Buy To Let

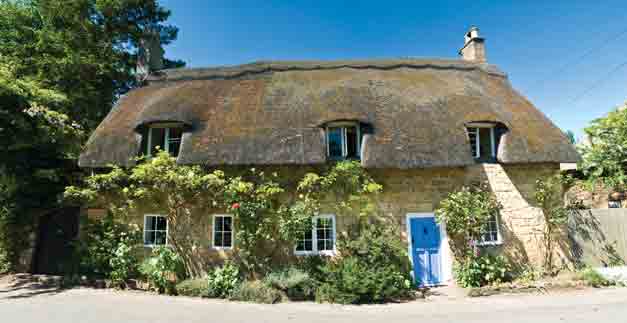

Holiday let property viewers ‘becoming more serious’

Enquiries around potential holiday let mortgages are increasingly coming from committed investors rather than those with only a leisurely interest like holidaymakers.

That’s according to Holiday Cottage Mortgages, which noted that almost three in five holiday let mortgage assessments requested in August last year came from those who were simply browsing. The firm said that these are often staycationers who have enjoyed their holiday so much that they begin to consider the idea of purchasing their own holiday let, and so book a few viewings with local estate agents.

Leigh Glazebrook, office head at Knight Frank’s Stow-on-the-Wold office in the Cotswolds, said: “The sheer demand from buyers in the Cotswolds has never been quite so high. Deciphering between those who are serious about buying and those who are browsing has been extremely difficult at times, particularly when you are trying to be efficient with time and also minimising unnecessary foot traffic in clients homes.”

The broker said enquiries between August 2019 and 2020 jumped by a whopping 108 per cent.

However, this trend seems to be loosening, with the number of ‘browsers’ contacting Holiday Cottage Mortgages almost halving, while two-thirds of enquiries last month were from those actively pursuing a holiday let mortgage. The firm suggested this demonstrates that the market is becoming more focused and serious once more.

Andrew Soye, founder of Holiday Cottage Mortgages, argued that it was easy to forget that holiday letting was already a growing market before the pandemic.

He continued: “With the recent focus on staycations, significantly more people have experienced how fabulous UK holidays really are and so we’ve seen a step-change in activity that we believe will last. Although international travel is opening up again, our view is that the demand for staycations is likely to remain high and we will see continued growth in the domestic travel sector, which will be very positive for the UK economy.”

Recent data from Moneyfacts found that the number of holiday let mortgages available on the market has more than doubled over the past year, with a host of lenders entering the market, most recently LendInvest.