How to

PM confirms pensions raid: how high earners should prepare

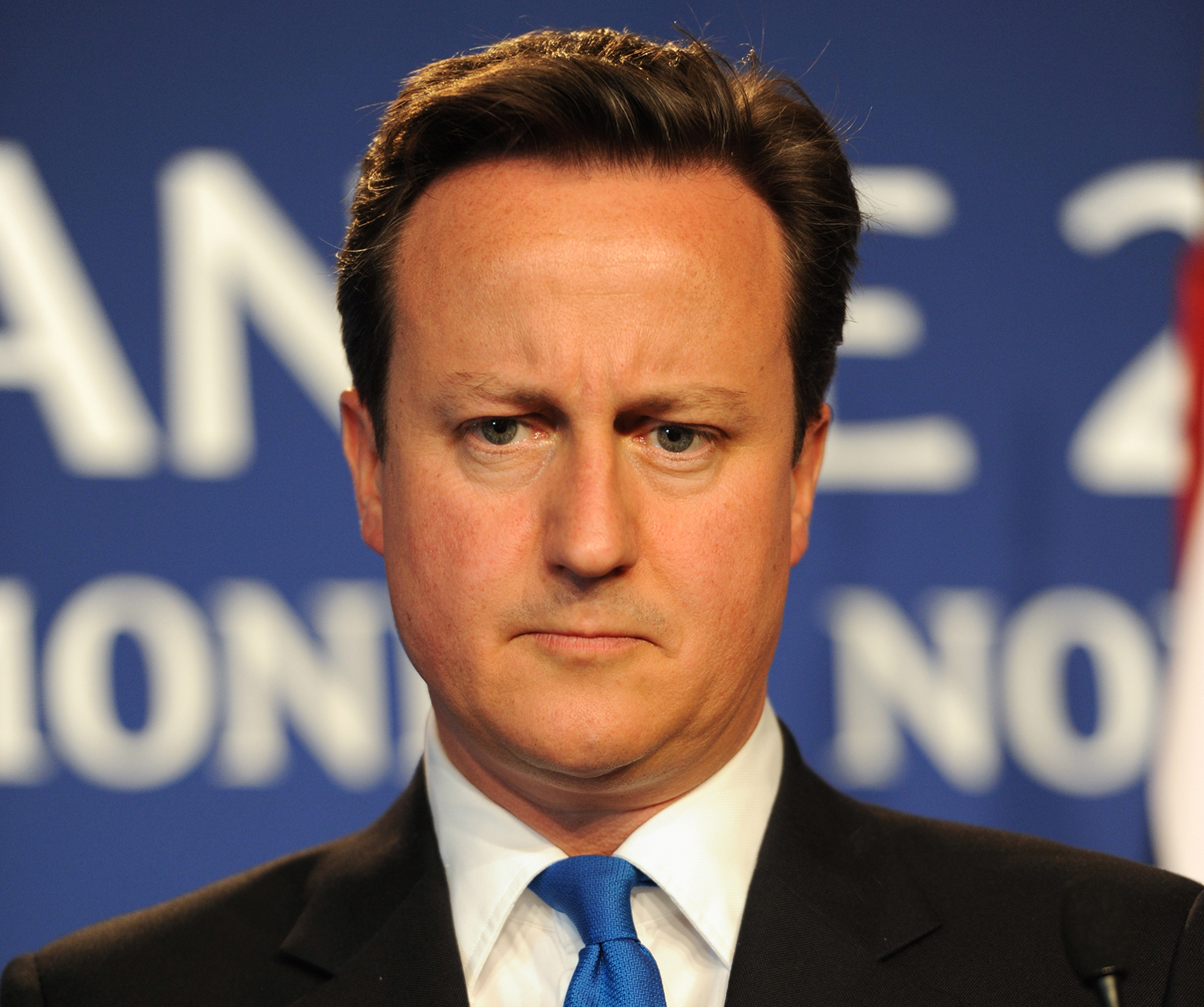

With the Conservatives pulling off a surprise overall majority in last month’s General Election, David Cameron has promised to implement “all” of the policies in the Conservative manifesto.

Among these pledges was a promise to reduce “the tax relief on pension contributions for people earning more than £150,000” to fund other commitments.

