Experienced Investor

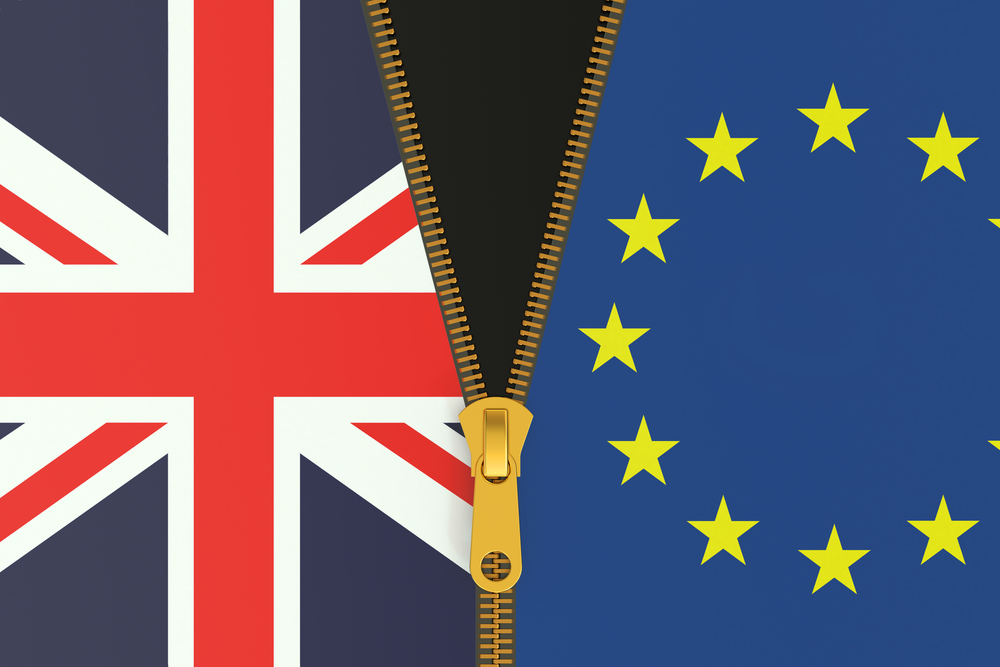

How to ‘Brexit-proof’ your investment portfolio

A leading financial adviser has warned clients to prepare their portfolios for a ‘leave’ outcome to the EU referendum. So what should investors do?

It’s now less than two months until UK voters decide the fate of our fair isle: whether to remain in or leave the EU.

There has been much speculation and commentary from both camps about the impact an ‘in’ or ‘out’ vote would have on the UK economy, and investors are rightly nervous about how the outcome will affect their portfolios.

Such nerves appear justified after one leading financial advice firm urged clients to ‘Brexit-proof’ their portfolios.

Nigel Green, chief executive of deVere Group, said: “The historic vote in June is currently looking incredibly close. As such, investors should now be considering how they Brexit-proof their portfolio to mitigate the effects of a fall in the value of UK assets should the Leave camping triumph on 23 June.

“We have seen that the referendum and the consequent campaigning has already created considerable uncertainty, with many companies in the private sector shelving or postponing investment due to the forthcoming vote. This uncertainty and volatility can be expected to intensify if Britain decided to leave the EU.”

Green’s comments come amid reports that British banks are preparing contingency plans in the event of a Brexit vote.

So what should investors do?

Portfolio positioning ahead of the vote

Fund manager David Coombs of Rathbones re-positioned his portfolios immediately after last year’s general election when the referendum was first announced, increasing his UK large cap holdings, while reducing his exposure to the domestic UK market “as much as possible”.

He maintained his high weighting to US and added to Europe and Japanese equities over the past year, which took his portfolio into an overweight position in international stocks.

In Europe, he has bought direct shares including some non-eurozone stocks such as Roche (pharmaceutical), Sampo (insurer) and Danske Bank.

Today his holdings aren’t much different, despite the ‘remain’ camp being the favourite with the bookies.

For him, the risk of Brexit is still relatively high, so he won’t be changing any of his holdings in the run up to the referendum. He would need to be “absolutely convinced” of a vote either way to make any changes at this point.

What about after the vote? If the UK remains ‘in’, Coombs says he would look to reduce overseas currency exposure and he may look at more domestic mid to large cap offerings.

In the case of a Brexit, Coombs says he’d need to do more analysis of the industry and companies to see the winners and losers to “identify and mitigate risks” and “take advantage of opportunities”.

Green of deVere agrees investors can protect themselves by increasing their exposure to overseas investments.

“It could be a timely decision to rebalance portfolios in favour of international stocks, bonds and perhaps property,” he says.

He notes that investing across geographical regions is in fact one of the “fundamentals of a well-diversified portfolio”, regardless of Brexit.

“It is a myth that investing internationally is riskier. Indeed, the greater diversification that is secured by going global, the greater the reduction of overall portfolio risk.”

Green says it is a “misconception” that international investment options are exclusively the domain of sophisticated investors.

“This is not true. There are many well-managed retail funds that offer global stock market exposure, using a wide variety of approaches.”

The winning and losing sectors of Brexit

Rory Bateman, head of UK & European equities at fund group Schroders, has come up with a list of investment sectors set to do well should the UK public vote ‘leave’ on 23 June – and a list of sectors that are likely to suffer:

Brexit losers:

General retailers: in some cases as much as 60% of srock purchase is in US dollars, with their entire revenue base here in the UK which means sterling weakness will have a significant impact on their profitability.

Airlines: a significant chunk (>35%) of their cost base is in US dollars but with limited dollar revenue, which suggests the currency fluctuations will have an effect on profitability. The regulatory picture may change if the UK leaves the EU given the single aviation market structure is up for debate, but from a volume of traffic perspective, lower immigration may have an effect.

London commercial real estate and housebuilders: London’s ability to retain its status as Europe’s pre-eminent financial centre is unclear but we have already seen a de-rating of the sector brought about by possible lower rents and funding issues. Homebuilder companies, particularly those exposed to the London property market, are at risk especially given the extended rally in these stocks over recent years. Modest declines in house prices have a significant impact on earnings with a 1% price fall impacting earnings per share by around 5%.

Domestic banks: Banks are economically cyclical and vulnerable to negative sentiment. It is worth noting valuations are very low and they will almost certainly have priced something in already for Brexit risk. Schroders says the lack of clarity around the ability of multinational banks operating in London (US, Swiss, European) to passport financial services from the UK into the EU could also result in a downsizing of the broader UK financial services hub.

Brexit winners:

Consumer staples, pharmaceuticals, capital goods, resources and software as these are all big overseas earners which may benefit from the improvement in competitiveness driven by a weaker sterling for those that manufacture in the UK.

Food retail could be an unlikely winner (depending upon the severity of short-term economic weakness) as sterling weakness would be inflationary. The sector tends to pass on all inflation and there is a strong correlation between sector valuations and inflation.

The UK tech sector in general is a big overseas earner, and would benefit in the short term from any pound weakness resulting from Brexit. In both software and hardware, the vast majority of companies have a significant percentage (+75%) of revenue coming from overseas. However, there is a potentially negative impact of Brexit in the longer term. A large number of tech firms rely on a talented and often international work force; should a post-Brexit world make it harder for tech firms to attract and retain these talented individuals, this would likely have implications in the long term for firms’ ability to maintain their competitive advantage of leading edge intellectual property and innovation.