Experienced Investor

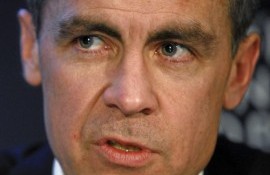

Carney: We are prepared to cut rates further if deflation takes hold

The Bank of England has said it is prepared to cut rates further and expand its quantitative easing (QE) programme should the current downward slide in inflation worsen materially.

Presenting the Bank’s Inflation Report today, Governor Mark Carney said the Bank “has the will, means and responsibility” to take further measures, including changing the pace of rate increases, cutting the bank rate to zero and further QE if risks materialise.

With UK CPI inflation having hit a 14-year low in December, dropping to 0.5%, but the UK economy growing at a reasonable pace, the Governor pointed to two potential risks which could cause the Bank to act.

Firstly, lower oil prices could provide greater stimulus to real incomes and demand. On the other hand, the risks of disappointing global growth could make deflation more long-lasting that expected.

The report outlined: “There are risks to the inflation outlook in both directions. Were downside risks to materialise, market expectations of the future path of interest rates could adjust to reflect an even more gradual and limited path for Bank Rate increases than is currently priced.

“The [Monetary Policy] Committee could also decide to expand the Asset Purchase Facility or to cut the Bank Rate further towards zero from its current level of 0.5%.”

The stronger capital positions of building societies means the Bank is now better placed to cut rates below their current level, Carney added.

However, the Governor said the downside risks are not the Bank’s central scenario. He suggested lower inflation will stimulate demand, and said CPI turning negative would not represent “deflation” as such.

The MPC still thinks inflation will return to target within the next two years, predicting a dip into negative territory this Spring before a sharper upwards turn later this year.

Investors viewed this as a slightly more hawkish stance, meaning sterling rose from $1.52 to $1.53 as a result, while 10-year gilt yields rose from 1.67% to 1.72%.

At the Inflation Report press conference, Carney also presented his letter to Chancellor George Osborne, explaining why inflation is more than a percentage point away from its 2% target.

Speaking at the press conference this morning, Carney said: “Inflation is at its lowest level since the introduction of inflation targetting, and it may [turn] negative in the Spring.

I have written my first open letter explaining why inflation is so low, and I will likely have to write a few more before the year is out.”

The key reason for the significant drop in inflation is the fall in oil prices, the price of a barrel of Brent crude having more than halved over the past few months, leading to lower food and fuel prices.

But Carney also attributes part of the drop to a general lack of inflationary pressures in the economy, as a result of a long period of high unemployment and muted wage growth.

Lower inflation also means there is unlikely to be an interest rate rise in the second part of this year, as originally expected by many. Interest rates have remained at the record low of 0.5% since March 2009.

The fall in inflation seen in recent months has caused economists, fund managers and other market participants to push back expectations of a rate rise to 2016.