News

Have you won £1m in May’s Premium Bonds draw?

A Premium Bonds holder from Greater Manchester and another from Wandsworth have scooped the life-changing £1m prize in May’s draw.

The lucky bond holder from Greater Manchester has won the £1m jackpot with the number 282HY160082.

They held the maximum £50,000 Premium Bonds amount and bought the winning number in September 2016.

Another person from Wandsworth has also woken up a millionaire after their number 092QC393046 was randomly drawn by ERNIE – Electronic Random Number Indicator Equipment.

This winner held £49,000 in Premium Bonds and bought the winning bond in June 2003.

For everyone else, you’ll have to wait until tomorrow to find out if you’re one of the 3.4 million Premium Bonds winners. There were 117 billion numbers eligible for the draw.

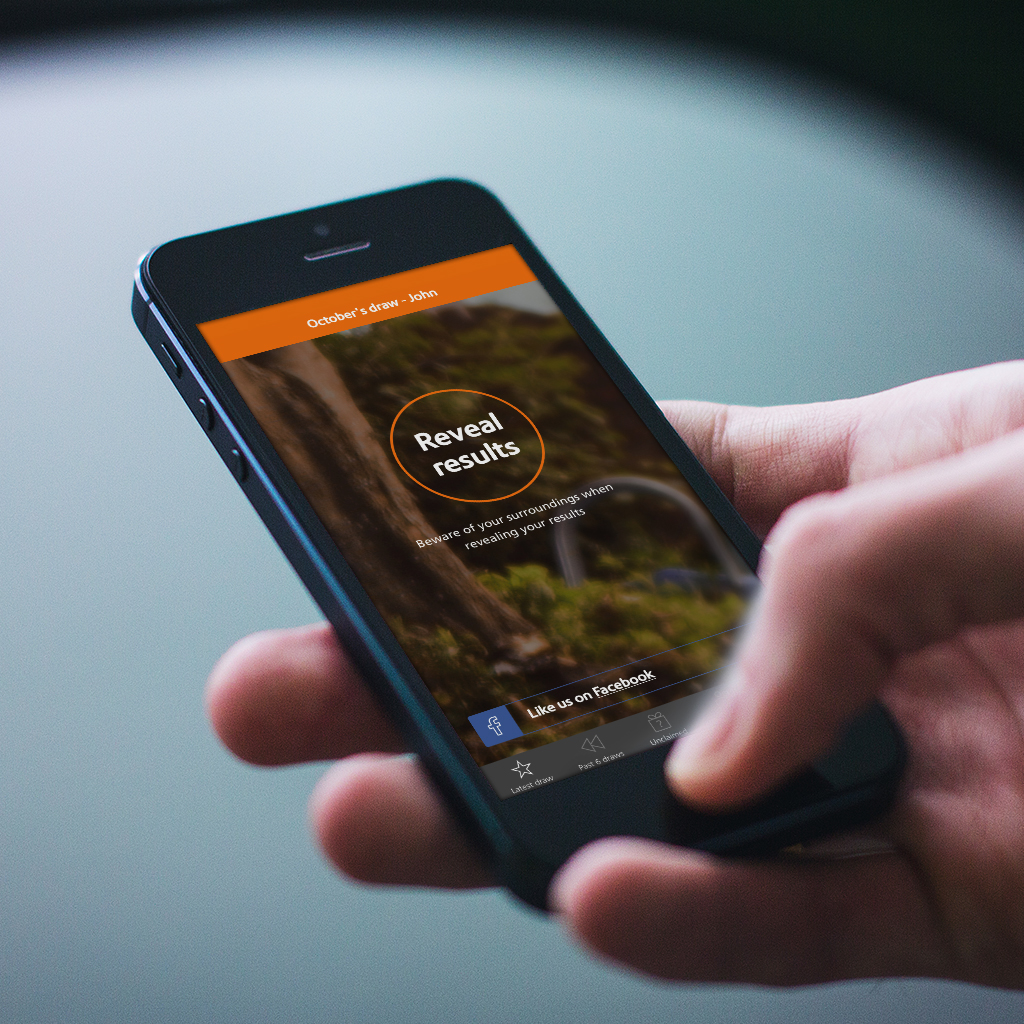

To check if you’ve won between £25 and £100,000 in the May draw, see the NS&I prize checker, the prize checker app or via an Alexa-enabled device from Wednesday 4 May.

You’ll need your Premium Bonds holder number to check, and you can also see if you have any unclaimed prizes.

NS&I – the government’s savings arms – said more than nine in 10 prizes are now paid straight into winners’ bank accounts or automatically reinvested, which reduce the chance of prizes going unclaimed.

Since the first draw in June 1957, ERNIE has drawn 562 million prizes worth nearly £23bn. The current annual Premium Bonds prize fund rate is 1%, with the odds of winning at 34,500 to one.

All Premium Bonds prizes are free of income and capital gains tax.