Investing

London open: FTSE 100 slips as investors await Fed minutes

The FTSE 100 fell into the red on Wednesday morning, hitting a fresh six-week low as investors nervously awaited the minutes of the latest Federal Reserve meeting.

The index dropped 0.5% to around the 6,420 mark early on. The last time the London benchmark closed lower was on 5 July when it finished the day at 6,375.52.

Market sentiment has been a extremely fragile over recent sessions ahead of the Federal Open Market Committee (FOMC) minutes which could give an indication of when policymakers intend to scale back quantitative easing (QE). The minutes are due out after UK markets have closed this evening, around 19:00.

Investors have been trying to pre-empt the Fed’s decision to taper stimulus by trimming positions and scaling back risk appetite over recent sessions – the Dow Jones declined for the fifth straight day in New York last night.

“Investors are very much anticipating the next round of QE news flow and probably won’t do a great deal until any new information is becomes known. The risk for investors is indeed that the Fed delivers tapering at a pace faster than predicted,” said Financial Trader David White from Spreadex.

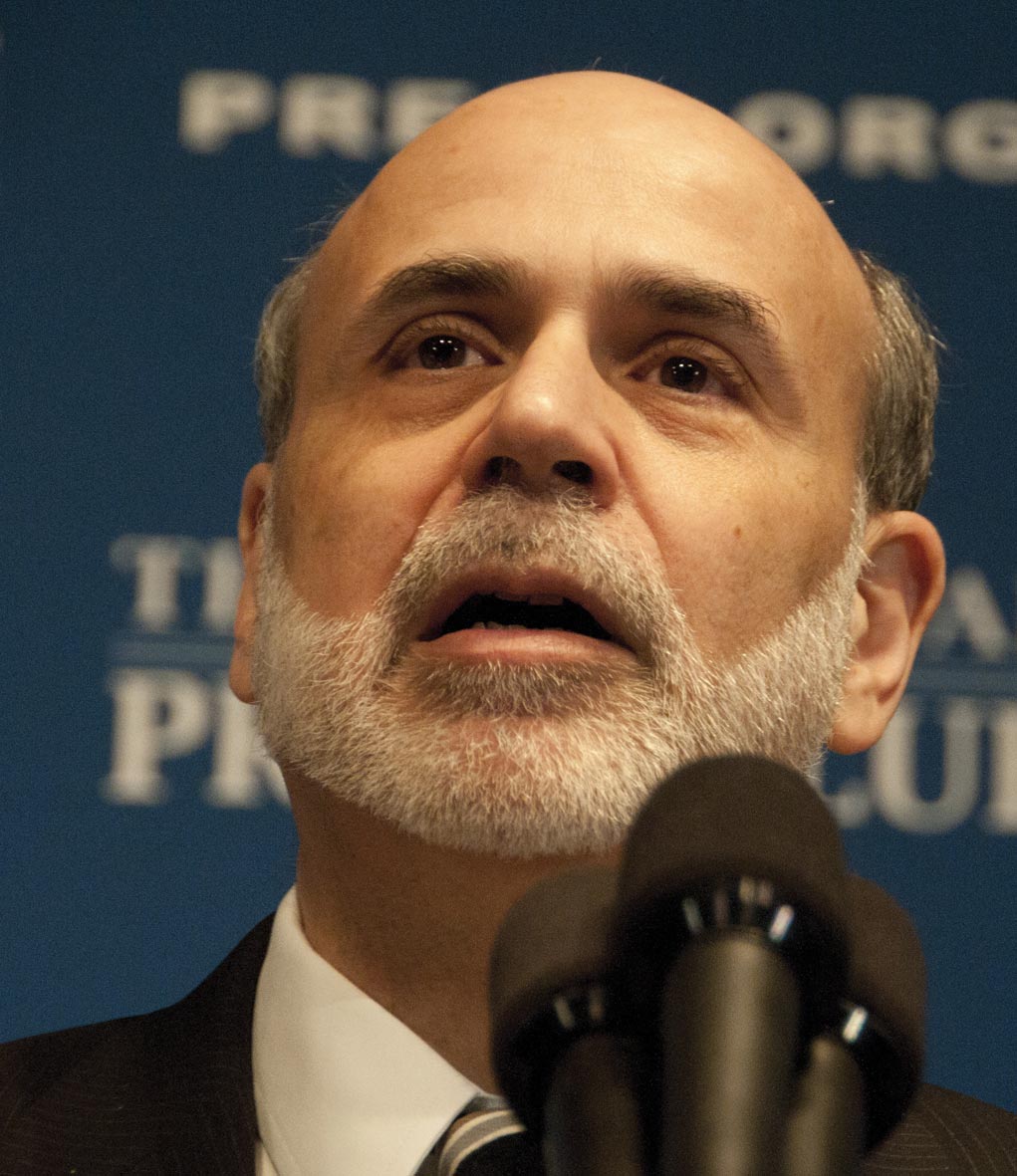

With there only being two FOMC meetings left this year which will be followed by a press conference with Fed Chairman Ben Bernanke (pictured) the majority of analysts seem convinced that the taper will begin in September.

“The Fed have previously saved the big decisions for such meetings,” pointed out Market Analyst Craig Erlam from Alpari.

The economic data schedule is to pick up today after a fairly quiet start to the week. UK public-sector borrowing figures are due out at 09:30, with the CBI’s Industrial Trends survey due out shortly after. In the States, the housing market will be in focus with MBA mortgage-application figures and existing home sales due out in the afternoon.

Greece will also again be in the spotlight today after Germany’s Finance Minister Wolfgang Schaeuble admitted that the nation will likely require a third bail-out package.

A number of heavyweight stocks were weighing on markets this morning after going ex-dividend, including British American Tobacco, Capita, Hammerson, InterContinental Hotels, Prudential and Carnival.

A number of mining stocks were also lower this morning as risk appetite is scaled back. Fresnillo, BHP Billiton, Rio Tinto and ENRC were all in the red. Glencore Xstrata however was bucking the trend, rebounding after some heavy losses the day before after the company disappointed with its first-half results.

Standard Life was leading the upside after receiving an upgrade by Credit Suisse to ‘neutral’. The broker also raised its target price from 325p to 362p.

Lloyds gained despite saying that it is to take a £330m loss on the disposal of its German life insurance business as it continues to downsize its international footprint. Banking peers Barclays, RBS and HSBC however were out of favour today.

Source: ShareCast