News

Majority of early retirees not tempted to return to work by pension changes

The government’s pension changes in the Budget are unlikely to tempt early retirees back into the workforce, research has found.

Interactive Investor polled users to establish how many over-50s who are already retired could be tempted back into the workplace as a result of changes made to the pension system in last week’s Budget.

It found that only a little over 9% of those who have given up work would consider going back into employment as a result of the abolition of the pension lifetime allowance or the increases to the pension annual allowance.

However, the measures may be marginally more effective in encouraging workers from delaying early retirement. Across all respondents, around 13% said that ditching the lifetime allowance and increasing the annual allowance would make them more likely to give up early retirement.

Among the over-50s, more than half (54%) said the changes would make no difference since they enjoy retirement, while around a fifth said the changes would have no impact on their retirement plans as they do not have a large enough pension pot.

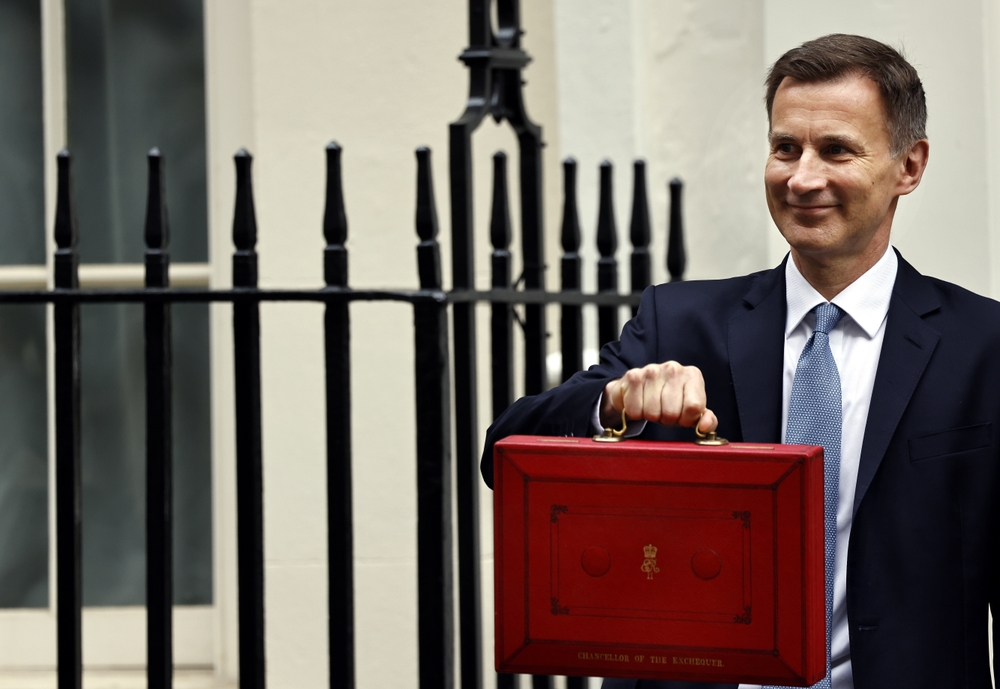

Jeremy Hunt’s pension changes

At the Budget, the Chancellor of the Exchequer Jeremy Hunt announced a host of changes to the pension system, which are designed to encourage more older people to remain in the workforce.

The lifetime pension allowance, which covers how much people can save into a pension over their lifetime before being taxed, was scrapped entirely from its current level of £1.07m. The Chancellor also hiked the amount that can be saved into a pension in a single year from £40,000 to £60,000.

In addition, the money purchase annual allowance (MPAA) was increased from £4,000 to £10,000. The MPAA is how much can be paid into a pension in a year after you have started accessing it.

The Chancellor’s hope is that these changes will mean older workers who may have been considering early retirement, or have retired already, will instead continue working into their later years. There have been concerns that the NHS in particular is being negatively impacted by workers deciding to retire early in order to avoid falling foul of these pension limits.

Pension changes not enough

However, the Interactive Investor study suggests that pension changes alone may not be enough. One of those surveyed, who works in the NHS, said that they still intend to retire early regardless, arguing that it was the working conditions within the health service that are the issue, not the tax situation.

Others said they were reluctant to try to take advantage of the changes as they fear there will be further changes in the future, such as a cap being reintroduced.

Alice Guy, head of pensions and savings at Interactive Investor, said that the Chancellor appears to be “whistling in the wind” with his plans to entice people out of early retirement.

She noted that for most retirees, saving enough to breach either the lifetime or annual pension allowance is a “distant pipedream”, while for those that do there’s little that will induce them back to work.

Guy continued: “It’s a difficult challenge for Jeremy Hunt as with 3.5 million over-50s not working, 320,000 more than before the pandemic, he is hoping the pension changes will encourage over-50s to dust off their boots and return to the fray. But our survey results show that most retirees either don’t want to return to work or will not be helped by the recent pension changes.”