Investing

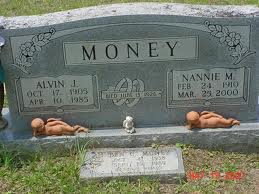

Grim reapings: making money from death

We reveal how you can profit from investing in crematoria and burial space.

The funeral arrangements for the late Baroness Thatcher are now in full swing, the high cost of which have been thoroughly debated over the past few days.

Although the cost of the average funeral in the UK is not quite as high as £10m, it is certainly a huge expense for the mourning next of kin, often costing as much as £5,000.

And as the population continues to grow and age, demand in the UK for cemetery space is accelerating at an alarming rate, with cemetery space in London and popular retirement towns nearing capacity.

The cost of the average burial plot has increased by 25% in certain parts of the UK in the last 12 months alone and despite the current recession, prices have continued to rise 10% per annum since 2007, according to an independent report published by the Chartered Institute of Public Finance and Accountancy (CIPFA).

All of this is attracting the attention of the private sector.

Investment firm Rockpool Investments recently launched a £3.5m Enterprise Investment Scheme (EIS) compliant investment opportunity in a crematorium in Kirkleatham, near Middlesbrough.

The freehold property is expected to be worth £4.6m upon completion of construction in January 2014. The firm says there has been keen interest from more risk-averse investors.

Managing partner Matt Taylor says: “There is a lot of appetite among investors for EIS qualifying investments with more predictable profits. Crematoria may be dull, but as an investment they have a lot to offer.

“The freehold property is an added attraction because investors like asset-backing. Kirkleatham Memorial is being capitalised with 100% equity – we want to keep the risk as low as possible and avoiding debt is a good way to do that.”

So how does the investment work? Well, investors can choose a short term investment period, which aims to return £1.33 in the fourth year per 70p of net invested cost, after claiming back income tax under EIS rules.

Investors also have the option to hold the investment past the fourth year, with a projected dividend yield of over 7%.

The project is being overseen by Howard Hodgson, CEO of Hodgson Holdings plc, who has interestingly been dubbed the superstar of the funeral world. Hodgson created the UK’s largest funeral group which is now part of FTSE 250-listed Dignity.

Hodgson says: “Cremation is now chosen by families in three quarters of bereavements, compared to barely one third in the 1960s. As the baby-boomers age, the death rate is pretty certain to trend upwards for the next 20 years.

“We chose Kirkleatham because the area is very poorly served. Bereaved relatives have to drive too far and then be rushed through a service, just because the crematoria in neighbouring districts are under such pressure. We can meet this demand and create a stable, utility-like investment, with predictable earnings.”

Alternatively, there is also the option to invest in burial plots via companies like Cemetery Invest.

The firm was set up to allow private investors to profit from the rising price of burial plots. It sells investors plots in a cemetery that is under construction at a discounted rate, then the funds raised are used to complete the cemetery and once the cemetery is open they re-sell those plots back to the public at the full price to generate a return for investors.

Investors receive the title to the burial plots they purchase as added security for the investment and also as a charge against the land until the plots are re-sold.

Cemetery Invest says it only invests in areas where demand is high and population growing and with reliable management companies that have good contacts with funeral directors and undertakers.

Alexander Ogden, CEO of Cemetery Invest, says: “The price of burial plots has not gone down in over 20 years and has seen an average increase of 10.4% annually over this period.

“Local councils are struggling with budget cuts from central government and are running out of space at many cemeteries. This is creating an issue were they need to make provision for more space but don’t have the funds to do so.

“The ethnic diversity of the population is also creating a strain on services as certain religions have specific needs when it comes to burial – such as the Muslim community that require plots to be facing mecca and burial as soon as possible.

“Both of these services cannot be guaranteed via the local council service in many areas so the need for a more ethnically diverse service is essential in the new cemeteries that we build.

“Burial plots are a fixed asset like land or property, and this creates a level of security for investors as there is no risk of total loss as there would be with shares or other types of investments.”

However, investors should note that this new area of investment is yet to be properly regulated. The investment will not yield any income or dividends and selling at short notice could prove difficult.