Household Bills

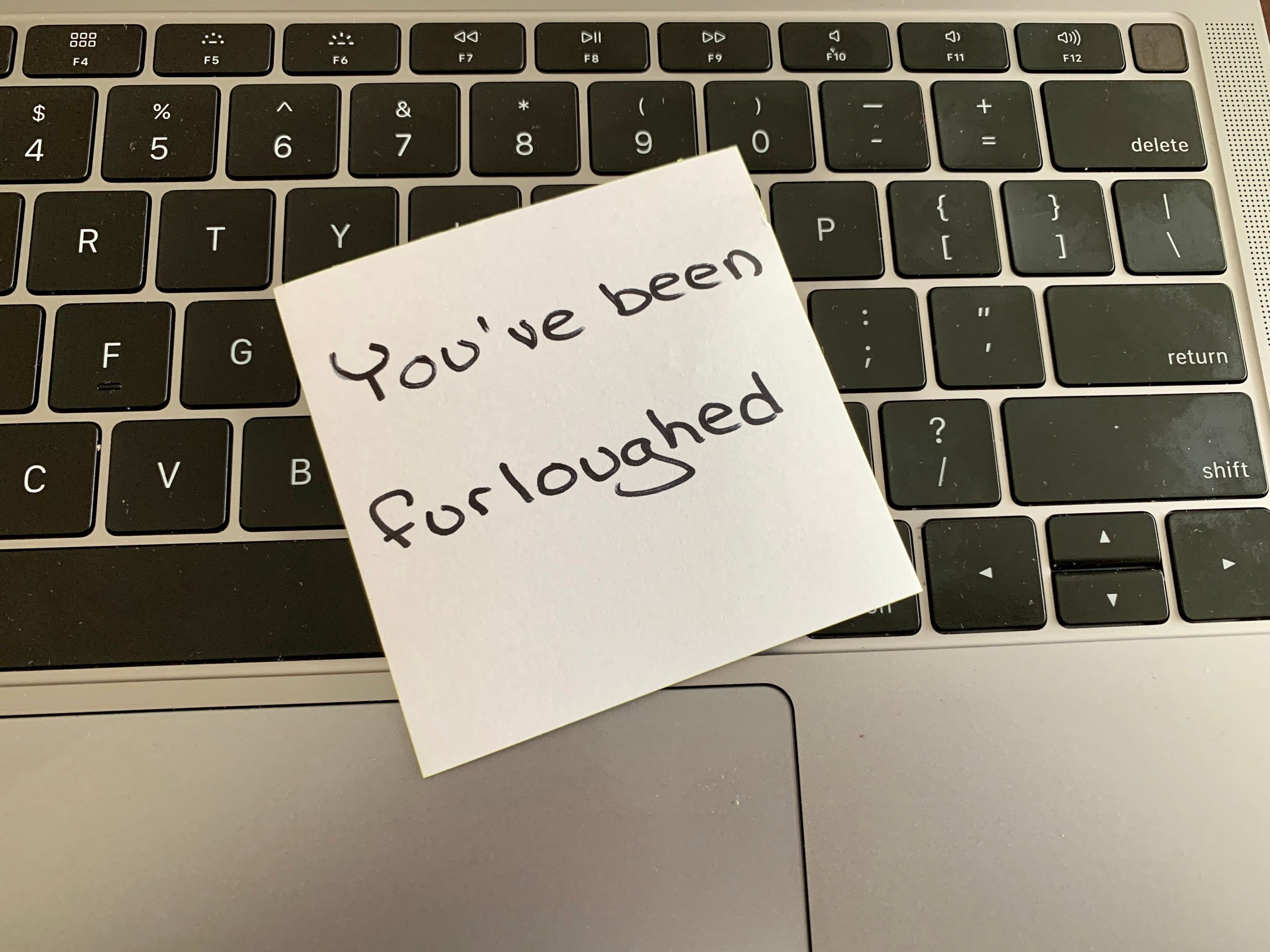

Workers on furlough fall to lowest level since start of pandemic

Almost three million people have moved off the furlough scheme since March as the economy began to bounce back and businesses reopen, according to government figures.

More than half a million workers came off furlough in June alone. At the peak of the pandemic in May 2020, nearly nine million employees were furloughed. About 1.9 million people remained on the scheme by the end of June 2021, compared to 2.4 million the previous month.

Rishi Sunak, chancellor of the exchequer, said: “It’s fantastic to see businesses across the UK open, employees returning to work and the numbers of furloughed jobs falling to their lowest levels since the scheme began. I’m proud our Plan for Jobs is working and our support will continue in the months ahead.”

The figures also show a fall in the number of young people on furlough, who for the first time ever, no longer have the highest take-up of the scheme. In the past three months, younger people have moved off the scheme twice as fast as all other age brackets, with almost 600,000 under 25s moving off the scheme.

Jobs in sectors including hospitality and retail are now also moving off the scheme the fastest, with more than a million coming off the scheme in the past three months.

This decline means those in hospitality and retail no longer make up the majority of all those on furlough. Furlough was extended until the end of September to allow for businesses to adjust beyond the end of the roadmap and to bring people back to work.

Starting on 1 August, the employer contribution to furlough costs will increase to 20%. With this contribution level continuing until the scheme ends at the end of September.