Insurance

Ex-cons reveal exactly what would stop them breaking into your car and home

With four in ten thefts committed by opportunists, ex-cons reveal what security devices and factors would stop them dead in their tracks.

A panel of ex-cons said 44% of thieves are opportunistic so they would avoid tricky break-ins.

Nine in ten (89%) said they would be put off from targeting ‘smart connected’ homes while 67% said they would think twice about breaking into a ‘smart connected’ car.

Smart connected refers to the use of tablets and mobile devices to keep properties secure. As an example, when the bell rings, the homeowner can use their mobile device to check who is at the door.

The study, led by Co-op Insurance, found that just 5% of 2,000 adults surveyed have actually invested in smart technology for their cars and homes.

Here are the top 10 deterrents for car thieves:

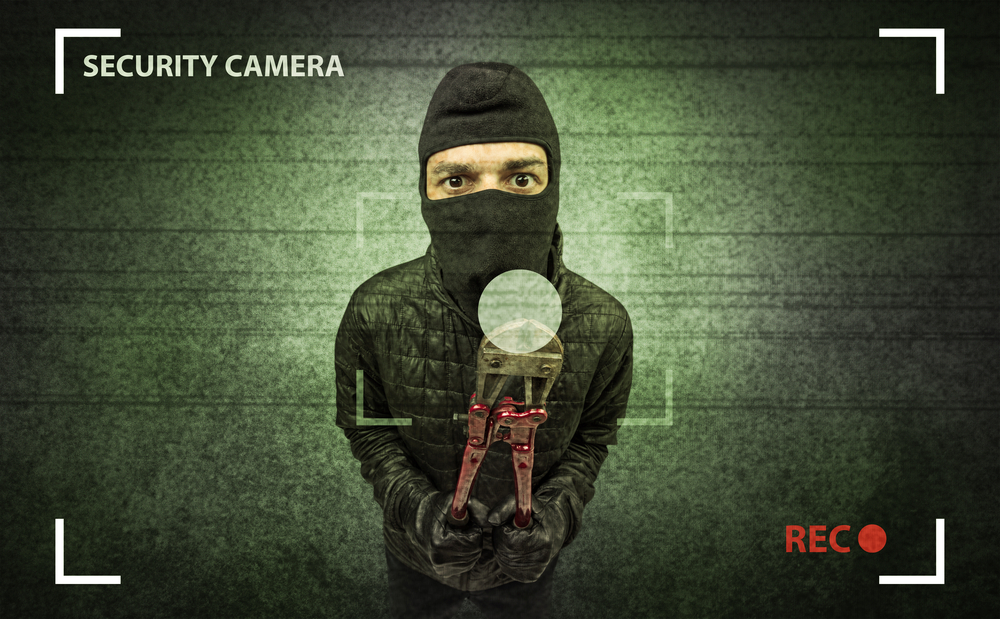

CCTV street camera

Car alarm

Street lighting

Car parked on a driveway

Newer car

Steering lock device

Older car

Neighbourhood Watch areas

Car parked on a dark alleyway

Immobiliser

Here are the top 10 deterrents for home thieves:

CCTV camera

Sound of a barking dog

Strong, heavy doors

TV which is turned on

Locked Upvc windows

Cars parked on driveway

Overlooked property

Surrounding fences

Gates outside the property

Motion activated security lights

The Co-Op research found that only 14% of UK adults have installed CCTV cameras and while ex-thieves point out that motion activated security lights are a key deterrent, just a quarter of UK adults said they’ve installed such lights.

Worryingly, 28% said they don’t take any security precautions. Over half (55%) sleep with their windows open at night, a quarter (24%) leave their doors unlocked while at home, and 12% have admitted to leaving their garden gates open.

A fifth said they post photos on social media showing they’re on holiday.

When weighing up properties to target, ex-convicts said the most difficult break-ins are of those properties situated in cities (82%). Three quarters said properties in isolated locations are easiest to break into.

Houses located off dirt tracks, bungalows and properties on housing estates are among those easiest to break into, while mid terraces, apartments with manned security and semi-detached houses are the most difficult to target.

Former bank robber Noel ‘Razor’ Smith said: “As a former criminal, I know all the tricks homeowners use to keep their homes safe, that’s why I find it shocking the Co-op’s research reveals 28% of us don’t take any precautions whatsoever. Luckily there are some very simple steps everyone can take to make our homes more secure and keep our valuables safe.”

Caroline Hunter, head of home insurance at Co-op added: “Almost half of thieves are opportunists so it’s really important that home and car owners are vigilant and think carefully about security.

“Nobody should have to go through the trauma of having their property burgled and there are some small measures which homeowners should be mindful of to ensure any opportunists cannot be tempted.”