Investing

Monday newspaper round-up: Small business, ECB, China

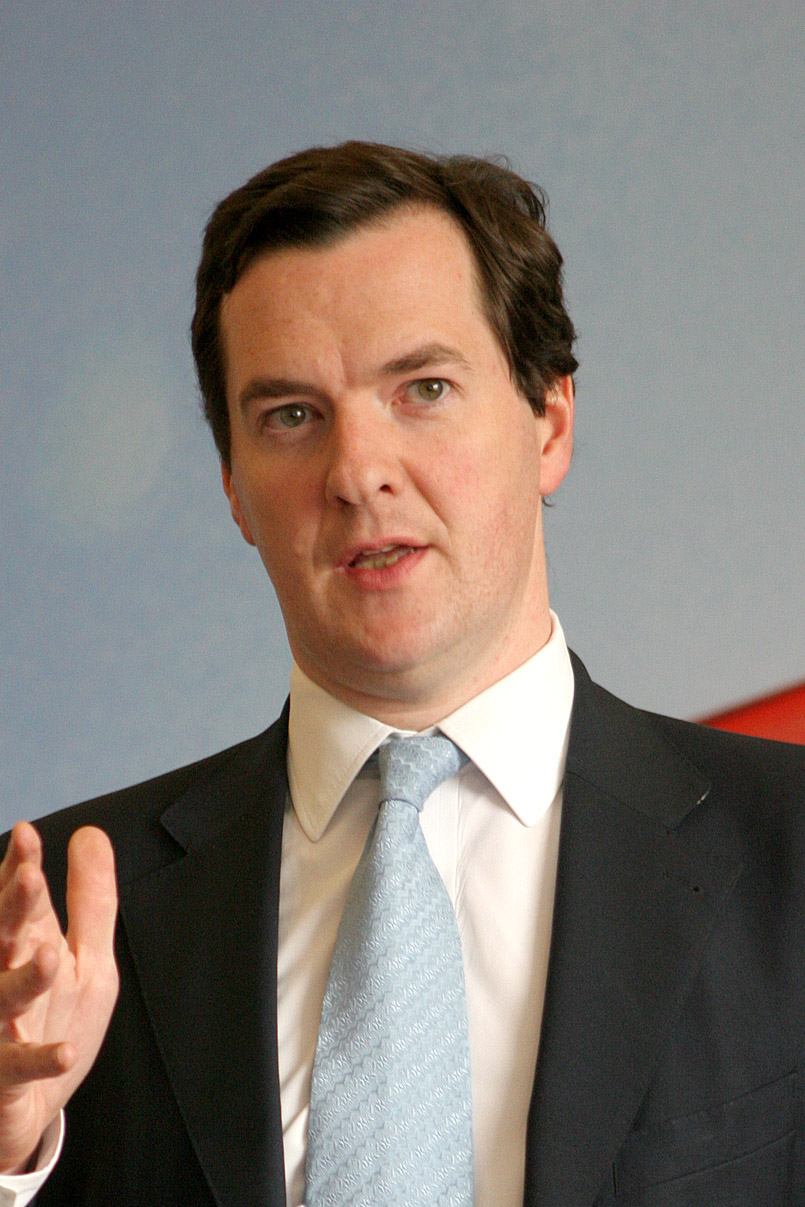

George Osborne has made his latest bid to prop up the faltering economy by revealing plans to launch a small business bank to make it easier for growing companies to gain access to “multi-billion pounds” of government funding.

The Chancellor believes the bank will play a key role as part of a series of measures planned to provide an autumn boost for the economy and meet business calls for a growth strategy. However, no new government funding will be put into the bank.

“We are getting on top of the deficit,” Mr Osborne said.

“These are difficult times for the British economy, it’s a difficult time for the world economy but our economy is healing. We have to do more and we have to do it faster,” The Telegraph reports.

China’s manufacturing activity fell to its lowest level in more than three years in August as the global economic slowdown continues to weigh on the world’s largest exporter, HSBC has said.

The final reading of the British banking giant’s closely-watched purchasing managers’ index (PMI), which gauges nationwide manufacturing activity, slid to 47.6 last month from 49.3 in July, HSBC said in a statement.

This was the lowest since March 2009 and marked the 10th consecutive monthly fall, the bank said. It chimed with the official PMI figure released at the weekend, which hit a nine-month low of 49.2. A PMI reading above 50 indicates expansion, while one below 50 points to contraction.

The World Bank’s Food Price Index soared by 10% in July, but global grain stocks are currently high enough to prevent a repeat of 2008’s food riots, according to the World Bank. Things could rapidly change though. The index, which weighs the US dollar price of internationally traded food commodities, shows that sharp price increases were felt across the board in July.Rice, which fell 4%, was the only major exception.

The World Bank was reassured by the decline in rice prices. “Large supplies of rice from bumper crops and increasing competition for Thailand (the world’s largest exporter) have led to a recent rice price decline,” it said. “Weak demand from the eurozone and a slight growth slowdown in China and the developing world in general all favour price moderation.”

However, it warned that “the jury was still out”, citing potential threats such as major producers pursuing “panic policies” such as restricting exports and weather developments in the near future “especially related to el Niño,” according to The Telegraph.

EDF has been holding talks with China about sharing the soaring cost of building £10bn worth of new reactors at Hinkley Point, Somerset. The move underlines growing pressure on the French company’s internal finances and has reignited a fractious debate about Communist state-run businesses playing a critical role in sensitive western energy infrastructure.

The overtures to Beijing’s state corporations – as well as approaches to Middle Eastern sovereign wealth funds – come as EDF faces growing investment demands in France and the UK that have sent debt levels rocketing to €39.7bn (£30bn).

“We have always said we were open to the idea of other partners investing in the project. As we approach our final investment decision, it is right to consider funding options including seeking additional partners,” said an EDF spokesman, The Guardian writes.

Only a quarter of Germans think Greece should stay in the Eurozone or get more help from other countries in the currency union, a Financial Times/Harris poll has found. The overwhelming verdict highlights Angela Merkel’s domestic dilemma as she comes under pressure in Europe to agree more time or money for Greece to get its €174bn second bailout back on track.

Negative German sentiment, detailed in the poll conducted in August, stands in marked contrast to that in Italy and Spain, where respondents were far more reluctant to cut Athens loose. The diverging views pose a big challenge to EU leaders who this month must again grapple with how to deal with a new Greek government poised to ask for two more years to implement painful economic and government reforms demanded by international lenders as part of their three-year bailout program, The Financial Times explains.