Household Bills

A quarter of Gen Z can’t take an energy meter reading

Four in 10 (43 per cent) young people feel anxious about setting up accounts with utilities companies and insurers.

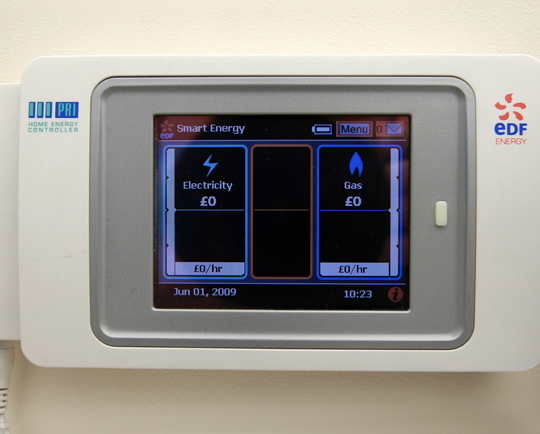

More than a quarter (28 per cent) of 18 to 24-year-olds don’t know how to read an energy meter and a third rely on help from their parents to when taking out an insurance policy, according to MoneySupermarket.

In its study into how people view their households bills, the price comparison website found that four in 10 (43 per cent) young people feel anxious at the thought of setting up accounts with energy companies and insurance providers – more than three times more than the national average of 12 per cent.

This could explain why more than half (51 per cent) of 18 to 24-years-olds seek parental advice before setting bills up and why more than a third (37 per cent) are more likely to let their parents take a lead role in setting up insurance policies, such as car, home or contents, compared to 7 per cent nationally.

The research also found that young adults are the least likely to look into switching energy supplier, with a third (34 per cent) admitting they have never searched for cheaper deals, compared to a quarter (24 per cent) of the nation overall.

A further misconception within this age group is the belief that energy bills can only be paid quarterly (12 per cent), when more regular billing is also available for those who want to pay a fixed amount each month via direct debit.

Rachel Wait, consumer affairs spokesperson at MoneySuperMarket, said: “Managing household bills for the first time can be a daunting prospect for young adults, but the reality is there’s no need for concern – it’s actually much easier than you think. Many providers offer online account management and you can switch utilities, such as energy and broadband, in a matter of minutes.

“By staying on top of your household bills, you’re more likely to make savings, especially if you shop around for the best deals. Searching and comparing deals across your switchable household bills could save you hundreds of pounds for just a few minutes of your time. You could reduce your energy bill by almost £238, car insurance by £250, home insurance by £42 and broadband by hundreds of pounds. That means you could be looking at a combined annual saving of nearly a thousand pounds.”