Household Bills

Cost of living help: £400 energy bill discount for all

Every household in Britain will receive a £400 discount on energy bills from the government in October, with no requirement to pay the money back.

Millions of vulnerable households will also receive hundreds of pounds in extra government support to ease the financial pain of the soaring cost of living.

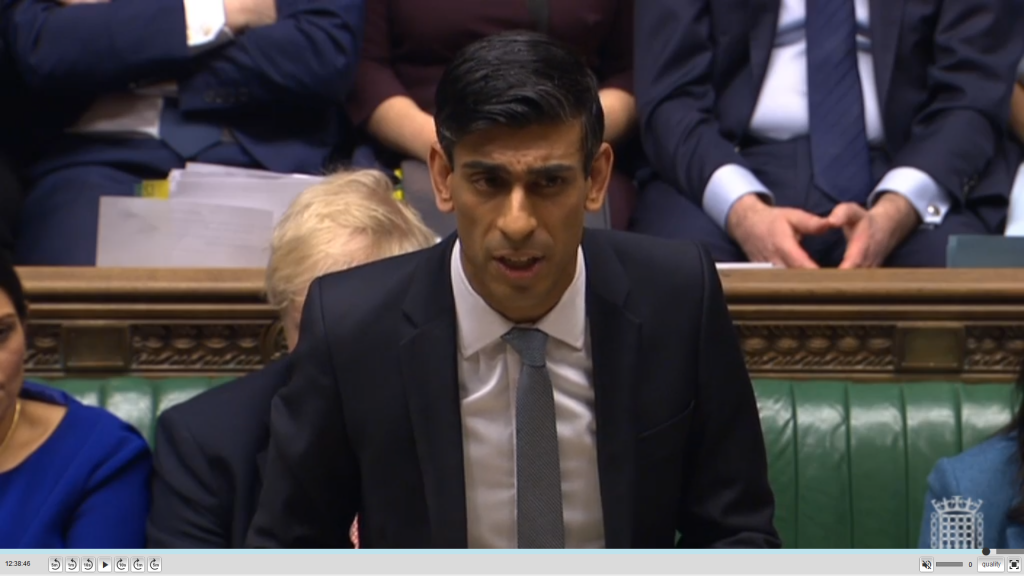

Almost 8million families will receive help worth £1,200, including a ‘cost-of-living’ payment of £650, under a £15bn package of measures, announced by Chancellor Rishi Sunak.

The one-off cost of living payment will be made to low-income households on Universal Credit, Tax Credits, Pension Credit and legacy benefits. There will be separate one-off payments of £300 to pensioner households and £150 to individuals receiving disability benefits.

The new energy bill discount will replace the previously announced £200 discount on energy bills, which had a requirement that households repay the benefit.

The chancellor also announced a £500 million increase for the Household Support Fund, delivered by Local Authorities, extending it from October until March 2023.

The cost of living statement also gave details on a ‘windfall tax’ on energy companies to pay for the measures.

The temporary levy will be a rate of 25% and is expected to raise around £5bn.

The news comes as energy bills could rise by a further £800 in the Autumn, according to energy regulator Ofcom, with the energy price cap predicted to increase up to £2,800 in October.

The move would push 12 million homes into fuel poverty, the watchdog warned earlier this week.

Rishi Sunak said: “We know that people are facing challenges with the cost of living and that is why today I’m stepping in with further support to help with rising energy bills.

“We have a collective responsibility to help those who are paying the highest price for the high inflation we face. That is why I’m targeting this significant support to millions of the most vulnerable people in our society. I said we would stand by people and that is what this support does today.

“It is also right that those companies making extraordinary profits on the back of record global oil and gas prices contribute towards this. That is why I’m introducing a temporary Energy Profits Levy to help pay for this unprecedented support in a way that promotes investment.”

Sarah Coles, senior personal finance analyst at Hargreaves Lansdown, said: “Unfortunately the sheer scale of energy price rises mean that despite the support announced today, a huge number of families will still face enormous challenges in making ends meet.

“Rishi Sunak said that over the year energy bills will rise by an estimated £1,200. Even after they received the £150 council tax rebate and the £400 grant, this still leaves them having to squeeze an extra £650 from their budgets – at a time when the price of everything else is on the march too.

“What’s more, by waiting until October to provide the energy grant, there’s a real risk that people’s financial resilience will be completely exhausted by then.”