Experienced Investor

Will your investment or currency platform trade during the referendum and result?

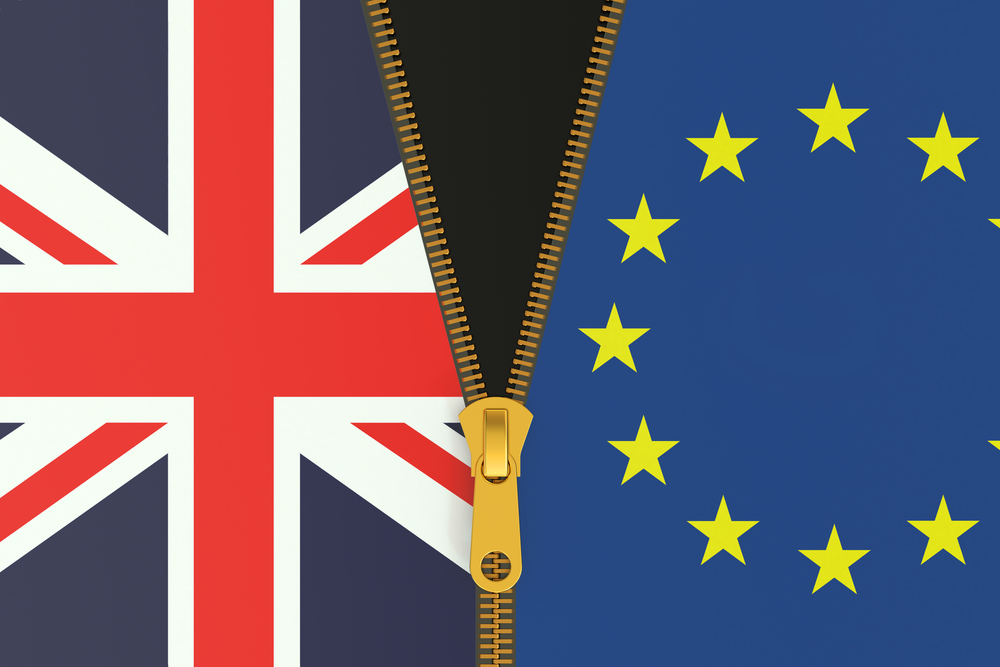

The markets and currency are expected to be highly volatile today and tomorrow when the results of the EU referendum are known and investors are set to pounce to benefit from a leave or remain vote. But will your platform continue to trade in the normal way?

There’s no escaping today’s EU referendum vote and while many investors have already positioned their portfolios to absorb the shock of a leave or remain result, others will be trading in the early hours in reaction to the news.

While it’s reported that some foreign exchange and money transfer providers have decided to close for business today and Friday and that some investment platforms won’t accept online trade orders, YourMoney.com contacted currency specialists and investment firms to find out what, if anything, is changing.

Currency and money transfer

Chris Saint, senior analyst, Hargreaves Lansdown currency, said: “Dramatic exchange rate swings are to be expected regardless of the result, with a sharp drop in the pound’s value possible in the event of a Brexit.”

Here’s what the foreign exchange and money transfer providers told YourMoney.com:

Azimo: No transfers can be made at present as it’s temporarily suspending the service from 6am on Thursday 23 June until currency markets “have settled following the UK European Membership vote and we can safely trade again”. The website adds that it will inform customers via email when the service is back up and running as normal.

Caxton FX: Extended trading hours from 8am to 8pm Thursday and Friday.

FairFX: Trading as usual.

HiFX: Trading as usual.

TransferWise: From 7am, you won’t be able to create new transfers from any currency to GBP and from 6pm today, you won’t be able to create new transfers from GBP to other currencies. If you make a transfer to, or from, GBP and Transferwise won’t receive the payment by 8pm today, it will be automatically cancelled. It added that once the referendum results are in, it will resume service on Friday.

Investment platforms

Here’s what the investment platforms told us:

Axa Investment Managers: Business as usual.

Charles Stanley Direct: Expects higher volumes and more market volatility than usual. The website states: “It is possible that market makers will reduce the size of orders that can be placed online and be slow to answer phones. In practice this may mean that you are more likely to have to place a limit order instead of a market order and it may take longer for us to be able to place such trades. We ask for your understanding if you are thus affected.”

Chelsea Financial Services: Business as usual.

Fidelity International: It told us: “Our key focus is our clients and meeting their needs. As you would expect, we have undertaken contingency planning as we approach the vote, as we do for any potentially significant market events. Our call centres are prepared and ready to answer any questions from clients.” It added that it will be operating normal opening hours but will “continuously assess call volumes tomorrow and over the weekend” and has “lined up extra staff to help clients if needed.”

Hargreaves Lansdown: It told us it’s extended the opening hours and has put many more staff on the help desks and deal desks.

TD Direct Investing: It will be open at midnight today and will reopen at 5am tomorrow morning to provide additional support to investors.