Insurance

The insurance warning holidaymakers are still ignoring

Nearly a third of British holidaymakers buy their travel insurance on the day they travel, new data shows.

Comparison site Compare Cover analysed more than four million quotes between December 2016 and November 2018 and found 30% of people waited until the very last minute to buy holiday insurance.

Buying insurance late in the day means that you are not protected if you need to cancel your trip.

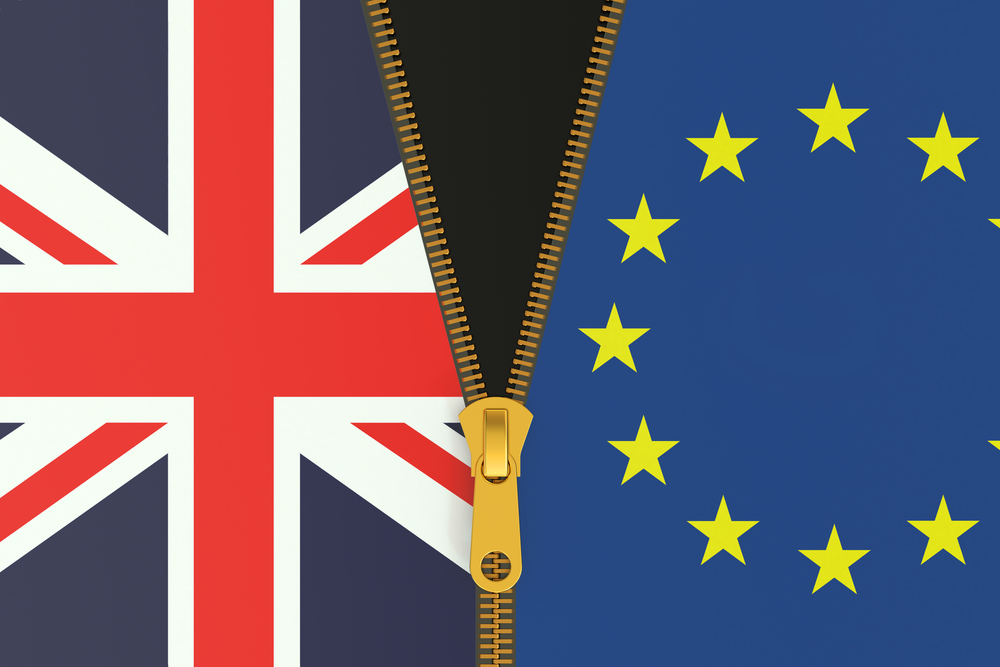

However, there is another reason not to wait: Brexit.

With so much uncertainty surrounding the UK’s departure from the European Union (EU), Simon Williams, travel insurance product manager at Compare Cover, says it’s vital to get the right insurance for your holiday “especially if you’re travelling in the coming months”.

With the future of the European Health Insurance Card (EHIC) in doubt, the government has advised holidaymakers to buy travel insurance so they can still get healthcare treatment abroad if necessary.

Free EHICs give UK citizens the right to access state-provided healthcare during a temporary stay in another European Economic Area (EEA) country or Switzerland.

Although the government and EU have publicly said they will protect EHIC rights after Brexit, this can’t be guaranteed. The NHS website currently states: “If the UK leaves the EU without a deal on 29 March 2019, your access to healthcare when visiting an EU country is likely to change.”

Williams said: “This is of great concern to us, as past research conducted by Compare Cover found that more than a third of UK travellers (37%) admit to only sometimes purchasing travel insurance or – more worryingly – not buying any at all before they depart.

“That could leave people unprotected if they fall ill abroad, have no insurance and have no provision for emergency treatment through the EHIC scheme.”

A no deal Brexit could also result in potential flight disruption. The Department for Transport warned in September that airlines may lose the automatic right they currently enjoy to operate flights between the UK and the EU, meaning airlines may need to seek individual permissions to operate.

Williams said: “One thing that holidaymakers should consider is, if you take travel insurance out after knowing that we will go into a no deal Brexit – would insurers consider that as a “known event”?

“Known event” clauses are usually used in the case of bad weather being predicted and insurance cover being taken out after that forecast, but some insurers may deem a no deal Brexit as a similar “known event” and would therefore void your claim.

Tips for holidaymakers

According to Williams, holidaymakers should look carefully at the type of travel insurance they are taking out, making sure it will cover them in all pre and post-Brexit eventualities.

If they are in doubt, they should phone their insurer to go through all of the eventualities to ensure they can go on holiday with peace of mind.