Blog

BLOG: You shouldn’t need a PhD to understand terms and conditions

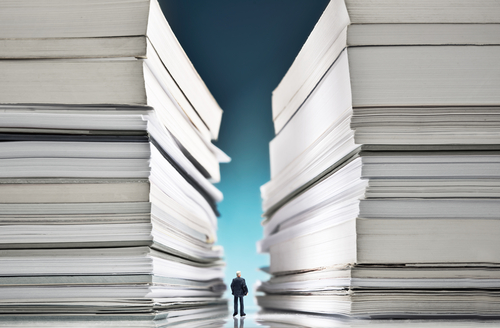

New Fairer Finance research reveals many insurance documents are only accessible to people educated to post-graduate level. It is time for the regulator to take action.

Terms and conditions are a necessary evil in today’s complex world. As lovely it would be to have insurance policies without exclusions, and bank accounts without charges, we’re too far along the road to turn back.

If we’re to accept financial products are necessarily complicated, it’s all the more important banks and insurers work as hard as they can to help their customers understand them.

Sadly, quite the opposite tends to happen in financial services. Banks and insurers manage to turn complex products into ones not even everyone in their own company understands – let alone their own customers.

Have you got A-levels in small print?

Fairer Finance research reveals the average insurance policy document is written in language only accessible to 18 year olds finishing Sixth Form College. Worse still, dozens of banking and insurance documents would only make any sense to people who have a post-graduate university degree.

We looked at 285 banking and insurance documents, and ran them through a number of readability tests. These are fairly broad brush measures, looking at things such as how long sentences are, and what the average number of syllables is per word. But, they are a good rule of thumb for understanding whether a document makes any sense to the average consumer.

The National Literacy Trust says 16 per cent of UK adults have the reading age of an 11 year old. We couldn’t find a single insurance policy document with a reading age of 11 or less. Banking documents weren’t much better. The average reading age was 16 – GCSE age – and many were much worse.

This isn’t just bad news for consumers, who can’t make head nor tail of the literature they’re given. It’s bad business as well. If people buy insurance policies without really understanding what is and isn’t covered, it inevitably leads to disappointment when they make a claim and find they’re not covered. Insurers and their customers would all be much better off if everyone was clear about what was included, and what wasn’t. Sadly, we’re miles away from that.

Who’s going to move the elephant in the room?

We’re publishing these figures to try and pressure policymakers into action. The problem with complex T&Cs is not a new one. Everyone from the PM to the head of the Financial Conduct Authority would privately admit consumers are now forced to sign up to all sorts of things that make no sense to them. Sadly, it’s one of those problems most seem to see as too big to tackle.

To give some credit where it’s due, the FCA did put out a discussion paper in the summer, encouraging companies to work harder to communicate clearly with their customers. Although, this strand of work doesn’t feel as though it’s going to end in any kind of action.

If they really wanted to, the FCA already has all the tools it needs to make life difficult for companies who write their documents in impenetrable legalese. The rules say documents should be “clear, fair and not misleading”. We don’t think a single company passes the test at the moment, and we’d like to see the FCA making an example of the worst offenders.

This is not just a problem for banks and insurers – it’s much wider. Every time you sign up for any service online, you’re forced to click a button agreeing to pages and pages of small print.

The Stateside view

Maybe it’s time for a more radical strategy for tackling small print, such as the approach currently catching on in the US?

In Florida, state laws stipulate insurance documents must achieve a minimum readability score. Documents failing to achieve this minimum level are deemed unenforceable. We applied these standards to insurance and banking documents in the UK. The table below illustrates the worst offenders we found:

In case you’re wondering what a reading grade is, it equates to a US school year. In the US, year 12 is the last year of high school. Once you get to grade 15 and above, you’re into post-graduate study. Yes, that’s right – you’ll need a PhD to understand Admiral’s travel insurance policy!

Our latest research just focuses on reading ages. Last year, we looked at length, and found some T&Cs were twice the length of Animal Farm and Of Mice & Men.

What more evidence is required to convince policymakers this is a problem that needs to be got to grips with?

James Daley has been a consumer campaigner and financial journalist for 15 years. He is the founder of Fairer Finance.