Investing

US stocks jump after Fed begins tapering stimulus

US markets soared to new all-time highs on Wednesday as the Federal Reserve made a surprise early move to gradually scale back quantitative easing.

The Federal Reserve will reduce its asset purchase programme by $10bn per month from January 2014, taking it from $85bn to $75bn.

It will scale back its treasury purchases by $5bn to $40bn a month, and its mortgage-backed securities purchases by $5bn to $35bn a month.

The move to gradually scale back the stimulus measures indicates the central bank’s confidence in the improving US economy.

However, it also reaffirmed its commitment to low interest rates, saying interest rates are likely to stay close to zero “well past the time that the unemployment rate declines below 6.5%”, as long as inflation remains below 2.5%.

That statement helped reassure investors that the Fed is not about to begin a cycle of policy tightening.

The Dow climbed 1.84% to 16,168 while the S&P 500 rose 1.66% to 1,810, marking new highs for both indices.

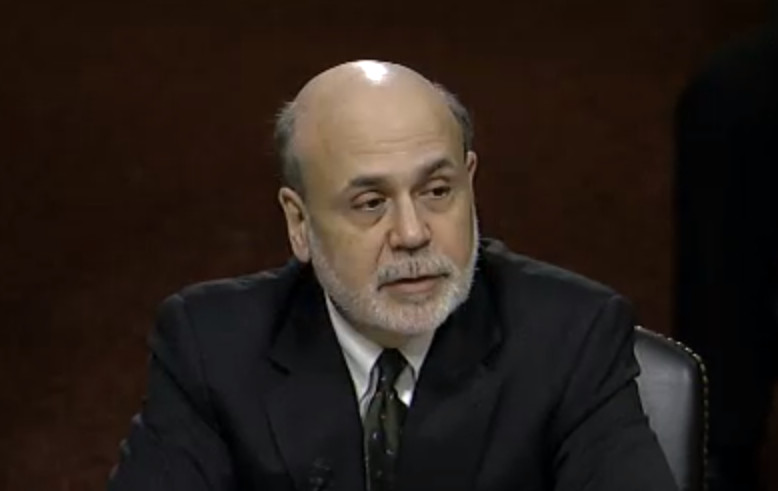

Speaking after the meeting of the Federal Open Market Committee, Fed chair Ben Bernanke (pictured) said improved labour market data in particular had prompted the move, which most economists had not expected to be announced until the FOMC’s January or March meeting.

“Reflecting cumulative progress and an improved outlook for the job market, the committee decided today to modestly reduce the monthly pace at which it is adding to the longer-term securities on its balance sheet,” Bernanke said.

“The action today is intended to keep the level of accommodation the same overall and to push the economy forward. We are committed to doing what is necessary to getting inflation back to target.”