Experienced Investor

‘Biden bounce’ sees FTSE 100 lifted after inauguration

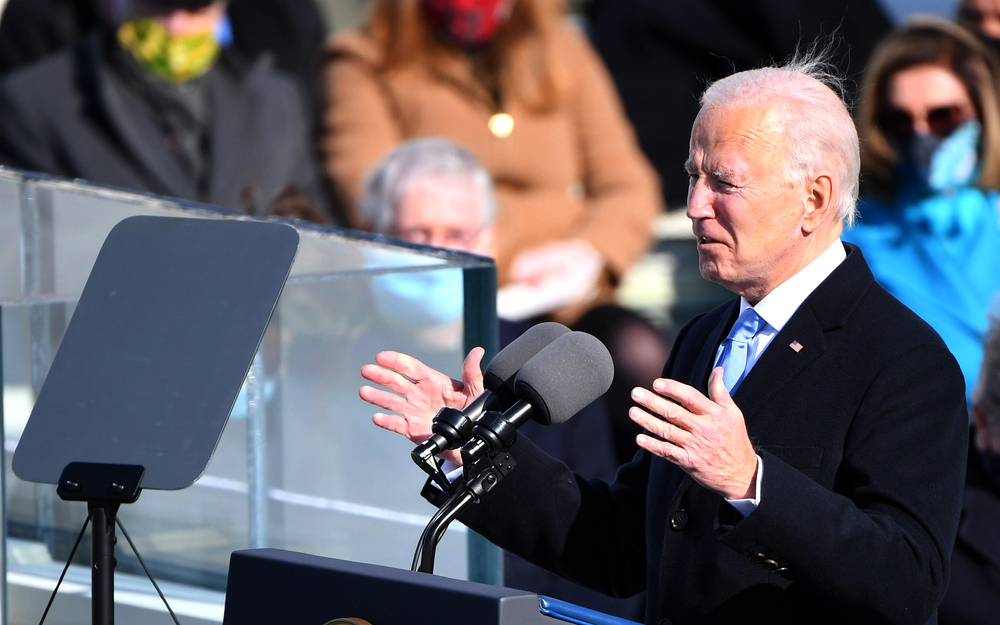

Joe Biden was sworn in as the 46th president of the United States of America yesterday. The move to the White House has brought stability for investors, and saw the FTSE 100 open with a “spring in its step”.

The new era for America saw the FTSE 100 advance 0.5% to 6,771 with financials, technology and healthcare stocks performing strongly.

HSBC and NatWest rose around 2.5% while software company Sage Group was the biggest riser, up 3.5%.

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, said: “’Stay at home’ shares like Just Eat Takeaway, Ocado and supermarket group J Sainsbury were also gaining ground, with expectations that a prolonged lockdown into the spring will keep demand for its deliveries high.”

Elsewhere, the positive momentum on Wall Street amid Biden’s $1.9 trillion emergency spending programme also extended across Asia and Europe.

Russ Mould, investment director at AJ Bell, said: “The Nikkei 225 moved 0.8% higher after the Bank of Japan upgraded its economic forecast for the next fiscal year to 3.9% expansion versus a 3.6% gain seen three months ago.

“The top riser was advertising group Dentsu, up 5.3%, as a stronger economy could drive more promotional activity among corporates. Also driving the share price was news that Dentsu might sell its headquarters in Tokyo for $2.9 billion.

“Germany’s DAX index traded 0.6% higher with healthcare, industrials and technology among the sectors in demand.”

However, Streeter added a note of caution: “The wave of optimism currently washing through the financial markets, prompted by President Joe Biden’s inauguration, is likely to ebb if infection rates to continue to rise, the vaccines are slow to roll out and if the virus mutates further.

“Already Covid-19 has wreaked huge damage on economies around the world and a recovery will be painful with plenty of set-backs expected along the way.

“High unemployment rates will cause a ripple effect on consumer demand and although in the US industries like construction and green energy are expected to benefit from increased investment going forward, sectors worst hit by the pandemic such as retail, hospitality and travel are nursing injuries which are unlikely to heal for years.

“There is also a disconnect between the US stock market and the wider economy because indices are dominated by technology companies. They have been boosted by the acceleration of behaviour changes and digital trends brought on by the pandemic. But the spectre of greater regulation now hangs over the sector. New legislation will take time to be enacted, but the winds of change are blowing in the direction of a much tougher stance towards tech, which is likely to put pressure on some valuations down the line.”