Investing

Investor confidence takes a knock from geopolitical tensions

Recent global conflicts have had an impact on investor confidence, Fidelity’s Investor Confidence Indicator has found, but the group urges investors to not let these events dramatically impact their market outlook and to keep investments diversified

Although the longer trend is of improving investor confidence, buoyed by improvements in the UK economy, the events of recent weeks have knocked sentiment. The results showed that after a gradual increase of confidence (67% to 75%) between March and May, recent global events have weighed on investor confidence which fell by around 20% between May and July.

Tom Stevenson, Investment Director for Fidelity Personal Investing, said: “With the recent growth in GDP confirming an improving UK economy, it may seem surprising that the latest Investor Confidence Indicator shows a dip in investor confidence. I think there are several possible explanations:

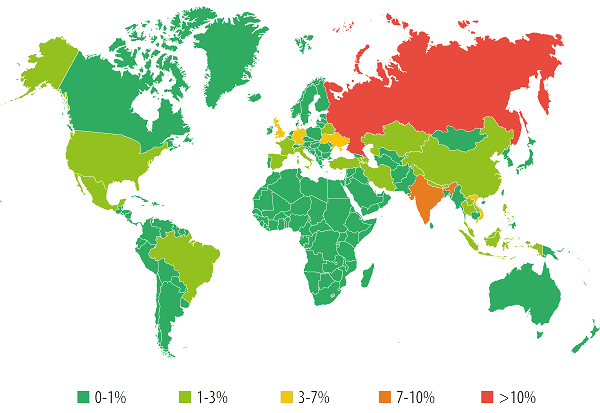

“First, geo-politics has re-appeared on investors’ radars. An escalation of violence in Syria, Iraq and Gaza, coupled with the shooting down of the Malaysian airliner, is a reminder that risks can appear unexpectedly and quickly. This is bound to have had a dampening effect on investor sentiment.

“Second, political risk is returning to the fore, especially in the UK which faces a referendum on Scottish independence and a General Election within the next 12 months.

“Third, it now seems likely that the UK will be first out of the blocks with higher interest rates – possibly as soon as November this year. Markets have become used to extremely low rates and the prospect of a rise in the cost of borrowing will unsettle investors.

“Fourth, in many markets, valuations are no longer particularly cheap. The balance between risk and reward no longer seems so favourable.

“None of these issues should be dismissed by investors, but there is equally no need to worry unduly or to start rebalancing your investments if they are well diversified. As well as these concerns there are also a reassuring number of market positives today. Central banks remain accommodating, with rates likely to rise only gradually and to a lower level than we have got used to in earlier cycles. The current earnings season on both sides of the Atlantic has been quite encouraging, with companies matching, or in some cases beating, expectations. Also, the income on offer from many blue-chip shares continues to make equities a compelling home for savings and investments.”

Stevenson says that there are steps investors can take to protect themselves.

1. Make sure your eggs are in different baskets

It’s important to remember to spread your money – and your risk – over a good variety of different assets, from a range of regions and sectors. Putting all of your eggs into one investment basket means you’re tied to the fate of one particular asset.

2. Remember not to leave too much of your money in cash

When confidence dips, the temptation may be to move money into cash savings accounts. However, with UK interest rates at historic lows, those saving in cash risk real-terms losses on their money, due to possible inflation rises in the future.

3. Know your risk, and plan accordingly

There are lots of savers who fail to account for their risk tolerance when planning to invest. Knowing your risk is a personal and individual responsibility – and no two investors are the same. Once you’ve decided your preferred level of risk, you can take advantage of support systems, which choose different investment options for you, based on the risk you’re willing to take.