Investing

Osborne sets aside £77m to tackle ‘cowboy’ tax advisers

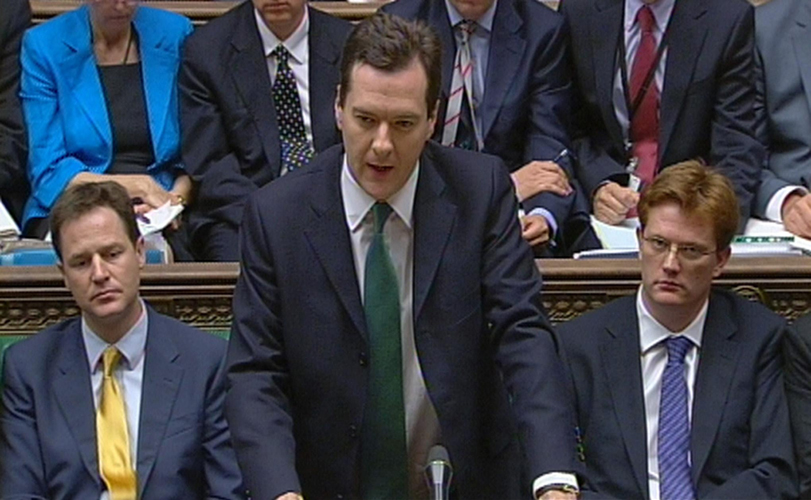

Chancellor George Osborne has given HM Revenue and Customs extra powers to tackle advisers promoting aggressive tax avoidance schemes.

The Revenue will be handed an extra £77m to boost its investigations into anti-avoidance activity by wealthy individuals and multi-nationals.

“The action we are announcing today will help HMRC close in not only on those who seek to avoid or evade tax, but on the dubious ‘cowboy’ advisers who sell them the schemes and dodges they use to cheat the law-abiding majority,” he said.

“The government is clear that while most taxpayers are doing their bit to help us balance the books, it is unacceptable for a minority to avoid paying their fair share, sometimes by breaking the law.”

Around 100 extra staff will be recruited with the additional funding, that the Government expects will bring an additional £2billion per year in tax for the Revenue.