Experienced Investor

Is Alibaba’s IPO set to break records?

Earlier this year, Chinese e-commerce giant Alibaba started proceedings to launch on the US stock market. Soon, those proceedings should come to fruition and Alibaba will arrive on the New York Stock Exchange.

In doing so, many anticipate that Alibaba may beat Facebook’s record – set in 2012 – as the biggest ever new listing on US markets. If it does that, then the next record in Alibaba’s sights – set by Visa in 2006 – would be for the biggest amount raised in an IPO.

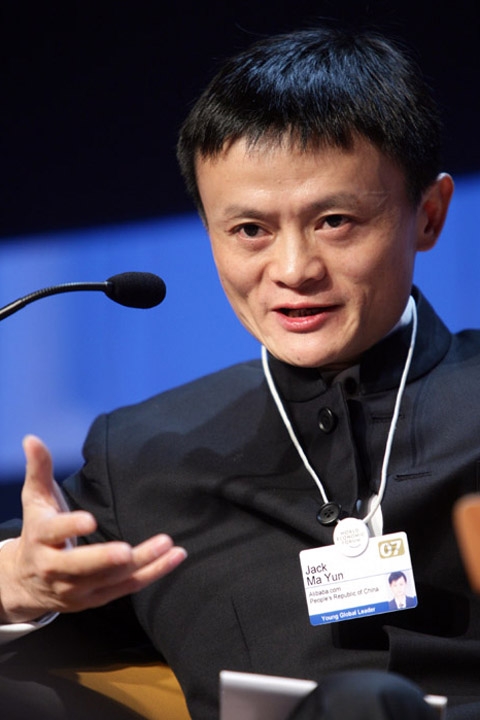

So who is this new challenger? Perhaps the most surprising thing for many western investors is that a relatively unknown quantity may overtake such established brands. Not so for Chinese consumers and investors, however, where Alibaba and its executive chairman Jack Ma are both household names.

The company runs three main websites – Alibaba, Tmall and Taobao – all of which operate in the e-commerce sector. Respectively, they cater for business-to-business, business-to-consumer and consumer-to-consumer sales. Between those websites (plus a few others) Alibaba caters for 85 per cent of all online shopping in China.

Unsurprisingly, that has led to a stunning volume of sales through the business, which reached $248 billion in 2013. That figure outstrips that of Amazon and Ebay combined and presents almost 50 per cent growth from the previous year.

No wonder, then, that traders are excited about the prospect of Alibaba arriving on the stock market. But what chance does it have of achieving a record-breaking debut?

To beat Facebook’s listing in 2012, Alibaba will have to end its first day of trading worth more than $105 billion. The consensus of market analysts puts its minimum worth at $115 billion (and most agree that it is worth far more than that), so as long as things go broadly to plan, it should beat that target. Indeed, IG’s grey market on Alibaba – which offers traders a chance to speculate on the value of the IPO before it takes place – indicates that traders believe the company will hit a market cap of around $210-220 billion.

Whilst Facebook arrived with a high value, it only raised the fourth most cash generated by an IPO: $16 billion, or 15 per cent of the company value. Visa, on the other hand, arrived on the market worth far less than Facebook but sold 50 per cent of its shares to raise $19 billion.

For Alibaba to break that record, it would have to sell at least 10 per ent per cent of its shares (if it meets the grey market value of around $200 billion). Current analyst opinion puts the value of the IPO at around $20 billion, so on paper the competition for largest IPO is far tighter than largest listing.

If Alibaba hits around the $210-220 billion mark it will be joining the very top of the charts in terms of US listed companies. Just three companies on rival index the NASDAQ would be worth more; Apple, Google, and Microsoft are worth $574 billion, $386 billion and $358 billion respectively. Alibaba would have its work cut out to outstrip them.

On their chosen exchange, the New York Stock Exchange, there would be 13 companies above them. Climbing the list may be an easier task, though, as just Exxon Mobile at the top is worth in excess of $300 billion.

First of all, however, they need a successful IPO and IPOs tend to be tricky with lots of factors influencing their success. Reports are already claiming that Alibaba may cut its own pricing by 20 per cent and lower its potential market cap to around $150 billion. Alternatively, interest in the listing may have waned by the time it actually arrives, cutting demand and Alibaba’s worth.

But if Jack Ma can successfully steer his company round these potential pitfalls, Alibaba could set some tough records to beat.

Patrick Foot is a financial markets writer at IG, the CFD and financial spread betting provider.

Spread bets and CFDs are leveraged products. Spread betting and CFD trading may not be suitable for everyone and can result in losses that exceed your deposits, so please ensure that you fully understand the risks involved.

This information has been prepared by IG, a trading name of IG Markets Limited. The material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.