Investing

‘Meddling’ politicians to blame for retirement crisis – report

Politicians are to blame for the dearth of money savers are setting aside for retirement, a new report has revealed.

A survey of 2,000 UK adults by investment adviser Bestinvest found that a third (34%) are discouraged from investing into a pension because they do not trust politicians and believe they will continue to “meddle” with them, while 31% are put off because the rules on pensions keep changing.

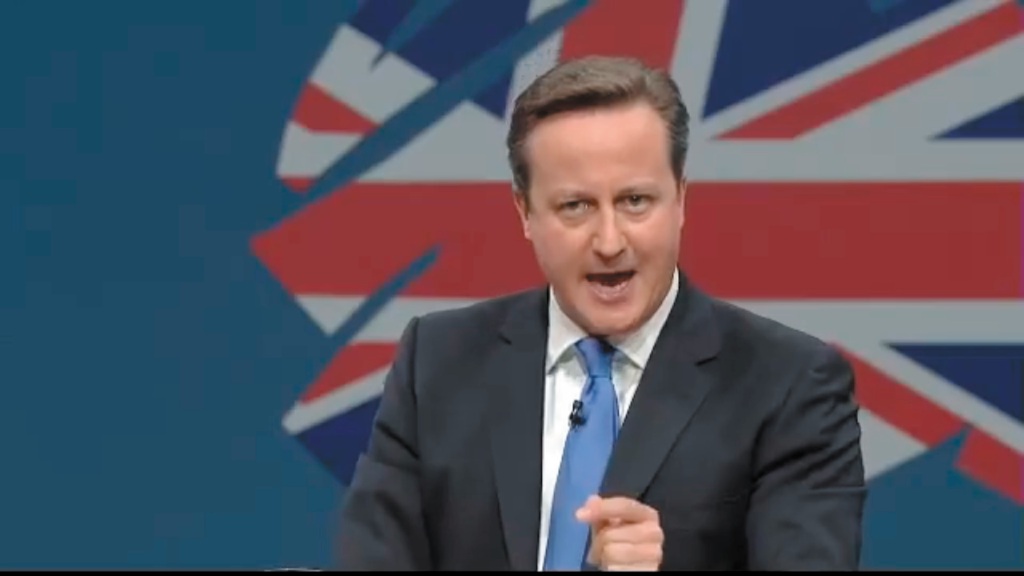

The research also revealed that 50% of people do not trust any of the main political leaders to support savers and investors. Of those who did believe a political leader to be supportive of savers and investors, David Cameron scored highest (20%) ahead of Ed Miliband (15%), Nigel Farage (8%) and Nick Clegg (5%).

The study comes ahead of Chancellor George Osborne’s Autumn Statement on 5 December which last year saw deep cuts announced in the amount that can be saved into pensions both annually and over a lifetime. Yet despite these reductions which take effect in 2014, the Liberal Democrats have already pledged to introduce a further 20% cut in the lifetime pension allowance and Labour’s Shadow Chancellor Ed Balls has proposed a reduction in the amount of tax relief that higher earners can receive on pension contributions.

The Bestinvest research reveals that tax relief on pension contributions is the most common motivation to continue or begin to invest into a pension (36%).

According to recent reports, the Government is mulling a potential reduction in the amount that can be withdrawn as a tax free lump sum from a pension on retirement, currently up to 25% of the value. Such a move could be deeply unpopular as the research reveals that another major reason deterring pension investment, cited by 23% of respondents, is that they want access to their money and do not like the idea of having their money locked up until retirement.

Individual Savings Accounts (ISAs) have become an increasingly popular alternative way to save for retirement instead of a pension, which may be partially due to the ability to access the capital at any time. Yet it is believed the Government has also been considering the introduction of a cap on the lifetime amount that can be invested in ISAs, possibly at £100,000.

Jason Hollands, managing director at Bestinvest, said: “With the Autumn Statement around the corner, politicians of all parties should take heed that their repeated calls to meddle with long-term investment allowances is having a deeply debilitating impact on people’s willingness to save. The urge to fiddle with the pension allowance has become an addiction among the political parties. Any pincer movement against ISAs would likely have a toxic impact both on public confidence in saving and investing but also on the electorate’s already withering assessment of the trustworthiness of politicians.

“Continual reductions in the pension allowance leave the impression the system is in flux. Investors now need to be reassured that the goal posts won’t keep moving. It is time for the parties to back off from further interference with the pension and ISA allowances.”