News

Act now before tax attack on pensions, says adviser

Middle class savers should act now on retirement savings before the government introduces a flat-rate of pension tax relief, the boss of a leading financial advice firm has warned.

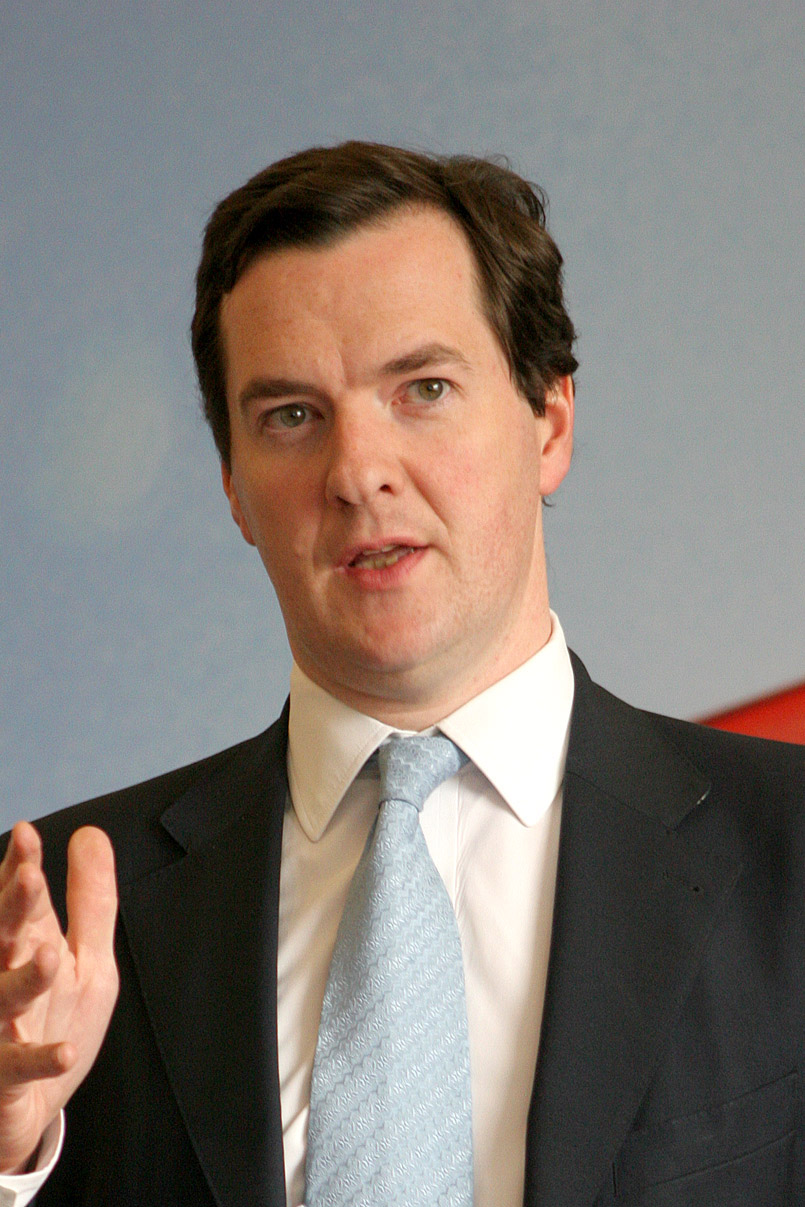

The warning from Nigel Green, CEO and founder of deVere Group, which claims to be one of the world’s largest financial advisory organisations, follows reports Osborne will “dramatically” overhaul the pension tax relief system by implementing a flat-rate of between 25 and 33 per cent in this year’s Budget.

Green said: “Those paying higher rates of tax have traditionally been awarded more relief on their retirement savings. It would seem this time-honoured practice is to be axed.

“Therefore, middle class savers who have been prudently putting money aside for their retirement are going to be hit by Osborne’s plans.

“Millions of people, who currently receive between 40 and 45 per cent relief, could see a significant drop in their retirement funds.”

With the Chancellor expected to announce the changes in the Budget in March, Green said higher earners should act now and take the tax relief while it lasts.

“Those seeking to make larger one-off pension contributions to make the most of their retirement savings might be wise to consider doing so sooner rather than later,” he said.

Attack on pensions

Green called Osborne’s plans a “tax attack on pensions” and “incredibly short-sighted”.

“It’s pretty easy for the government to make the case to attack pensions as there’s a good deal of money in them, most of it belongs to the better-off part of the population, and they get tax relief.

“This move by the Chancellor seems incredibly short-sighted. We should be incentivising saving now more than ever as retirement planning increasingly becomes a personal responsibility and as the country needs a financially secure older population for its long-term sustainable economic growth.”

[article_related_posts]