Investing

UK loses prized AAA credit rating

Moody’s has stripped the UK of its AAA credit rating on fears over rising government debt and years of slow economic growth ahead.

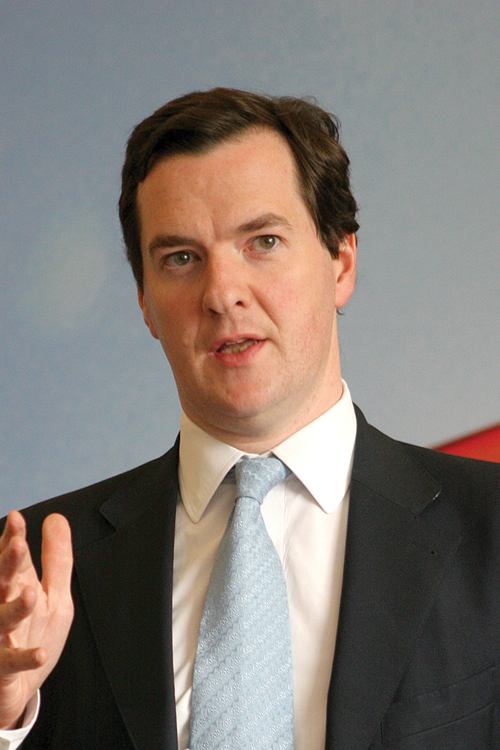

The ratings agency cut the country’s rating from AAA to Aa1 in a move which Chancellor George Osborne (pictured) said is a “stark reminder of the debt problems facing our country”.

“Far from weakening our resolve to deliver our economic recovery plan, this decision redoubles it,” he said, according to the BBC. “We will go on delivering the plan that has cut the deficit by a quarter.”

The UK is following in the footsteps of the US and France, which lost their AAA ratings in 2011 and 2012.

In a statement, Moody’s pointed to the “challenges that subdued medium-term growth prospects pose to the government’s fiscal consolidation programme, which will now extend well into the next parliament”.

It added the UK may not be able to reduce its debt pile until 2016. “Despite considerable structural economic strengths, the UK’s economic growth will remain sluggish over the next few years due to the anticipated slow growth of the global economy and the drag on the UK economy,” Moody’s said.

Economist Howard Archer of IHS Global Insight said markets had been expecting a UK downgrade from at least one of the major credit rating agencies, and the move is well priced in.

“For some considerable time now, it has looked to be very much a question of when – rather than will – one of the credit ratings agencies downgrade the UK. Indeed, all three of the major credit rating agencies – Moody’s, Standard & Poor’s and Fitch – have had the UK’s AAA credit rating on negative outlook,” he said.

“The markets have been increasingly pricing in the loss of the UK’s AAA rating for some time, so Moody’s actual decision to act may actually not have much of an impact – although the pound will be particularly vulnerable and lost further ground on the announcement of Moody’s decision.”

Archer said he does not expect the news will cause a sharp increase in the government’s cost of borrowing.

“UK gilt yields have risen appreciably from the lows seen around the third quarter of 2012, but again that can partly be attributed to other factors including a move back up in inflation and reduced sovereign debt tensions in the eurozone reducing the UK’s attraction as a safe-haven from the single currency area’s problems. We doubt Moody’s move will lead to a sharp upward spike in gilt yields.”