Household Bills

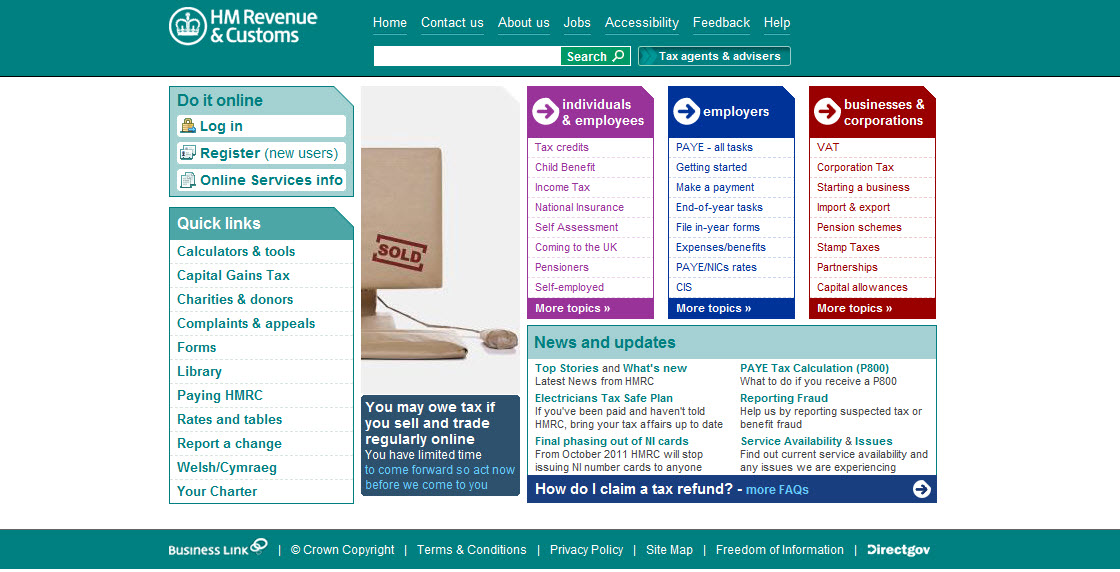

HMRC wins stamp duty tax case

Time maybe running out for those using stamp duty land tax avoidance schemes as the HMRC wins its first case against these schemes.

The decision, if left un-appealed, is said to potentially save more than £170m for the Exchequer.

Jim Harra, HMRC’s Director General of Business Tax, said: “This victory at the First Tier Tribunal sends a clear message to tax avoiders that we will challenge avoidance relentlessly.

“The decision is good news for the vast majority of taxpayers who pay, rather than try to dodge, their taxes. It shows that the courts will see through arrangements which are put in place just to avoid tax.

Regulations have also been laid that will force users of a wider range of stamp duty land tax (SDLT) avoidance schemes to disclose them to HMRC.

The new rules will give HMRC better access to information about these avoidance schemes and those who promote and use them. They can then be challenged and closed down more quickly.

Harra continued: “People who are tempted by tax advisers to enter into avoidance schemes should think twice and not be driven by greed into signing up for schemes that are just too good to be true.”