Investing

Moody’s: Triple-dip recession would cost UK its AAA-rating

Global credit ratings agency Moody’s has warned the UK is at risk of losing its AAA status should the economy slide into a triple-dip recession.

The agency’s comments follow the Bank of England’s decision yesterday to slash its growth forecast for 2013 to 1%.

The UK could struggle to raise revenues amid a more sluggish economic environment, making the task of cutting the deficit more difficult.

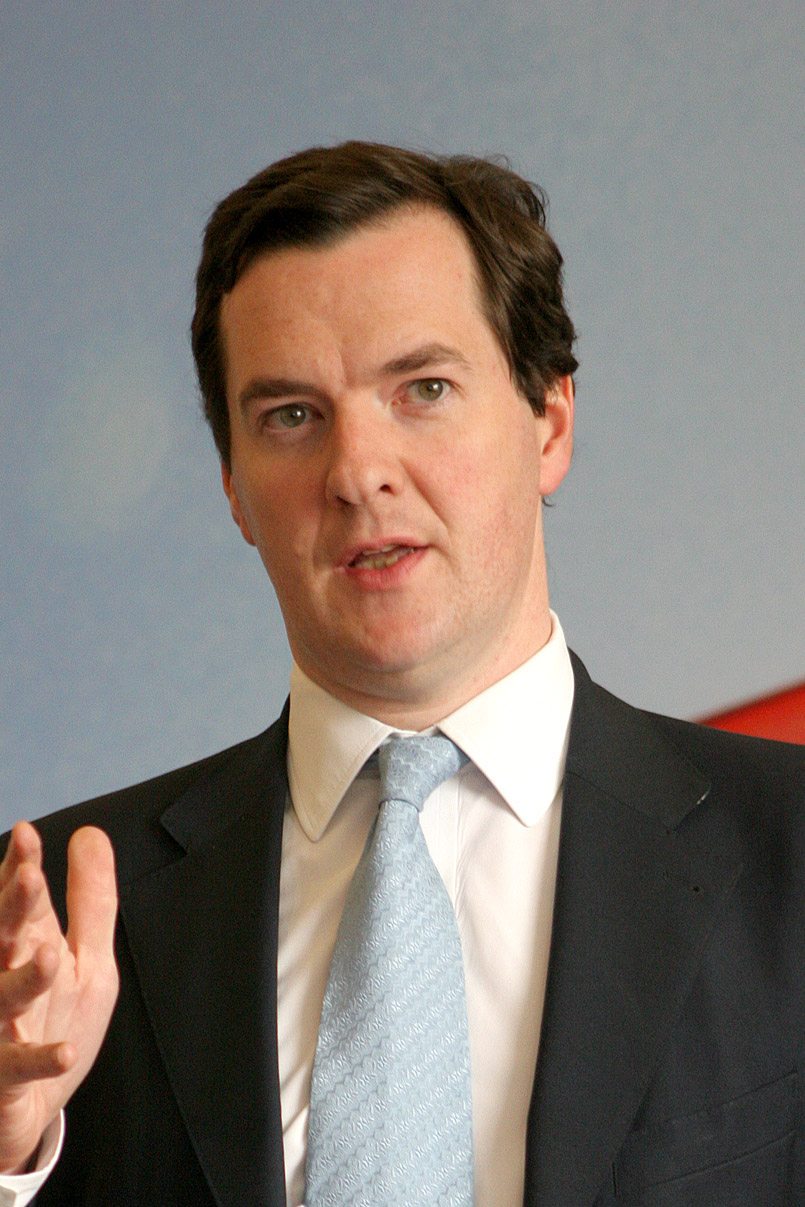

According to the Guardian, Moody’s met with Chancellor George Osborne (pictured) on Wednesday as part of the agency’s annual assessment of the British economy. Th agency said it will be closely monitoring Osborne’s strategy of balancing economic growth with deficit reduction.

According to a Moody’s statement, the firm is most concerned about Osborne achieving this balancing act while contending with “weaker economic prospects as well as by the risks posed by the ongoing euro area sovereign debt crisis”.

“The UK government’s most significant policy challenge is balancing the need for fiscal consolidation against the need for economic stimulus,” it said.

The cut to the UK economy’s credit rating could happen as early as January, if growth appears to be worsening or if Osborne veers off course on his timetable for cutting the deficit, Moody’s warned.

A key date will be 5 December when Osborne released his Autumn Statement. Moody’s will then assess the speed of the deficit reduction, the growth outlook and the most importantly, the likelihood that the debt to GDP ratio will start to come down over the next three to four years.

However, on a more positive note, Moody’s also said the UK’s AAA-rating is underpinned by “significant structural strengths” including “very favorable debt structure”.

“The fact that the country has a large, diversified, highly competitive economy, a very flexible labour force, and its track record of structural reform,” were other positives, read the statement.

In the BoE’s quarterly inflation report yesterday, governor Mervyn King said the bank had halved its forecast for growth in 2013. He attributed recent more optimistic forecasts on one-off factors, such as the impacts of the Olympic Games which, once removed from the equation, would leave Britain growing at around 1%.

Moody’s put the UK on ‘negative watch’ in February this year due to concerns over the impact of the credit crisis, along with France and Austria. At the time the Chancellor said the warning came as a “reality check” for Britain.