Household Bills

Autumn Budget cancelled to focus on Covid-19

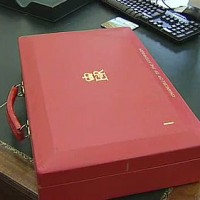

The Treasury has cancelled this year’s autumn Budget, normally scheduled for October or November, in order to focus on the economic fallout from the coronavirus pandemic.

Chancellor Rishi Sunak is updating the House of Commons later today on how he plans to protect jobs through the winter, as fears of a second wave of Covid-19 grow.

It is rumoured that Sunak’s ‘Winter Economy Plan’ could include a German-style wage subsidy scheme to replace the UK’s furlough scheme which is due to end next month.

Genevieve Morris, head of corporate tax at tax and advisory firm Blick Rothenberg, says: “The announcement that there will be no Budget this year comes as no surprise. It would have been difficult for the chancellor to announce tax changes in the Autumn which are aimed at recouping the costs of the pandemic, whilst the country is still in the grip of a second wave and many businesses and individuals will be looking at having to pay deferred income tax, corporation tax and VAT liabilities and start repayments on the CBILs in the first quarter of 2021.

“What we need from the chancellor now is a promise that there will not be overnight tax changes announced in the Autumn, or reforms which put additional burden on individuals and businesses. A promise from the chancellor now will remove the ambiguity which is worrying people at the moment and at least provide some certainty over the next six months.”

Rachael Griffin, tax and financial planning expert at Quilter, says it makes sense for the chancellor to delay the tough decisions until at least next Spring.

“By then government will hope to have a much better idea of whether an effective vaccine is viable for next year, and the UK’s longer-term relationship with the EU ought to be clearer. At the moment it would be extremely challenging to make long-term policy decisions with so much up in the air.

“As we learn more over the coming months it may become a little easier to build an informed projection about the trajectory of the economic rebound. In turn, that makes it easier to build an evidenced based case for what may be some difficult policy decisions.”

“Rishi Sunak’s stock is currently pretty high. Polling shows he has come through a rollercoaster six months in good shape, with the public clearly approving of measures like furlough. If he can avert a major jobs crisis over the winter – a difficult challenge – and maintain some of that good feeling with the public then perhaps he may yet be tempted to use it as a platform to implement some difficult revenue raising measures in March, ahead of the new tax year.”