Investing

Markets hit record highs and dollar tumbles after Fed surprise

The US Federal Reserve surprised investors and sent shares soaring after it unexpectedly opted to hold back on any tapering of its stimulus last night.

Despite having previously signalled to the market that the US economy was now strong enough to withstand the slow withdrawal of stimulus, the Fed yesterday caught investors off guard after it opted to continue its $85bn monthly bond purchase programme.

The Federal Open Market Committee said it wants to see more evidence that an economic recovery has taken hold in the US before the stimulus is curtailed.

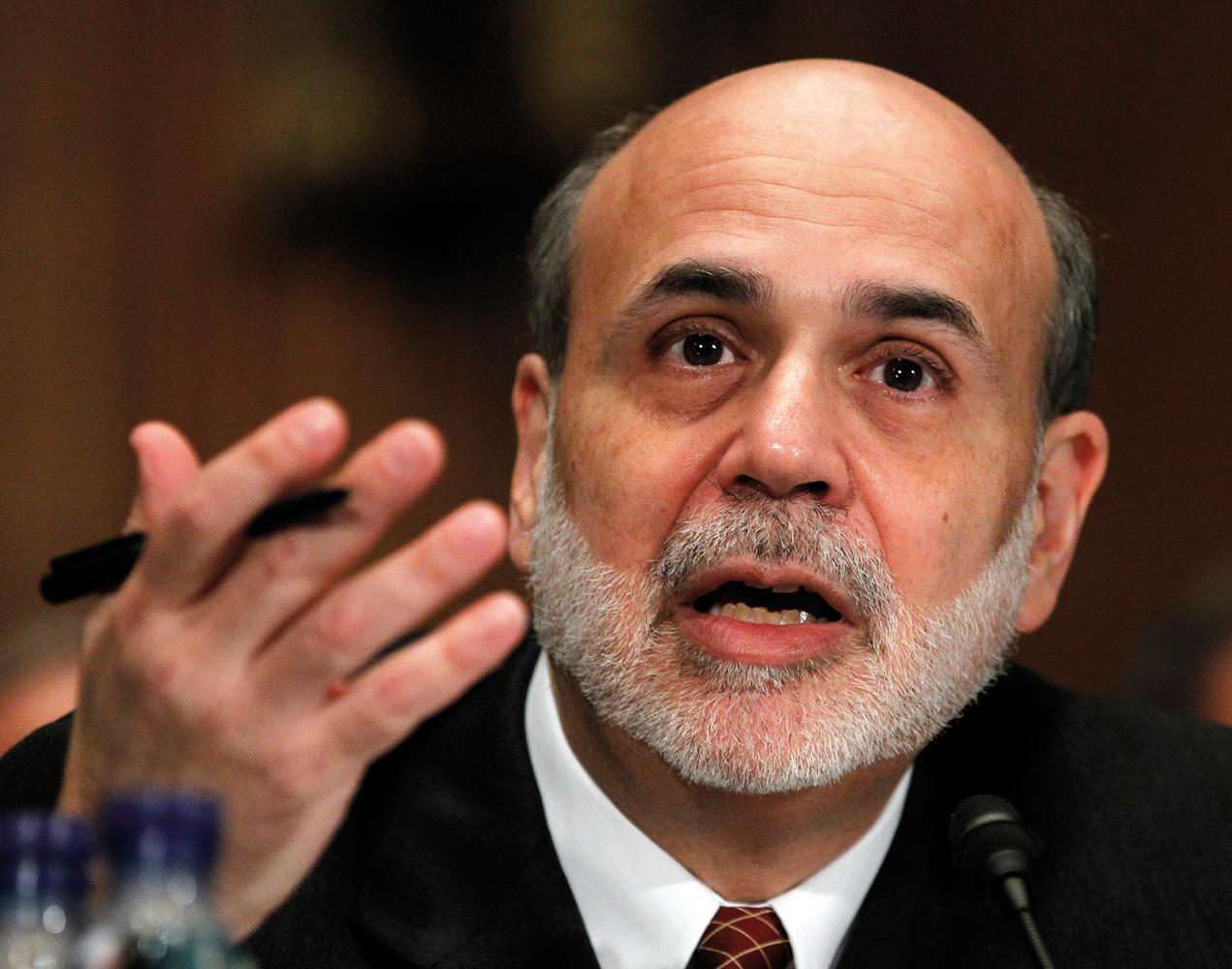

Most investors had expected the Fed – headed by Ben Bernanke (pictured) – to say it was cutting back purchases by between $10-$15bn a month.

Equity markets around the world jumped on the news, while the US dollar fell, driving up the price of gold substantially overnight.

In the US, the S&P 500 closed up 1.2% at 1,725, having hit a record high of 1,729 during trading.

The Dow Jones Industrial Average closed up 1% at 15,677, the index also having reached a record peak of 15,709 during the session.

In Asia markets were also in firmer territory just before closing this morning, with the Nikkei 225 up 1.3% and the Hong Kong Hang Seng up 1.6%.

Meanwhile gold jumped over 4% to $1,364 after the US dollar weakened.

The dollar declined to an almost seven-month low against a basket of currencies it is traded against most often, including the euro and sterling.

Luke Bartholomew, investment analyst at Aberdeen Asset Management, said: “Bernanke’s decision to keep the QE taps on full is a big surprise. It sends a clear signal to the market that the Fed will do everything it can to support the nascent US recovery and this lends further credibility to its forward guidance.

“The decision perhaps reflects how fragile the US recovery is and the recent cooling in data. The Fed’s updated 2016 forecasts are also dovish with a lower than expected forecasted Fed funds rate for the end of 2016 and a lower inflation forecast.”

Bartholomew added the move by the Fed means tapering may now be delayed until December.