holding in JOHCM UK Dynamic. Manager Alex Savvides said: “Morrisons has had a new management team with a new strategy that has succeeded. The company also has other goodies in its basket. Uniquely in the supermarket sector, it is also a food producer. It has a growing partnership with Amazon and, unlike its rivals, it owns rather than leases almost 90% of its store estate. Morrisons has also performed well this year, taking share in a very tough UK grocery market.”

And finally, there’s the stocking fillers. Torcail Stewart, co-manager of Baillie Gifford Strategic Bond, holds Hasbro. He said: “Hasbro is the second largest toy manufacturer in the US. It makes board games like Monopoly, Connect4 and Scrabble and has a range of toy brands which has grown over the decades including Transformers, Nerf, Twister, Play-Doh, and My Little Pony. It also produces toys under license from other companies, in particular Disney, making Star Wars, Marvel, and Disney Princess figurines.

“Hasbro has a long history of being run with a fairly conservative balance sheet. Thus, the recent elevated levels of debt from Hasbro’s acquisition of Canadian media producer Entertainment One, will likely normalise with time. Entertainment One is a business we have lent to in the past and has strong revenue streams derived not only from original programming such as Peppa Pig or PJ Masks, but also excellence in entertainment production and distribution. We see the combination with Entertainment One being an apt acquisition and believe Hasbro bonds are likely to perform well as debt levels reduce with time.”

Juliet Schooling-Latter is research director at FundCalibre