Household Bills

Why ‘fiscal drag’ means we’ll all pay more tax

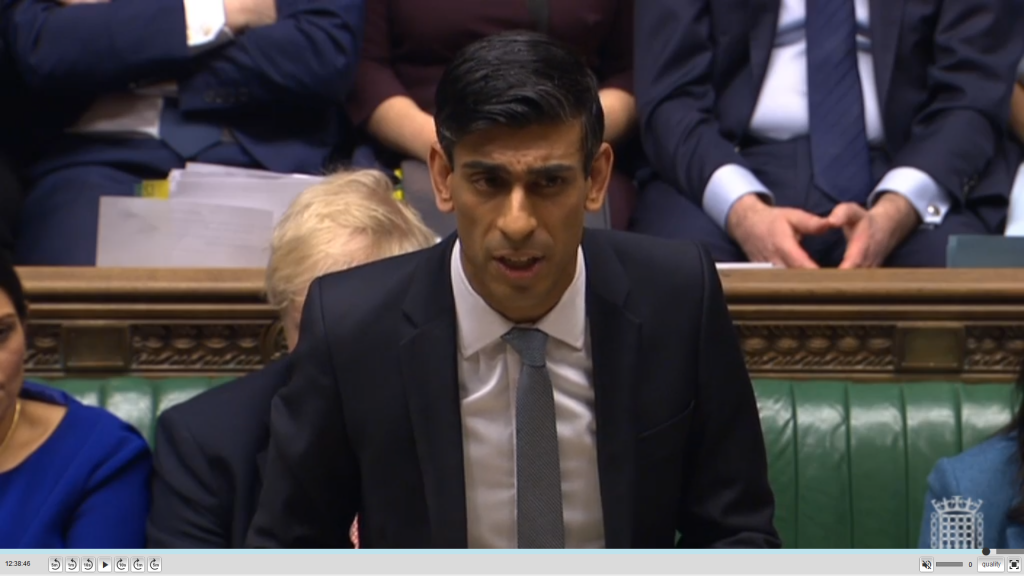

The chancellor didn’t put income tax rates up in yesterday’s Budget – but workers will still pay more tax.

Rishi Sunak announced on Wednesday that the personal tax allowance will increase from £12,500 to £12,570 in April as planned. But after that the personal allowance won’t be increased again before April 2026.

The personal tax allowance is how much you can earn each year before paying income tax, and has increased substantially in recent years. The government had previously committed to increasing the allowance by the rate of inflation each year.

The threshold for paying higher rate tax is increasing from £50,000 to £50,270 in April. However, this threshold will also be frozen until at least 2026.

What is fiscal drag?

Most people see their wages go up each year, so that they keep up with inflation or the cost of living.

But unless tax bands also increase with inflation, workers could find themselves in a higher tax band than before even though their wages haven’t risen in ‘real’ terms (i.e. after inflation). This is known as ‘fiscal drag’.

So, the freezing of the personal allowance and the threshold for 40% tax means that, depending on wage inflation over the next five years, people are likely to end up paying more income tax.

The Office for Budget Responsibility (OBR) says the chancellor’s decision to freeze personal tax thresholds will bring 1.3 million people into the tax system that didn’t pay tax before. It calculated that if incomes rise with inflation, freezing the tax allowances will raise about £8bn a year by 2025-26.

The Treasury’s own figures estimates that the policy will cost taxpayers £1.5bn in 2022/23, £3.6bn in 2023/24 and £5.79bn in 2024/25, raking in £19bn in total for the public purse by 2026.

Is fiscal drag fair?

Sunak has defended the move as “a fair way to help solve the problems that we need to”.

He told Sky News: “I think, crucially what people need to understand is no one’s take home pay that they have today is affected or lowered by this policy. What it does do is remove the incremental benefit that they might have experienced in the future as inflation fed through to their wages.

Sarah Pennells, head of financial capability at Royal London, said: “The previous commitments made by government to avoid any further rises in tax and VAT have been maintained, and it’s welcome when the country needs to encourage growth in consumer spending.

“However, the freezing of the personal allowance and higher rate threshold from 2022, will create additional higher rate taxpayers.”

The Low Incomes Tax Reform Group points calculated that, for example, an inflationary increase of about 1% would have increased the personal allowance from £12,570 in 2021/22 to £12,700 in 2022/23.

This extra personal allowance of £130 would have saved a basic rate taxpayer £26 of income tax at 20%.