In an interview today on ITV’s This Morning, when asked how he would pay for a planned doubling of the amount of free childcare for families where both parents are working, the Prime Minister confirmed that this would come from the removal of some pension tax privileges for people earning over £150,000 a year.

So, with the apparent die cast on this policy, higher earners might expect an announcement on 8 July, when the new Government announces its first Budget.

David Smith, financial planning director at Tilney Bestinvest, looks at the potential implications of this and the forthcoming reduction to the Lifetime Allowance (LTA) which was announced in the last Budget and is set to come into force in April 2016.

“Whilst details in the manifesto were sparse, in media briefings it has been suggested that the raid will see the current gross annual pension allowance of £40,000 phased down to £10,000 for those earning between £150,000 and £210,000 or more. This equates to a loss of £13,500 in tax relief for someone earning £210,000 or more which, when combined with the reduction in the Lifetime Pension Allowance, means higher earners increasingly need to think beyond pensions when developing their retirement plans.

“To analyse the implication of the reduction of the LTA, Tilney Bestinvest highlights the scenario of three individuals (with different levels of earnings) all saving towards their retirement, in 10 years’ time, each with current pension savings of £380,000.

“Under the new proposals the effectiveness of a pension as a savings vehicle is strikingly reduced for individuals earning in excess of £150,000. Over 10 years, compared to current legislation, anyone earning £210,000 or more could miss out on tax relief of £135,000 and have their pension curtailed by in excess of £375,000:

What five steps can be taken?

- Utilise the current year Annual Allowance: As it stands, the annual allowance is currently £40,000. For individuals with readily realisable funds, planning to utilise their annual allowance this year, it seems prudent to do so in advance of the Budget on 8 July. Whilst there can be no guarantee, it would be surprising if any reduction to the annual allowance for high earners applied to contributions already made.

- Utilise unused Annual Allowance from previous years: Where individuals haven’t utilised all of their annual allowance in recent years, it may be possible to carry forward any unused allowance from the previous three tax years which could be as much as £140,000. Whilst details of potential changes to the annual allowance are unclear, it makes sense to do so sooner rather than later.

- Fund next year’s pension contribution, this year: The eccentricities of pension legislation mean that it is possible with planning to utilise next years’ annual allowance, this year. This is predicated on the assumption that any potential change would not be retrospective or be applied to contributions already made. In doing so, higher earners could receive up to £13,500 in tax relief that would otherwise be lost if the rules are changed.

- Negotiate a pay cut, but hurry! So-called ‘salary sacrifice’, involves an employee giving up earnings in return for an equivalent pension contribution, paid by their employer. Prior to the Budget, there may be scope for some individual to restructure how they are remunerated, which could potentially protect against legislative change. Someone earning £175,000, with available annual allowance could ‘sacrifice’ earnings of £25,000 and potentially avoid annual allowance restrictions entirely.

- Be conscious that the Lifetime Allowance (LTA) is reducing again in April The coalition Government announced in March that the LTA will reduce in April 2016 by a further £250,000 to £1 million. Anyone with a relatively modest pension fund of £310,000 could be affected if they intend to utilise the £40,000 annual allowance (assuming that they do not have their annual allowance restricted) until they retire in 10 years as in such a scenario, they would only need to enjoy net annual growth of 5% to accumulate a pension fund of £1 million. A combination of the earlier planning steps could be considered to address this issue.

“Pensions continue to be a target of reform, not all of which is welcome, which presents high earners with a very narrow window of opportunity to capitalise on current rules. How and when tax relief for higher earners will be restricted is not yet clear, but it could be as soon as the 8 July Budget or possibly from the next tax year. Therefore, if you are planning on making a pension contribution this financial year, and you have funds available it makes sense to consider contributing prior to this date.

“For those likely to be caught be the proposed lower annual allowance or the reduced lifetime allowance, retirement planning will require a broader approach than simply maximising pension and ISA contributions. While the likes of Enterprise Investment Schemes and Venture Capital Trusts can have a role to play, their specialist and higher risk nature means they cannot fill the gap created by decreased scope for pension investments on a like for like basis. For many, careful use of annual capital gains tax allowances, to draw down lump sums from portfolios of growth investments will have an increasingly important role to play, so bespoke financial planning is going to be key.”

[article_related_posts]