Experienced Investor

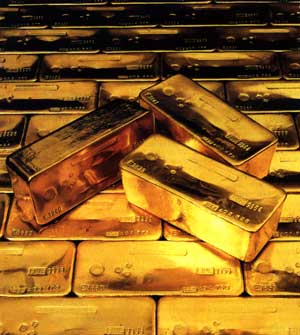

Fuel crisis and end of furlough prompt flight to gold

Demand for gold has soared in the past week as uncertainty about the state of the British economy intensifies.

The Pure Gold Company, which buys physical gold and silver on behalf of private investors, saw a 719 per cent increase in sales of gold bars and coins by first time investors over the past seven days compared with the previous week.

“The end of furlough, an on-going petrol crisis, HGV driver shortage and intermittent empty shelves are stoking fear of more chronic trade disruptions,” said Josh Saul, chief executive of The Pure Gold Company.

“Our clients are looking for a safe-haven asset that will protect their wealth amidst growing uncertainty.”

The firm said it had also seen a 257 per cent increase in clients selling physical gold bought in the last few years.

“They’re looking to provide liquidity for debt and bills that their depleted incomes won’t satisfy,” said Saul.

However, he cautioned that gold should be viewed as a long-term investment that rides out inflationary pressures and economic peaks and troughs.

He said: “Depending on how long they have held their gold for, some are enjoying growth of up to 50 per cent, while others selling within a shorter time frame haven’t fared as well.”

Elsewhere, the firm has seen a 73 per cent rise in recently divorced clients purchasing gold and silver since March 2020.

Many of these clients have cash they eventually want to be put towards the purchase of a house, but they do not want to leave it in the bank earning nothing nor expose it to the stock market.