Buy To Let

Osborne to give Bank of England powers to cap mortgage loans

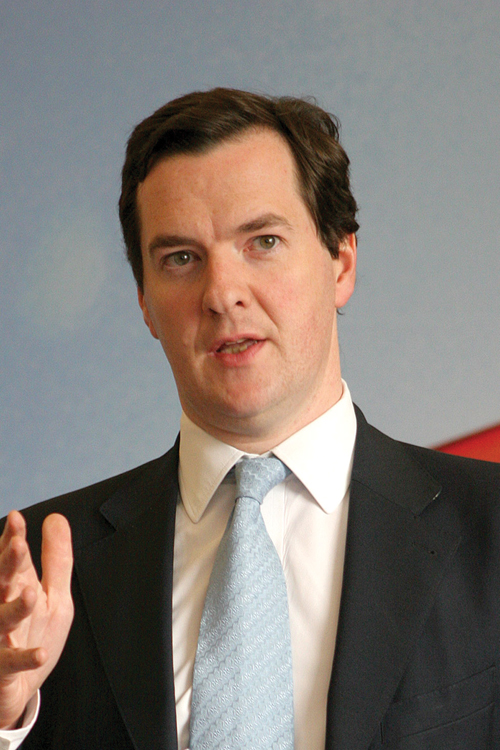

George Osborne is to give the Bank of England new powers to cap the size of mortgage loans compared to family incomes and house values in a bid to cool the housing market.

According to the BBC, the Chancellor will announce the plans, which will be given to the Bank by the end of this Parliament, during his annual Mansion House speech this evening.

He is also expected to announce plans to build up to 200,000 new homes.

Speaking this afternoon, Mr Osborne said: “I’m acting against future risks in the housing market by today giving the Bank of England new powers to intervene and control the size of mortgages compared to family incomes and house values”.

Earlier today, Business secretary Vince Cable told the BBC has was ‘appalled’ lenders continue to offer loans five times a mortgage applicant’s income.

The latest figures from the Office for National Statistics (ONS) found prices rising at an annual rate of 17% in London, compared with 8% in the UK as a whole, leading to fears that an unsustainable bubble is developing in the housing market.