News

JPMorgan Chase launches digital bank in the UK

US banking giant JPMorgan Chase has entered the UK market with a current account offering 5 per cent interest and cashback on everyday spending.

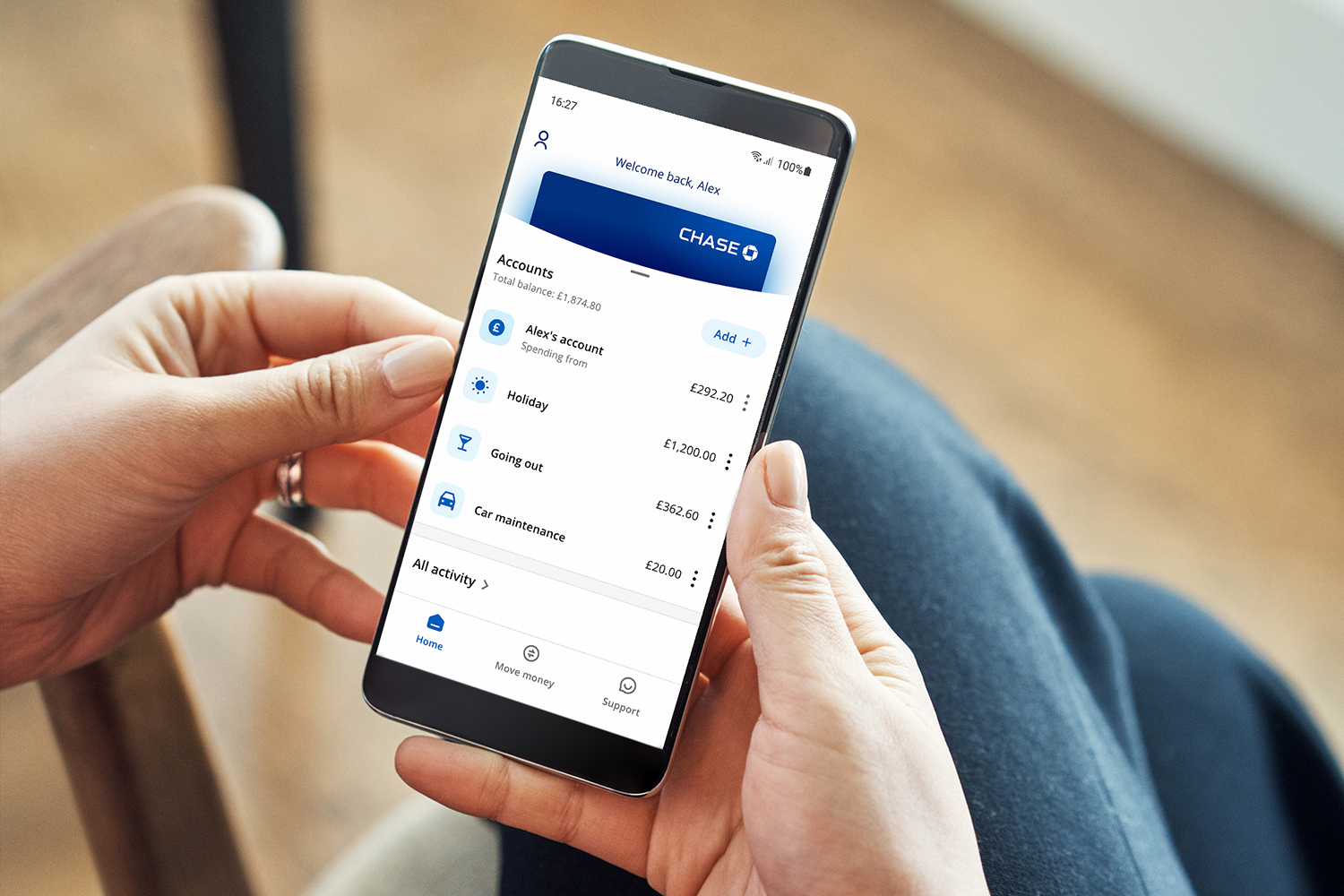

The new digital bank ‘Chase’ will have no branches. Instead, customers can sign up at chase.co.uk where they will be invited to download the Chase app.

The fee-free current account offers a market leading 5 per cent interest on round up spending. For example, if a customer spends £1.90, 10p will be moved to a separate savings account where interest is paid monthly.

The account also offers one per cent cashback for 12 months on debit card spending.

Laura Suter, head of personal finance at AJ Bell, said: “First impressions are that this new account will blow the competition out of the water, with an attractive cashback deal and a market-beating interest rate on its savings feature. The one per cent cashback is better than rivals as it’s on spending, rather than just certain bills or direct debits, and it also doesn’t require a minimum monthly deposit or come with a fee.

“A cash round-up feature has become fairly commonplace with banks now, and it means each transaction is rounded up to the nearest pound, with the difference siphoned off into a savings account. But the fact that Chase is paying 5 per cent interest on its round-up savings makes it very attractive. The top rate you can get from other banks paying interest on their round-up feature is 0.25 per cent, meaning the new Chase rate leapfrogs those offerings.”

The account is free to use abroad – including ATM withdrawals.

Customers are given a numberless debit card so they don’t put their account details at risk if they lose their physical card. Account details are stored behind a secure login on the Chase app,

Sanoke Viswanathan, chief executive of Chase, said: “We’re offering people in the UK the opportunity to experience Chase for the first time with a current account that’s based on simplicity, a fuss free rewards programme and exceptional customer service.”

Chase plans to launch more banking products, including new current account features, savings and investment accounts, and lending products.