Investing

UK economy ‘isn’t as strong as it looks’

The UK economy grew by 0.8 per cent in the second quarter of 2014, but some experts question its true strength.

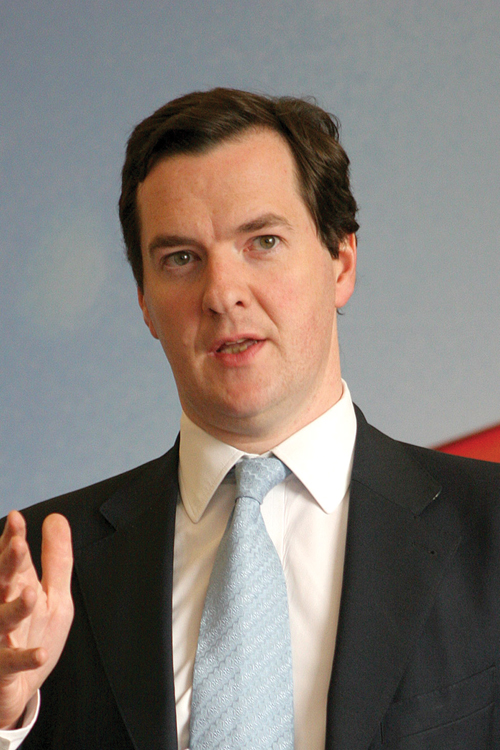

According to figures from the Office for National Statistics Gross Domestic Product (GDP) grew 3.1 per cent year-on-year and is now 0.2 per cent ahead of its pre-crisis peak. While Chancellor George Osborne celebrated “a major milestone in our long-term economic plan”, Ben Brettell of Hargreaves Lansdown said that significant challenges lie ahead.

He explained: “The UK economy isn’t as strong as it looks. While it has surpassed its pre-crisis peak in absolute terms, a larger population means GDP per capita is around six per cent lower. The economy has been growing by adding jobs, but there is an underlying issue with productivity, and this is why we are not seeing any meaningful increase in wages.”

The Bank of England has noted some signs of slowing output in the second half of 2014, Brettell said, and events in the Middle East and Ukraine could lead to a destabilising spike in oil prices. In addition UK consumers are struggling under a “substantial” consumer debt burden, the scale of which could deter the Bank of England from raising interest rates in the near future.

He continued: “Research suggests that for every 0.25 per cent increase in the average mortgage rate, the average household’s disposable income falls by about 1.25 per cent. I don’t believe the economy is strong enough yet to battle that kind of headwind.”

Chris Williams, CEO of Wealth Horizon, said that the latest GDP figures were encouraging.

“However,” he said, “for the majority of the population, real living standards still fall short of their pre-crisis levels. Families are still working hard to repair personal balance sheets and young and old have been affected by high living costs and low interest rates on savings. Now could be a good time to reflect on the progress that has been made on a personal and economic level. Key to this will be not to get carried away and to continue the new ethos of saving over spending.”