Experienced Investor

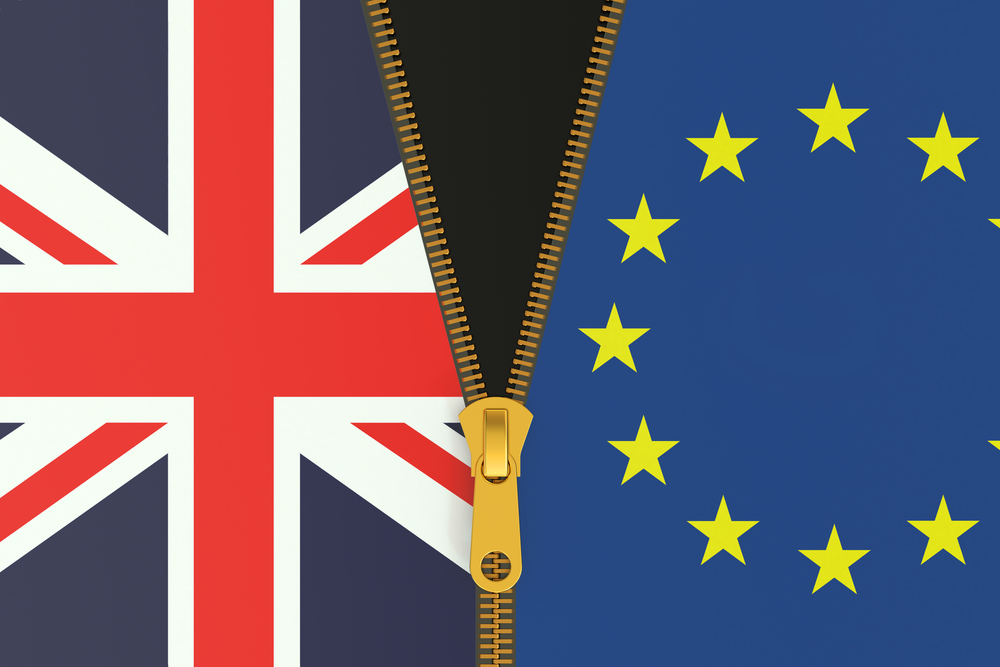

Brexit anxiety saw investors pull £3.5bn from funds in June

Nervous investors pulled £3.5bn from investment funds in June as Brexit hysteria came to a head.

This dwarfed the £561m removed from funds in the worst month of withdrawals during the financial crisis, January 2008.

Figures from the Investment Association show the biggest outflows were in UK equity funds and European equity funds, which saw redemptions of £1bn and £813m respectively.

Property funds experienced outflows of £1.4bn, while mixed asset funds experienced a smaller outflow of £191m.

Some £464m was also withdrawn from ISAs over the course of the month.

Fixed income funds were the best-selling asset class in June with net sales of £258m.

The Investment Association, the trade body for UK’s investment managers, said June’s outflows occurred in the context of record levels of funds under management.

Guy Sears, interim chief executive of the Investment Association, said: “Clearly, Brexit has been unsettling, with property and equity funds particularly affected following earlier outflows during 2016. At the same time, flows were positive into fixed income and targeted absolute return sectors as investors sought safer harbours.”

Jason Hollands, managing director of Tilney Bestinvest, said the figures were unsurprising given some of “the near apocalyptic forecasts” made around the impact of a leave vote on markets.

And while the economic impact of the Brexit vote is still unclear, he said “alarmist claims” that it would prompt a market meltdown have proven wrong.

“Fears of the vote posing a systemic risk to capital markets have abated, the FTSE 100 is trading higher in sterling terms that it was prior to the vote and the most domestically-skewed FTSE 250 index has recovered from the initial knee jerk sell-off,” Hollands said.

“A risk now is that because of a myopic focus on Brexit in recent months, investors may have become immune to other, much greater risks hanging over the markets that have not gone away.

“In our view, China continues to pose a considerably bigger risk than Brexit ever did, given its persistent pursuit of debt fuelled stimulus and worrying manufacturing overcapacity. More broadly there is still too much leverage trapped in the financial system after years of relentless stimulus programmes and in the aftermath of Brexit, way be about to pile on more liquidity with a further cut to interest rates this week. These financial sugar rushes cannot go on forever.”